-

Opes Advisors shows would-be borrowers how purchasing a house fits into their total financial picture, now and years into the future. Many of its loan officers are licensed investment advisors.

December 20 -

Goldman Sachs and JPMorgan Chase are among a group of institutions reportedly backing Axoni, a capital markets technology firm that specializes in distributed ledger infrastructure.

December 20 -

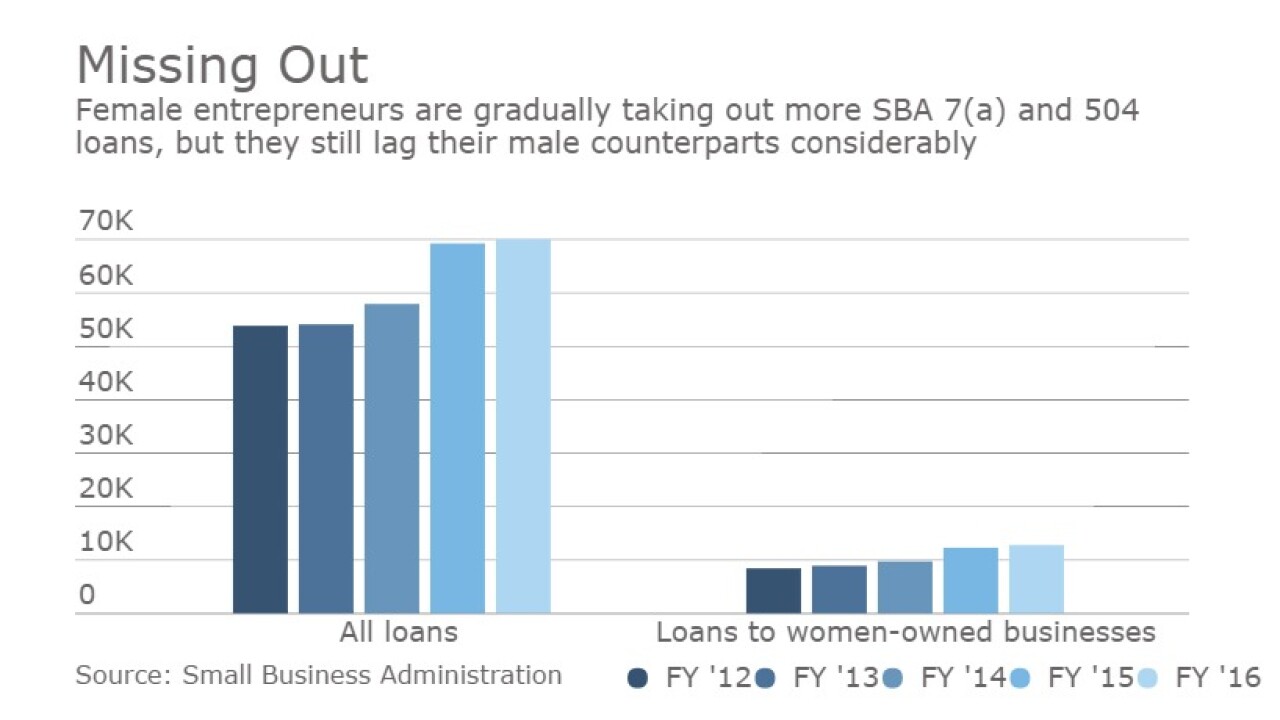

Female entrepreneurs who apply for loans online and are evaluated by an automated system get a bigger share of online credits than they do traditional in-person bank loans. It could be a sign that automated credit decisions are fairer.

December 20 -

Tim Pawlenty, the head of the Financial Services Roundtable and former Minneosta governor, sent a letter Monday to President-elect Donald Trump requesting that he take steps to harmonize government cybersecurity requirements.

