-

Application programming interfaces are the connective tissue of the digital transformation at banks. Their role is getting more important as consumers look for more ways to connect.

August 10 -

Banks need to embrace technology that can deliver the speed and personalization millennials have come to expect or risk losing this customer segment to fintech companies for good.

August 10 CCG Catalyst

CCG Catalyst -

The emergence of lenders that have no real connection to a geographic area prompts questions over how the Community Reinvestment Act's "good neighbor" policy can continue.

August 10

-

The U.S. is steadily building the foundation of a nationwide faster payments system, but not all of the pieces are connected. Many of the elements developed independently, with influence from across the globe.

August 9 -

To help people safeguard their card information when they shop online, a handful of fintech startups are developing ways of keeping that information hidden, providing merchants with tokens instead.

August 9 -

The U.K. Competition and Markets Authority is looking to open application programming interfaces to spur competition in the country's banking sector.

August 9 -

The DAO heist and subsequent reversal of funds on the Ethereum blockchain demonstrate why developers and miners of public blockchains should have more accountability.

August 9 St. Mary's University School of Law

St. Mary's University School of Law -

Under pressure from regulators to beef up risk management in commercial real estate lending, banks are using new software tools to improve analysis.

August 8 -

Community banks are often burdened with manual data entry for processing commercial loans. Union State Bank has turned to digitization software to make it easier. It may sound modest in the age of APIs, but it made a quantifiable difference.

August 8 -

Distributed ledgers have the potential to simplify and strengthen bank regulatory oversight when applied in the appropriate context, such as during the Shared National Credit examination program.

August 5 Crowell & Moring LLP

Crowell & Moring LLP -

Banks must use analytics rather than customer surveys to determine what does and what does not inspire prospects to become customers.

August 5 Liberty Bank

Liberty Bank -

At its launch in 2004, ThankYou had its own separate identity, customer base and website from the rest of Citi even logging into the program was difficult.

August 5 -

American Banker readers share their views on the most pressing banking topics of the week. Comments are excerpted from reader response sections of AmericanBanker.com articles and our social media platforms.

August 5 -

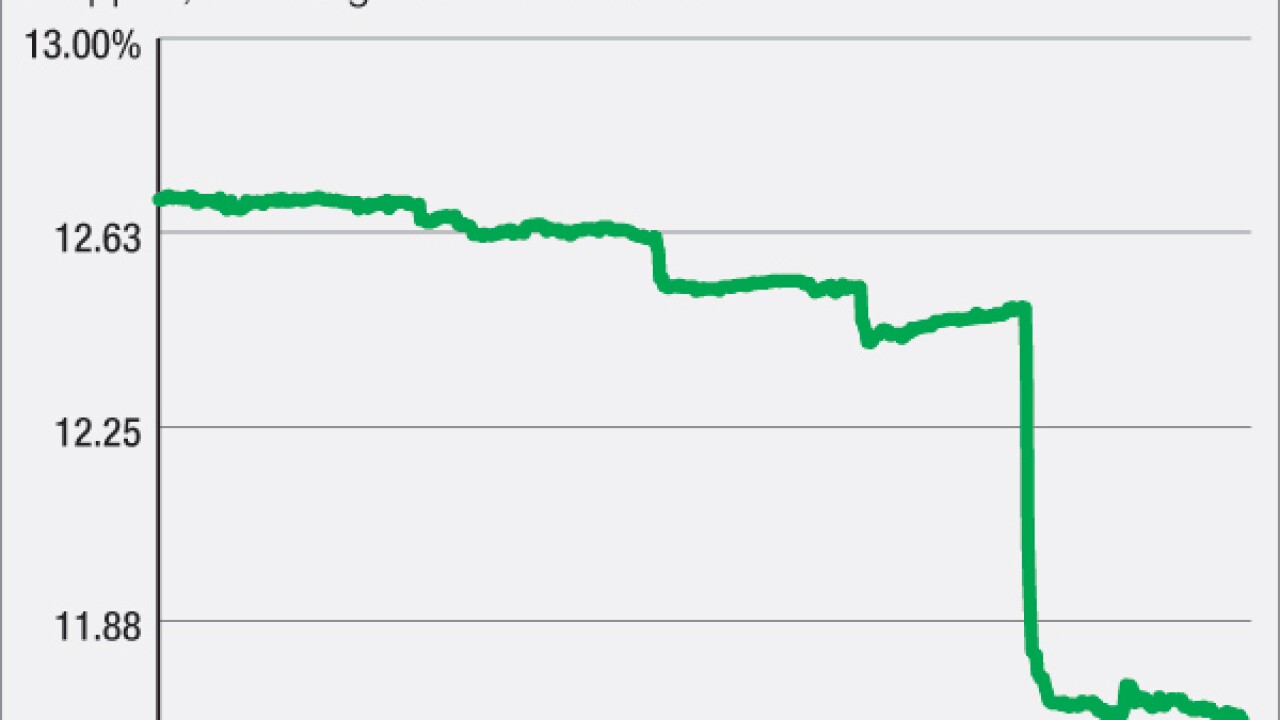

Green Dot profits more than doubled to $8 million in the second quarter as revenues rose slightly and expenses ticked down.

