-

From the election's policy implications for banking to deep analysis of the Wells Fargo scandal, here are some of our favorite stories of the year. Stay tuned for Part II.

December 23 -

The blockchain startup Axoni has raised $18 million in a Series A funding round led by Wells Fargo and Euclid Opportunities, the fintech investment business of the interdealer brokerage ICAP.

December 22 -

At a time when individual accountability at corporations is mounting, here is how compliance officers can detect and prevent fraud occurrences within their own firms.

December 22 Intralinks

Intralinks -

The decision to rewrite the regulation came two days after a hearing in which New York bankers unleashed a litany of complaints about the regulation to Empire State lawmakers.

December 22 -

BBVA Compass is replacing CEO Manolo Sanchez, who has led the charge for digital innovation at the bank during his eight years at the helm, with an executive from the Spanish parent company's Turkish franchise.

December 22 -

Had Wells Fargo simply complied with regulatory guidelines on multifactor authentication across all channels, there would have been substantially less fraud.

December 22 Open Identity Exchange

Open Identity Exchange -

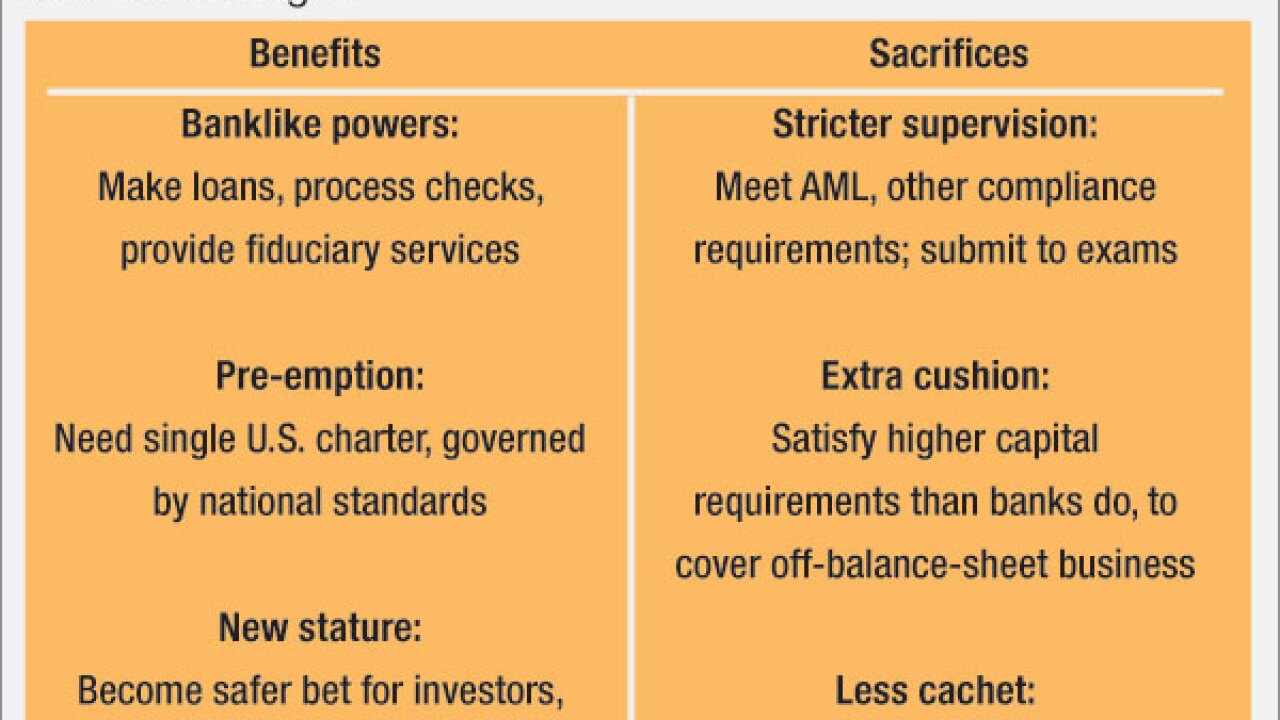

Now that the OCC has proposed a limited-purpose bank charter for fintech companies, a host of innovative new banks will soon flood the market or maybe not.