December 19 -

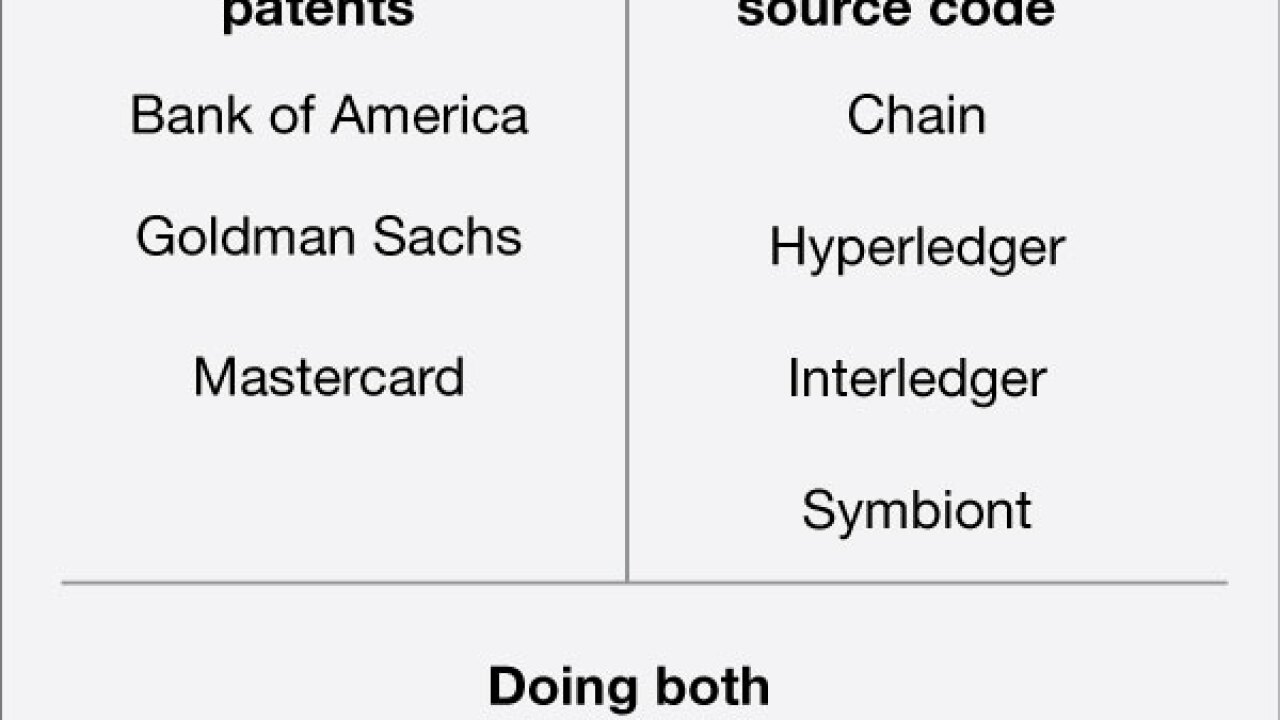

As financial institutions have gained a clearer understanding of blockchains, they've begun to see the merits of openness in supporting collaborative innovation, and the limitations of the old you-can't-touch-this approach.

December 19 -

Radius Financial Group worked for years to achieve an end-to-end digital closing process, finally doing so this fall. Here's how the Massachusetts lender got it done.

December 19 -

The appeal of information pathways such as the internet were seen as possibly bringing about a "comeback" for artificial intelligence in financial services in the 1990s.

December 19

-

U.S. Bancorp has named Citigroup executive Sayantan Chakraborty head of product management for its global treasury management business.

December 19 -

Much of regtech focuses on automating compliance functions, but the human eye is still needed in some cases. Royal Bank of Canada and D+H have developed an assessment tool designed to help employees do their jobs better.

December 16 -

To act like a startup as many banks say they want to do institutions must employ a nontechnical strategy: build services based on customers say they want.

December 16 Seed

Seed -

American Banker readers share their views on the most pressing banking topics of the week. Comments are excerpted from reader response sections of AmericanBanker.com articles and our social media platforms.