August 4 -

The transactions look so ordinary that most banks' fraud filters aren't able to detect them. And the perpetrators aren't typical hackers they are middle-aged churchgoers who believe they are taking back what's rightfully theirs.

August 4 -

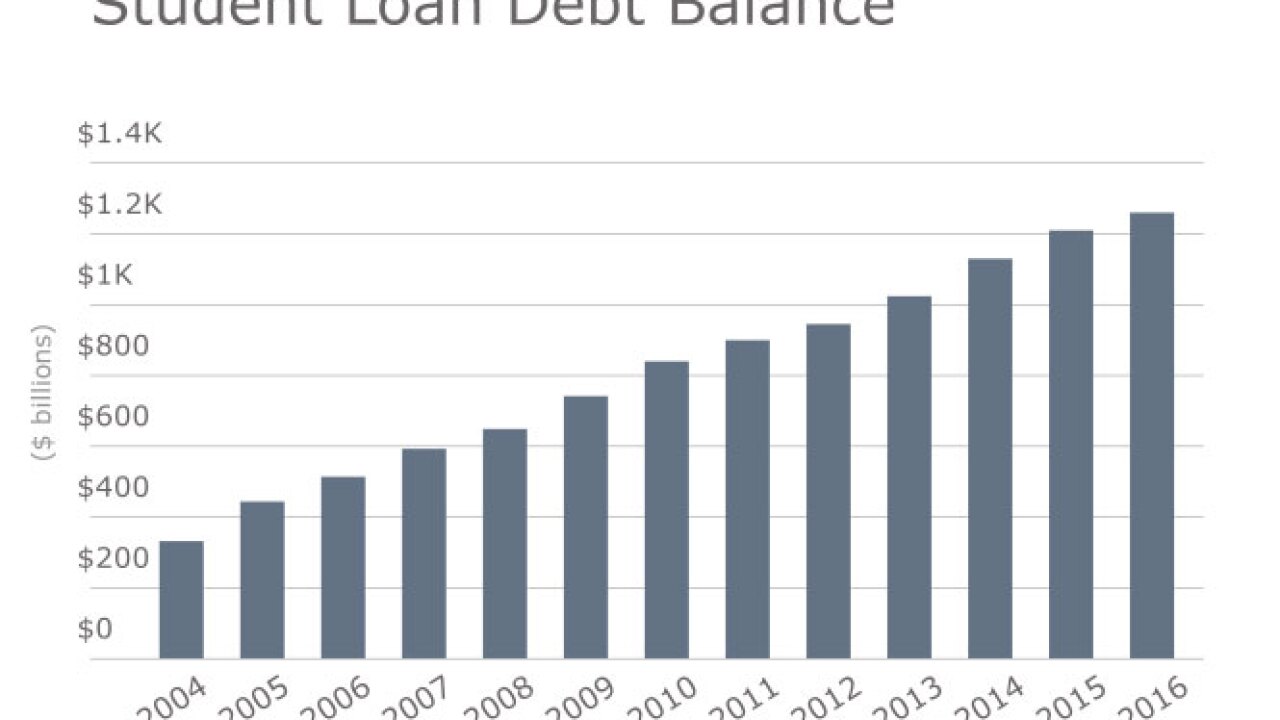

Fintech firms and millennial-focused advisers are providing advice on student loan refinancing, with the expectation that over time it will eventually lead to new business, in the form of brokerage and retirement accounts.

August 4 -

Bank of America, which spends about $1 billion a year handling cash, will save money and require fewer employees as more customers make payments electronically, Chief Executive Officer Brian Moynihan said.

August 4 -

In the wake of the Bitfinex heist, protecting consumers must again be at the forefront of the digital currency community.

August 4 Consumers' Research

Consumers' Research -

Elliptic, a startup that monitors the bitcoin network for suspicious patterns, has introduced anti-money-laundering data into its service through a partnership with LexisNexis Risk Solutions.

August 3 -

The situation turns on whether the CFTC inadvertently pushed Bitfinex to adopt a weaker security system than it had been using. However, the way the bitcoin exchange used the new system was significantly flawed, security experts said.

August 3