-

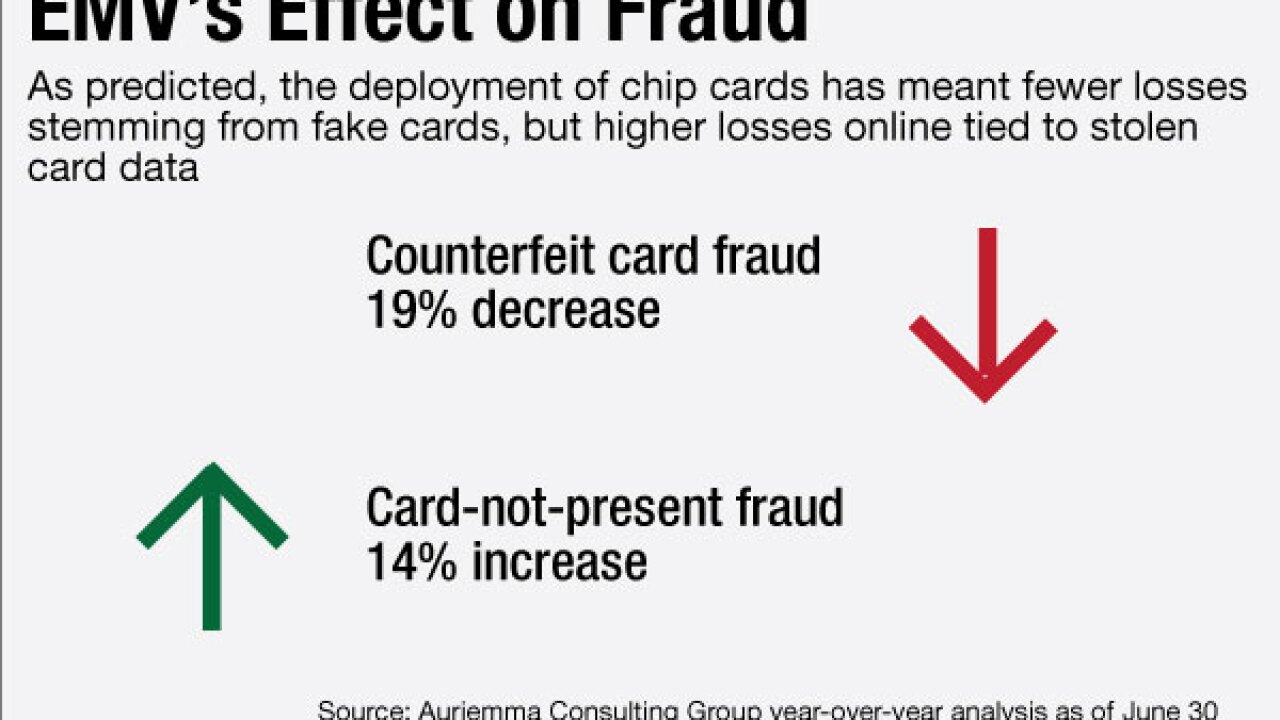

As online shopping and card fraud increase, startups offering easy-to-use "burner" cards could see strong traction.

December 13 -

Fifth Third Bancorp has invested in an online lending firm that makes loans to franchisees of popular retail chains.

December 13 -

Some are replacing legends, others are overseeing major mergers or product launches, and at least one big-bank CEO is on the hot seat. These are the industry executives to keep an eye on in the new year.

December 13 -

Both major brands are accelerating a move away from traditional checkout, and all retailers need to make adjustments for the future.

December 13 Judo Payments

Judo Payments -

The payments messaging network Swift has told its client banks that the threat of cyberattacks "is very persistent, adaptive and sophisticated and it is here to stay."

December 12 -

Banks and data aggregators agree that screen scraping is a practice probably best left behind. In the coming year, the two might get better at sharing data via APIs.

December 12 -

First Republic Bank in San Francisco has bought Gradifi, a two-year old firm that works with small and large companies to help their employees pay down student debt.

December 12 -

Banks aiming to market internally developed products to other banks are also taking steps to become better vendors. Leader Bank, for instance, took more than a year to get its technology and staffing up to snuff before pitching its rent-payment program.

December 12 -

The core-tech vendor Fiserv has agreed to buy Online Banking Solutions in Atlanta.

December 12 -

Bankers who are working to transform their institutions for the digital age have a new resource for networking and education.

December 12 -

Ally Financial is now making home loans.

December 12 -

Large banks will soon launch Zelle, their person-to-person payments app. Will it succeed or will it be another name on a growing list of such platforms that never panned out?

December 9 -

A week after the Office of the Comptroller of the Currency created a new federal charter for fintech firms, California's financial regulator is calling on other states to work together in making their licensing system more palatable to companies.

December 9 -

As regulators open the door to fintech firms applying for bank charters, what has already been a long journey to this point is only going to get more intense.

December 9

-

A flood of fintech companies are promising to create a better experience for mortgage borrowers, forcing lenders to contemplate buying a vendor's software, building applications in-house or even outright acquiring a company with digital expertise.

December 9 -

American Banker readers share their views on the most pressing banking topics of the week. Comments are excerpted from reader response sections of AmericanBanker.com articles and our social media platforms.

December 9 -

SAN FRANCISCO Want to improve the customer experience? Start by making the employees' tools better.

December 8 -

When BankMobile, the brainchild of Jay Sidhu and his daughter Luvleen, relaunches on a new platform in January, security especially for the onboarding process will be completely redesigned.

December 8 -

The Office of the Comptroller of the Currency faces a challenging task as it attempts to add financial inclusion requirements to its pending fintech charter without following the exact blueprint of the Community Reinvestment Act.

December 8 -

U.S. banks are smart to take their time in embracing a model that cedes space to nonbank competitors and could put consumers more at risk for identity theft.

December 8 Financial Services Authority

Financial Services Authority