-

Bowing to industry pressure, the Consumer Financial Protection Bureau is warning consumers with notices on its complaint portal not to file disputes about inaccurate information on credit reports, among other changes.

February 5 -

The support from the stablecoin provider follows a string of tech firm acquisitions as Anchorage Digital broadens its crypto services.

February 5 -

American Banker's 2026 Predictions report finds that nonbank entities and check fraud are major threats to local banks in the coming months.

February 5 -

This month, Bank of America plans to unveil new incentives for cardholders with higher account balances. Reworking the rewards program is one lever the firm is pulling in its effort to lift the annual profit of the consumer unit to $20 billion by the end of the decade.

February 5 -

Fraudsters and modestly dishonest employees can use generative AI to quickly create convincing fake utility bills, pay stubs, passports and other documents banks rely on.

February 5 -

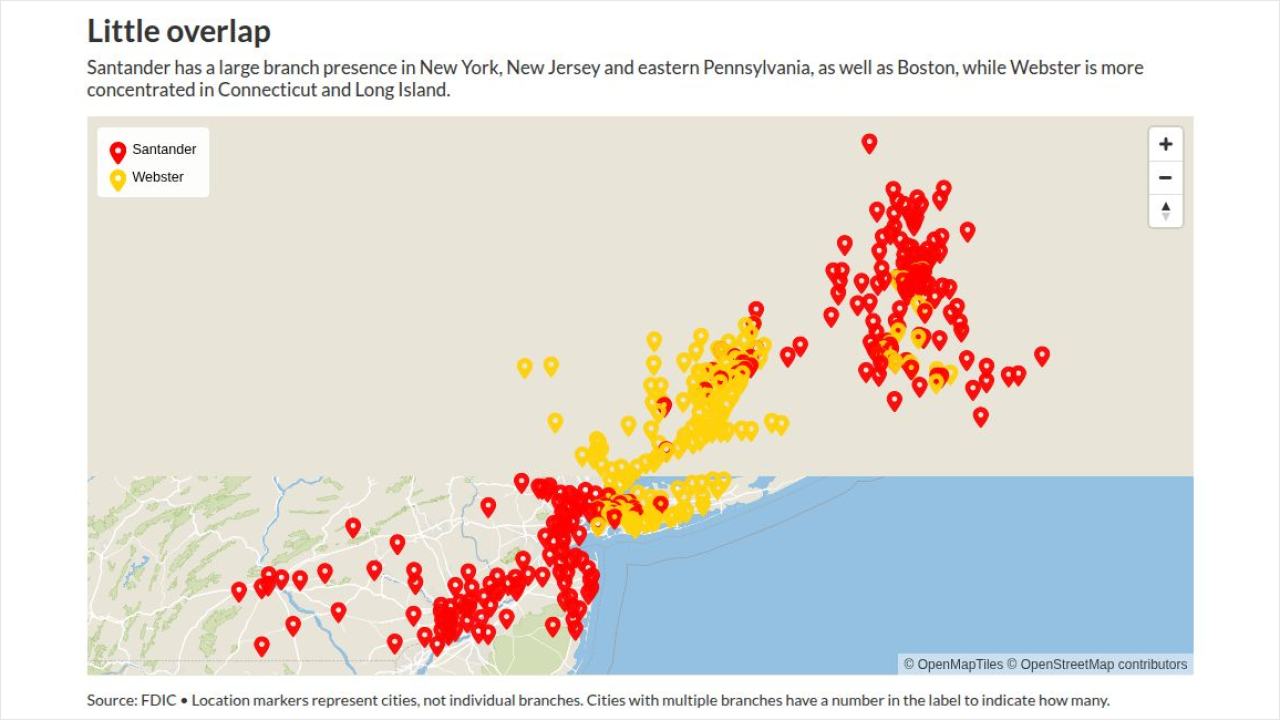

The Spanish banking giant is accelerating its U.S. growth plans with the pending acquisition of Webster Financial in Connecticut. The combined entity will be the second-largest foreign-owned bank operating in the country.

February 4 -

The latest directive, which takes effect in March, allows only U.S. citizens and nationals to seek government-guaranteed financing. It's drawing criticism from Democrats in Congress, small-business advocates and some lenders.

February 4 -

-

-

The proliferation of so-called "Drainer-as-a-Service" platforms that allow low-skilled attackers to execute sophisticated fraud schemes present a challenge to banks as cryptocurrencies go more mainstream.

February 4

-

The "exorbitant privilege" the U.S. has long enjoyed because of the dollar's status as the world's reserve currency would be supercharged if global adoption of stablecoins leads to greatly increased demand.

February 4

-

Community bankers say credit unions and new fintech entrants are increasing the competition for deposits and loans, even as deregulation is lowering capital and compliance costs, according to a new survey from reciprocal deposit provider IntraFi.

February 4 -

The Spanish banking giant, which has been trying to grow its U.S. business, plans to acquire the Connecticut-based parent company of Webster Bank.

February 3 -

The crypto and payment fintechs both debuted on the stock market in late January with strong openings, then traded down ahead of a four-day partial government shutdown.

February 3 -

Acquiring the $5.8 billion Northfield Bancorp would give Columbia a presence in both Brooklyn and Staten Island. The deal provides a window into the impact of New York Mayor Zohran Mamdani's plan to freeze rents on the city's multifamily real estate market.

February 3 -

Some traditional bankers are unsettled by the wave of crypto and fintech banks getting bank charters. This Nashville bank CEO sees opportunity.

February 3 -

It won't be long before bank customers can ask an AI agent to optimize their returns on idle cash. When it happens, banks' net interest income is going to come under direct threat.

February 3

-

The Swiss banking giant will come under the spotlight Tuesday at a Senate hearing.where the question of whether a 1999 settlement over Holocaust-looted funds should be reopened is expected to be discussed.

February 3 -

The digital bank added two new board members and raised $123.9 million as it continues to manage regulatory costs amid its push for profitability.

February 2 -

In keeping with its policy of outsourcing functions outside its core commercial and retail banking competency, Signature Bank near Chicago teamed with a larger trust company to fill a longstanding gap in its product set.

February 2