-

Apple and Australia's largest banks have been battling for more than a year over mobile payments access.

July 3 -

Apple's plans to display a bright blue bar on iPhone screens when an application is monitoring the user's location may feel like a threat to location-based marketing. More likely, it is an overdue wake-up call for banks to improve their communication about the benefits of location data.

July 3 -

Led by Starbucks and Apple's mobile payment apps, there's a boom underway and retailers need to act fast to avoid being left behind.

July 3 Akamai

Akamai -

The iPhone is 10 years old. Here’s a look at some of the ways the Apple product and the boom in smartphones overall have shaped banking in the U.S. over the past decade.

June 29 -

Apple's plans to display a bright blue bar on iPhone screens when an application is monitoring the user's location may feel like a threat to location-based marketing. More likely, it is an overdue wake-up call for retailers and banks to improve their communication about the benefits of location data.

June 29 -

The Westpac keyboard function, which helped support social payments, will be removed from the Apple store in July. The move follows a long dispute between banks and Apple over access to Apple Pay.

June 27 -

Punchh is betting NFC will be widespread, and it hopes to get an edge with clients with a direct connection to Apple Pay, enabling consumers to simultaneously earn and redeem restaurant loyalty program points.

June 27 -

The digital wallet market is expanding quickly, giving banks a chance to cement customer relationships by offering their own apps, writes Mike Lynch, chief strategy officer at InAuth.

June 23 InAuth

InAuth -

The agency recently sent a letter to nine banks urging them to stop offering deferred interest cards, arguing that consumers are often unaware of the risks involved.

June 8 -

Third party mobile payment apps are resetting consumer expectations, and retailers must embrace the technology, writes Joe Leija, general manager of North America at Ingenico ePayments.

May 22 Ingenico ePayments

Ingenico ePayments -

Payments stayed the same for years, then started evolving rapidly. That has issuers considering different ways to help consumers manage the change.

May 11 -

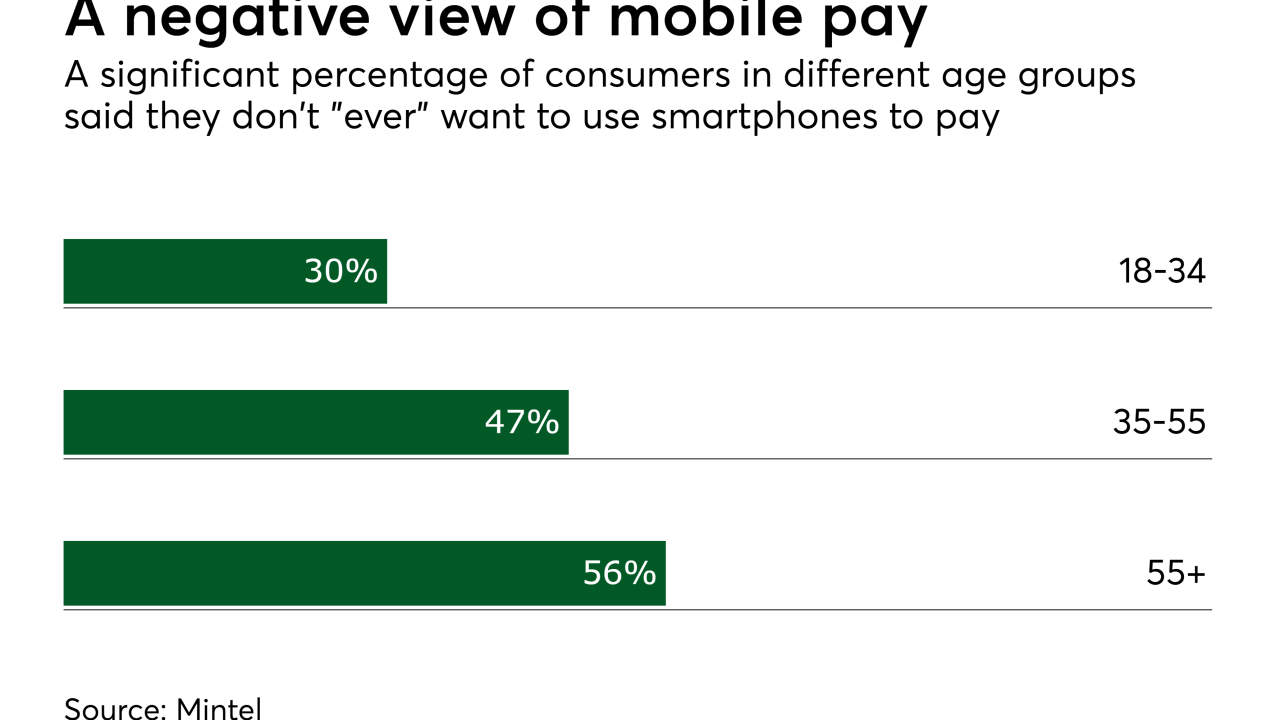

Banks and credit unions are often pressured to compete with third party mobile wallets to protect their brands. But it's unclear if that strategy is helpful in attracting consumers.

May 9 -

Banks are often pressured to compete with third party mobile wallets to protect their brands. But it's unclear if that strategy is helpful in attracting consumers.

May 8 -

Third party 'pays' and app companies like Uber are making the payment almost invisible, and threatening banks' relationships with consumers, writes G. Vedanarayan and David Griffiths of VirtusaPolaris.

May 3 VirtusaPolaris

VirtusaPolaris -

Apple Inc. may wish to launch a person-to-person money-transfer service to rival Venmo, according to a new report.

April 27 -

Tencent Holdings Ltd. is shutting down a popular feature on WeChat that allows iPhone users to tip emoji and content creators to comply with Apple Inc.’s policy on in-app purchases.

April 20 -

Apple Pay still struggles to displace cash and cards in the U.S., but its recent integration with Western Union shows the mobile wallet has some untapped potential.

April 18 -

New mobile wallets and digital payment innovators are threatening banks' traditional relationships with consumers, forcing banking to respond.

April 17 SecurionPay.com

SecurionPay.com -

Amazon is lending its considerable brand and heft to a cash payment model that borrows a vital piece of real estate from Apple Pay.

April 3 -

Machine learning, Siri and Alexa are taking off quickly, particularly among younger consumers. Banks and payment companies need to get in the game now.

March 29 Servion Global Solutions

Servion Global Solutions