-

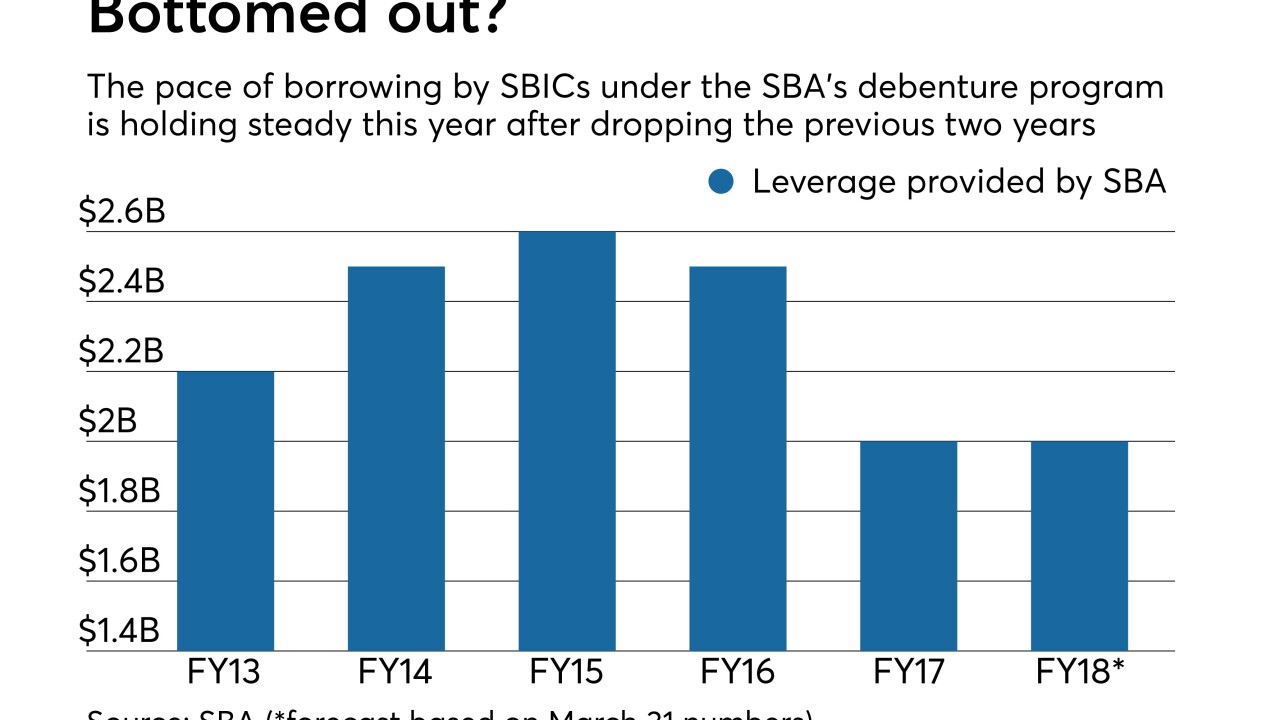

While the Small Business Investment Companies program has reported disappointing results since its 2015 peak, participating funds are getting more looks from curious bankers.

July 12 -

Toronto-Dominion Bank agreed to acquire Greystone Capital Management in a push to become the largest Canadian money manager.

July 11 -

Restaurant point of sale and back-office management provider Toast has received $115 million in Series D funding that the company plans use to develop technology and expand its market.

July 10 -

Fannie Mae and Freddie Mac enjoy considerable advantages because of their lower cost of capital and significant government subsidies. But with some conforming loans, the private market is finding a way to compete.

July 3 -

Spirit Community Bank would be the first new bank in North Carolina since 2009.

June 29 -

Denver-based P2Binvestor plans to use the new funds to expand its bank partnership program.

June 21 -

U.K. private equity firm Dunedin says it has invested "a significant stake" in a £44 million (U.S. $58 million) funding round for Global Processing Services, which provides payment processing and technology for financial institutions, digital banks, challenger banks and fintechs.

June 19 -

Ben Holzman helped build Bain Capital Ventures' enterprise software practice.

June 12 -

The bank’s joint initiative with CFSI awards capital to firms trying to address issues that the startup teams personally experienced.

June 7 -

Marqeta Inc. may never be a household name, but its behind-the-scenes payments services have attracted plenty of attention. The fintech startup announced Tuesday that it is raising $45 million from investors including Iconiq Capital, the family office with investors including Jack Dorsey and Mark Zuckerberg, and Goldman Sachs Group Inc.’s investment bank.

June 5