December 21 -

President-elect Donald Trump has threatened retaliatory tariffs on China if they cheat on their trading obligations. A good place to start would be Chinas payment card market.

December 21

-

Scandal, business models gone awry, missing money and executive shake-ups — 2016 had it all. Here are the financial services executives or groups of them who took the heat and will be looking for better times in 2017.

December 21 -

With identity management now established as a distinct industry, it needs an organization to nurture its practitioners like those that exist for the privacy and security sectors.

December 21 Kantara Initiative

Kantara Initiative -

Opes Advisors shows would-be borrowers how purchasing a house fits into their total financial picture, now and years into the future. Many of its loan officers are licensed investment advisors.

December 20 -

Goldman Sachs and JPMorgan Chase are among a group of institutions reportedly backing Axoni, a capital markets technology firm that specializes in distributed ledger infrastructure.

December 20 -

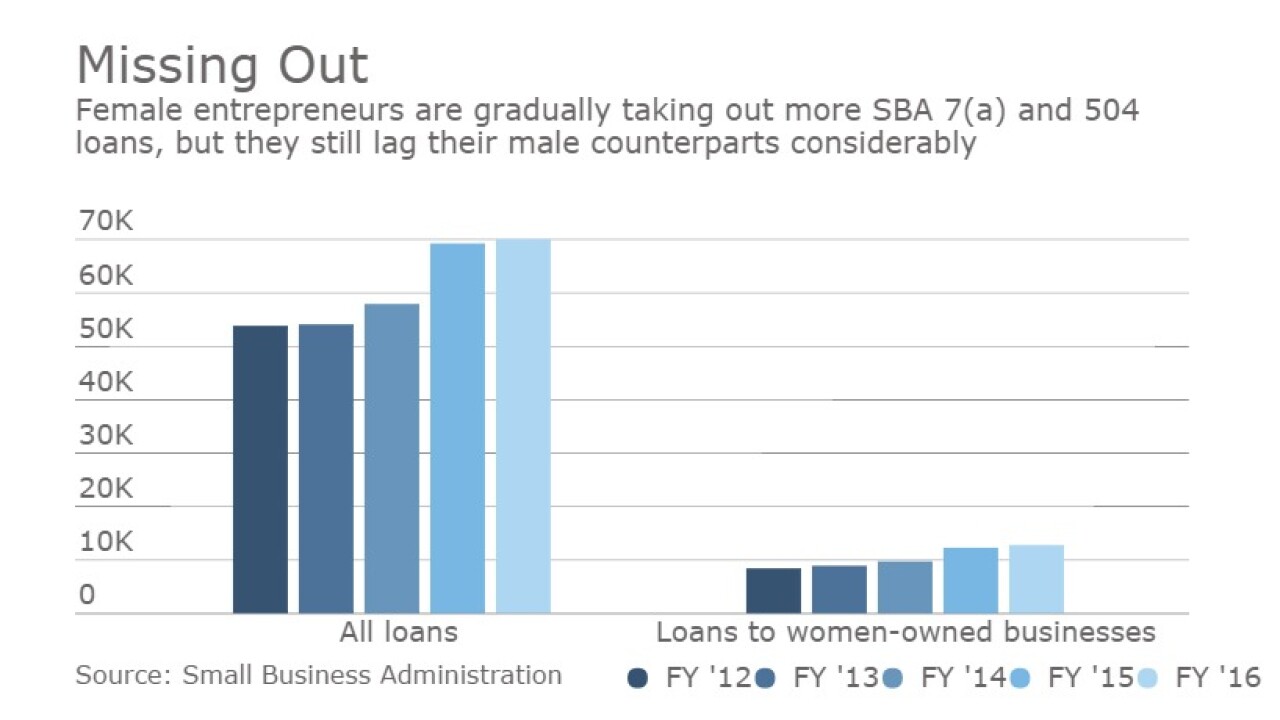

Female entrepreneurs who apply for loans online and are evaluated by an automated system get a bigger share of online credits than they do traditional in-person bank loans. It could be a sign that automated credit decisions are fairer.

