-

Community banks are grappling with a quickly changing operating environment, but they might have some practical advantages over large banks in building partnerships with fintech firms, and those relationships could give them the competitive edge they seek.

April 22 -

American Banker readers share their views on the most pressing banking topics of the week. Comments are excerpted from reader response sections of AmericanBanker.com articles and our social media platforms.

April 22 -

Long before daily talk of fintech, blockchain and APIs, the number of U.S. banking customers who used at-home services once amounted to the population of a small suburb.

April 22

-

Capital continues to flow freely into financial technology ventures, many of which are repositioning themselves as aspiring partners for banks rather than would-be disruptors.

April 21 -

The Paris Agreement on limiting the rise in global temperatures opens up new lending opportunities related to low-carbon projects while highlighting an array of new risks for financial institutions.

April 21

-

Experts from across the payments industry gathered in Los Angeles for SourceMedia's annual Card Forum and Expo. Here are some of the biggest ideas discussed at this year's event.

April 21 -

Traditional banks are not likely to match the nimbleness of a fintech startup for a whole variety of reasons. But that doesn't mean all is lost.

April 21

-

Richard Davis, the Minneapolis bank's CEO, is defending his decision to charge a fee for real-time payments. The move will allow it to earn back the cost of investment and prevent consumers from thinking of the bank as "a utility," he says.

April 20 -

For years, U.S. financial institutions have taken the position that it was riskier to replace legacy core systems than to leave well enough alone. Here's why that's beginning to change.

April 20 -

In the conclusion of a three-part interview, Ryan Singer, a blockchain-tech entrepreneur, explains why bankers should care about Washington's resurgent efforts to insert back doors into security systems.

April 20 -

Transactis, a billing and payments company, has received a $30 million investment from Safeguard Scientifics and five banks.

April 20 -

A closer look at a strangely named piece of malicious software shows it makes crafty use of drive-by downloads and Web injections to fool users into complicity with online banking fraud.

April 19 -

Community banks are at a crossroads as they face a threat from alternative lenders and the need to stay true to the traditional bank model. What they should do?

April 19 Sageworks

Sageworks -

A British author and a Singapore venture capital firm have formed a $5 million investment fund to help banks partner with startup companies in the blockchain industry.

April 18 -

WASHINGTON Several Democratic senators are calling for the Government Accountability Office to investigate whether financial technology companies are properly regulated.

April 18 -

Ally Financial has launched a mobile app that uses geolocation to caution smartphone-carrying customers when they are arriving at stores where they overspend.

April 18 -

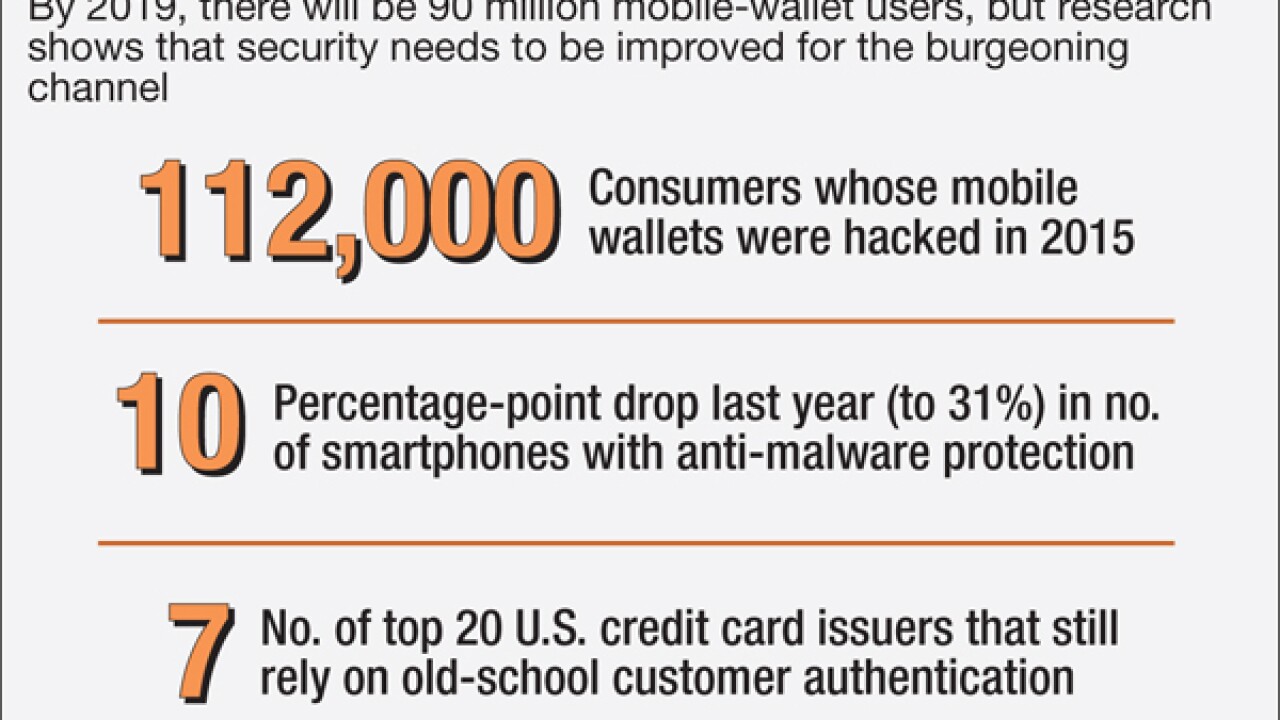

As mobile wallets become more popular they'll also become more popular targets for fraud. Banks ought to improve enrollment guidelines and other security tools in plotting their mobile-wallet strategy.

April 18 -

The idea of financial institutions resembling utilities has caught on with some industry observers for reasons other than reducing systemic risk.

April 18

-

Cyberthieves using malicious software discovered by IBM Security have stolen $4 million from business customers of two dozen financial services providers this month, IBM said.

April 15 -

The Memphis, Tenn., company's forecast for the remainder of the year calls for cost saves from a branch-reduction effort that's gaining momentum as online and mobile banking grow and monthly visits to branches plummet.

April 15