-

Citizens Community Bancorp is selling its Rochester Hills, Mich., office to Lake Michigan Credit Union.

December 3 -

Christopher Kay will oversee the Buffalo, N.Y., bank's branch and ATM networks as well as development of products and services that seek to mimic the cutting-edge offerings of other industries.

November 20 -

Silvergate is selling the branch to focus more on fintech deposits and specialty lending.

November 16 -

Prosecutors are unlikely to buy Goldman's rogue banker defense, observers say; survey predicts recession within two years.

November 16 -

The company is selling 14 branches, including several around Chattanooga, Tenn., and its mortgage business to FB Financial so it can focus on its Atlanta operations and national lending businesses.

November 14 -

As the Latham, N.Y., credit union adds branches, it plans to put an emphasis on service, rather than transactions.

November 14 -

When Listerhill Credit Union was developing its latest location, management decided on using smart ATMs and a more open floor plan.

November 12 -

The Dallas bank inherited the five Bank of the Hills branches when it acquired Sterling Bancshares in 2011.

November 1 -

Orange County Bancorp has identified two neighboring counties for expansion.

November 1 -

Big banks have plans to open hundreds of branches in new markets to add deposits, but smaller regionals have largely sought to hold the line on costs. Cullen/Frost Bankers' decision to double its branch count in Houston may be a sign that midsize banks are rethinking their retail strategy.

October 25 -

From branch networks to technology and cybersecurity concerns, there's plenty to keep leaders of CDFIs and small CUs awake at night.

October 24 -

Barred by regulators from adding assets for at least another six months, the bank has only one main lever to pull to boost returns.

October 12 -

JPMorgan's chief cautioned against expanded regulation for big companies, arguing that businesses contribute to the economy.

September 24 -

It will also invest in mortgage and small-business lending and in neighborhood revitalization efforts there. The moves are part of a nationwide expansion by the largest U.S. bank.

September 24 -

The Kansas company has agreed to buy three offices from MidFirst Bank.

September 24 -

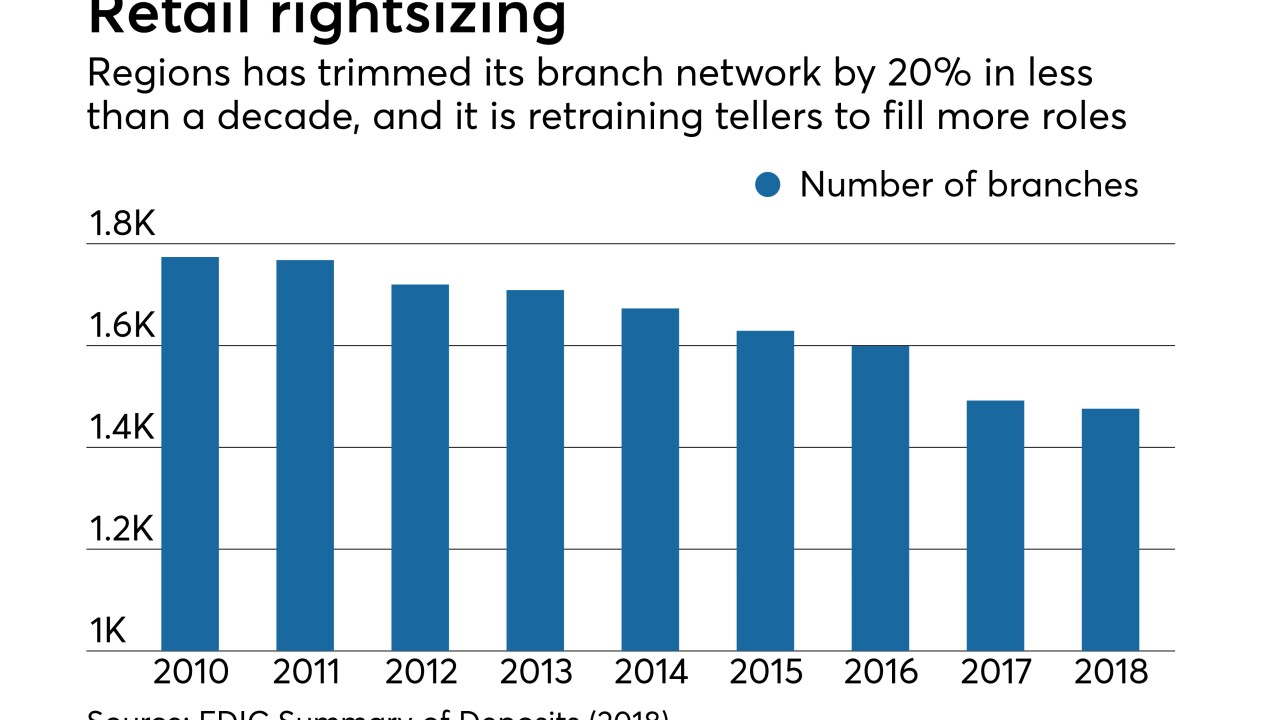

When the Birmingham, Ala., bank was rethinking its branch strategy, it had to reconsider the role of its tellers. Ultimately, it decided to transition those workers to a more general banker role that emphasizes meaningful conversations with customers and continuous career progression.

September 20 -

The cuts are part of a broader effort to trim expenses by roughly $3 billion a year by 2020.

September 20 -

This is the second such pact the Great Lakes State has entered in order to make interstate branching for state-chartered credit unions more accessible.

September 14 -

Some are relying on a national, digital strategy. Others say the right balance of costs and growth comes from more traditional means such as targeted branch openings and out-of-market expansion.

September 12 -

Scott Powell, the CEO of Santander Holdings USA, has spent years contending with a host of regulatory problems. He outlined a long-range vision that includes a branch-focused retail push and possible acquisitions.

September 4