-

Early adopters of The Clearing House’s Real Time Payments network have built gateways and accelerated fraud detection systems.

February 12 -

Early adopters of The Clearing House’s Real Time Payments network have built gateways and accelerated fraud detection systems.

February 12 -

For many newcomers to the U.S., establishing credit is a big challenge. A handful of entrepreneurs are developing tools to help verify their financial histories.

February 9 -

Marquette Bank is proof that community banks don't have to be the fastest or flashiest to compete with online lenders. Instead, the Chicago bank closely mirrored fintech offerings while promoting personal service to set itself apart.

February 8 -

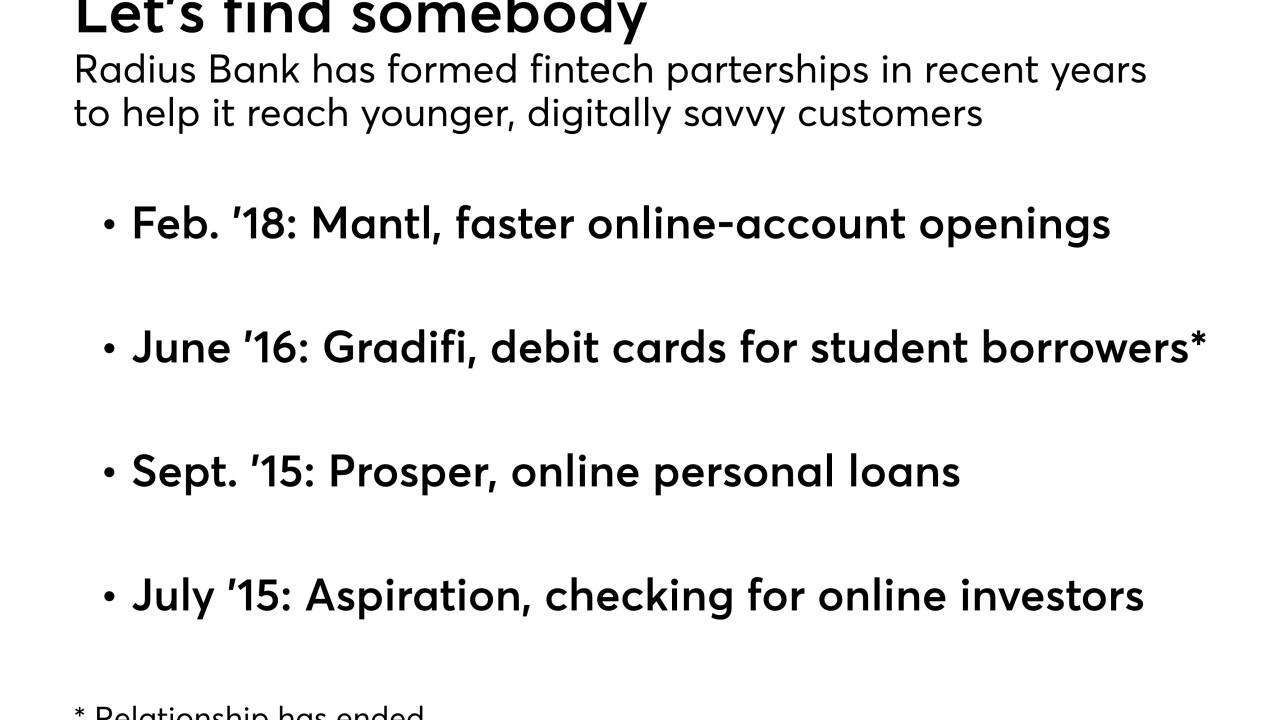

Its latest partner, Mantl, has built software that lets consumers open accounts in four minutes. In such alliances Radius seeks expertise it lacks, gets heavily involved in product development, and tries to balance the spirit of innovation with the demands of compliance.

February 7 -

Overstock will offer automated investing to its millions of shoppers. Some financial advisers reacted with a shrug, but are they underestimating the move?

February 5 -

Digit, which launched as an automated savings app in 2015, has decided chatbots are a flawed interface. Now it’s redesigning its popular app to reflect its new vision.

February 5 -

Large banks have begun sharing their adjusted gender pay gap ratios — how much women are paid versus men for similar jobs. The trouble is, they don’t have similar jobs.

February 2 -

The nation’s two largest banks don't want the credit risk associated with the transactions.

February 2 -

The few U.S. banks embracing data sharing say the industry is moving toward the standard.

February 1 -

Regulatory scrutiny of Tether and Bitfinex is spooking investors, though others argue the industry remains strong.

January 31 -

Bankers would like to take advantage of digital marketing tools that target customers similar to their own, but there are persistent fears that doing so could make financial institutions run afoul of regulatory restraints.

January 31 -

The tool runs the numbers and tells small-business people if they would qualify for an SBA loan, and if not, what they need to do to become eligible.

January 31 -

As it secures new funding and creates a joint venture in Japan, Moven says it is close to becoming a full-fledged U.S. “challenger” by purchasing a traditional bank.

January 31 -

The cloud-based vendor was formerly a division of Live Oak Bank.

January 31 -

The pioneering brand re-enters a market where fintechs now account for over 30% of personal loan originations.

January 30 -

The online lender to small businesses is expanding its business deeper into traditional banks’ territory with larger loans.

January 30 -

AriseBank said it was the first crypto platform to buy a traditional bank. But there’s no evidence it did anything of the kind — and its founder now says it has been raided by the FBI.

January 29 -

The Japanese cryptocurrency exchange Coincheck says roughly $400 million of the digital currency NEM was stolen. If banks and others are to invest in the digital-asset industry, it will have to do better.

January 26 -

The bank tweeted that website and mobile app service were restored after an outage that lasted much of the day.

January 25