December 16 -

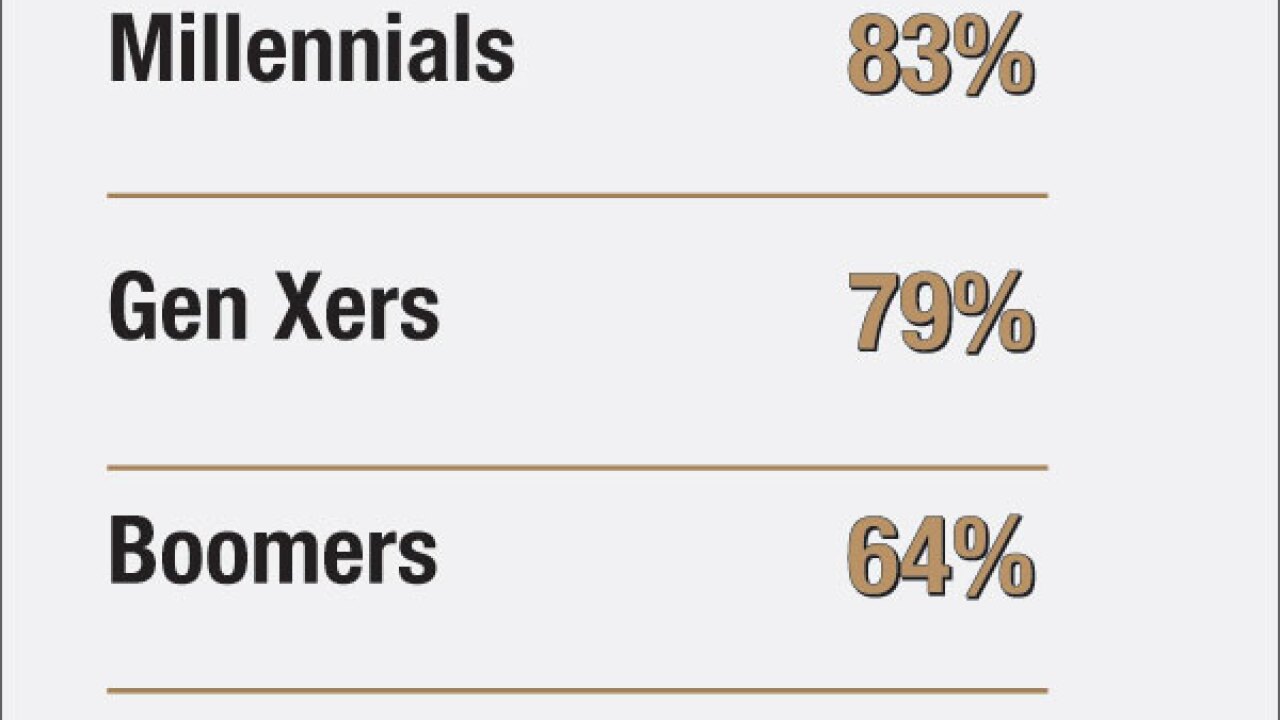

It is time for financial services to rethink retirement savings given changing work habits, customers' expectations of technology and the need for better transparency in 401(k)s.

December 15 -

To convince graduates that working for a bank might be better than joining a startup, lenders are keen to show new hires they are technology companies first, and banks second.

December 15 -

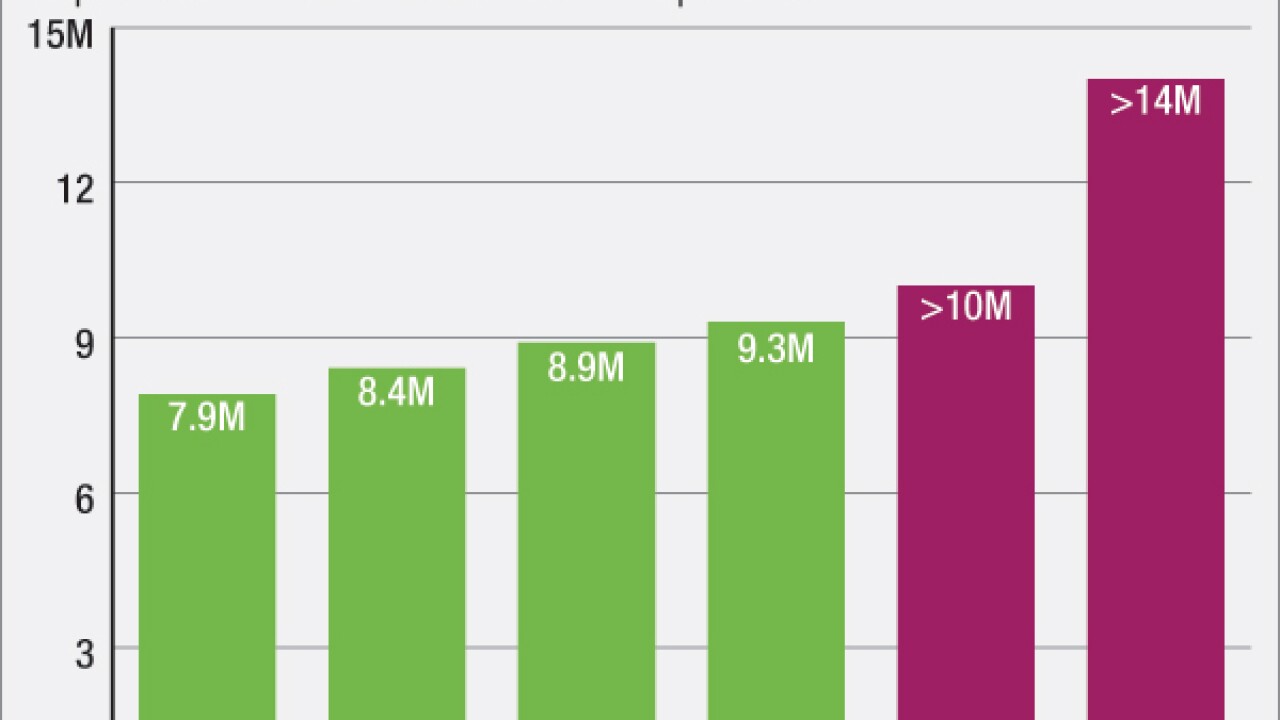

Yahoo! Inc. disclosed a second major security breach that may have affected more than 1 billion users, another blow to the company's reputation as it nears the sale of its main web businesses to Verizon Communications Inc.

December 14 -

The tech firm behind USAA's digital assistant has introduced an authentication tool that identifies customers by the sound of their voice or by their facial features.

December 14 -

WASHINGTON Senate lawmakers are putting pressure on the Treasury Department's financial crimes unit to clarify to banks that businesses hired by marijuana growers and dispensers should not be treated like pot firms themselves.

December 14 -

Call it the banking equivalent of a farmers market in Brooklyn: A startup is building a platform to highlight mission-driven banks for prospective customers who want to know how their money is lent.

December 14 -

Banks should embrace artificial intelligence so that they can more easily navigate policy shifts that will affect their compliance resources and processes.

December 14 The Rudin Group

The Rudin Group -

Bank of America's forthcoming mobile app update will include personal financial management features.

December 13 -

Ralph Hamers, CEO of ING Group in Amsterdam, sat down with American Banker to talk about the company's future in the U.S., plans to grow mobile users and banks' relationship with fintech.

December 13