December 20 -

Tim Pawlenty, the head of the Financial Services Roundtable and former Minneosta governor, sent a letter Monday to President-elect Donald Trump requesting that he take steps to harmonize government cybersecurity requirements.

December 19 -

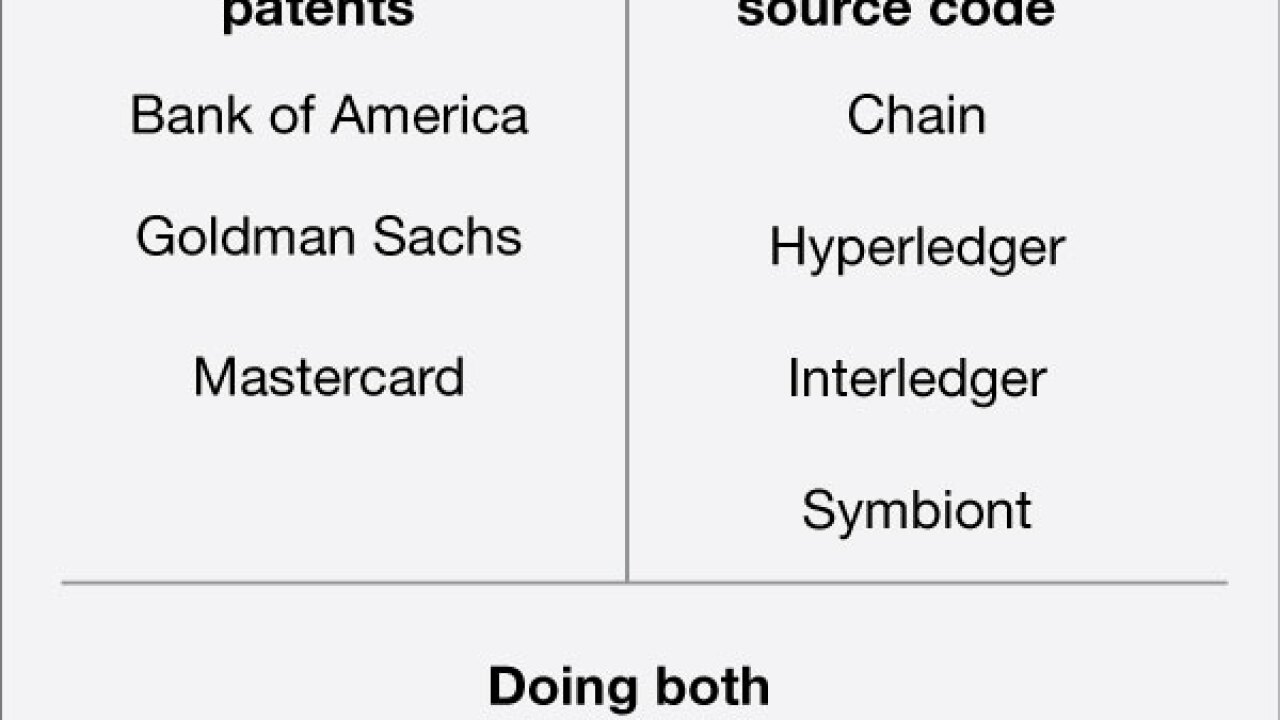

As financial institutions have gained a clearer understanding of blockchains, they've begun to see the merits of openness in supporting collaborative innovation, and the limitations of the old you-can't-touch-this approach.

December 19 -

Radius Financial Group worked for years to achieve an end-to-end digital closing process, finally doing so this fall. Here's how the Massachusetts lender got it done.

December 19 -

The appeal of information pathways such as the internet were seen as possibly bringing about a "comeback" for artificial intelligence in financial services in the 1990s.

December 19

-

U.S. Bancorp has named Citigroup executive Sayantan Chakraborty head of product management for its global treasury management business.

December 19 -

Much of regtech focuses on automating compliance functions, but the human eye is still needed in some cases. Royal Bank of Canada and D+H have developed an assessment tool designed to help employees do their jobs better.

December 16 -

To act like a startup as many banks say they want to do institutions must employ a nontechnical strategy: build services based on customers say they want.

December 16 Seed

Seed