-

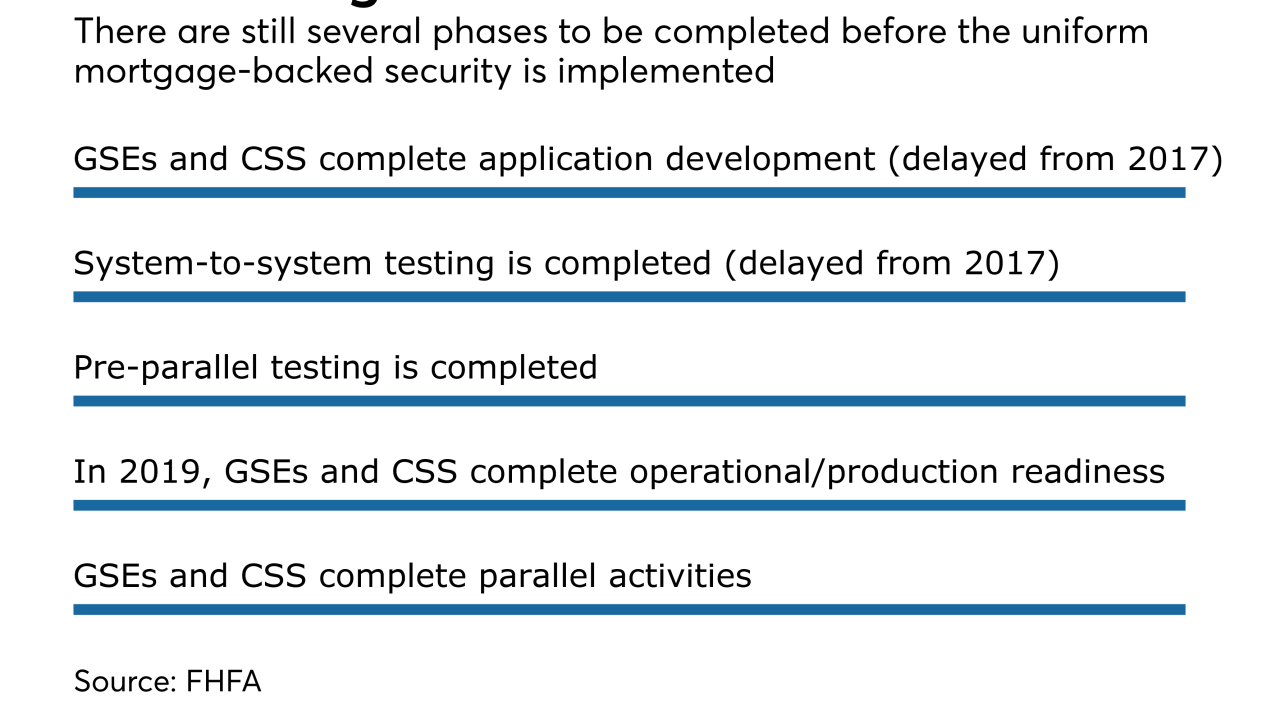

Testing of the common securitization platform is taking longer than expected, but the Federal Housing Finance Agency said it won't delay the 2019 launch of Fannie Mae and Freddie Mac's new single "uniform mortgage-backed security."

December 4 -

One of the world's largest bitcoin exchanges, bitFlyer, has landed in the U.S. with a focus on institutional investors — a move that suggests bitcoin's days as a payments instrument are still a long way off.

November 28 -

The digitally driven retail environment has caused lots of adapt-or-die challenges for payment processors and merchant acquirers, including spotting fraud as it moves from one device and channel to another.

November 22 -

Tech startups differ from a bank’s typical commercial clients; many want a trusted financial adviser.

November 21 -

PayStand, a blockchain business-to-business payments platform, has completed a $6 million funding round through BlueRun Ventures.

November 16 -

Deutsche Bank and Commerzbank have held talks before, and now they have a common shareholder — the U.S. PE firm Cerberus — in a position to broker a deal.

November 16 -

The private-equity firm Cerberus Capital Management has taken a 3% stake in Deutsche Bank four months after buying a 5% stake in another German lender, Commerzbank.

November 15 -

The authority of the Financial Stability Oversight Council to label a firm a “systemically important financial institution” triggers duplicative regulation even if banklike rules are not appropriate to the company.

November 9 Johnson Smick International Inc.

Johnson Smick International Inc. -

Fannie Mae servicers are facing pressure from the recent hurricanes, but so far are bearing up under the strain.

November 2 -

The term "shadow banking" is a pejorative, implying insufficient regulatory oversight, said Treasury in a report issued Thursday on asset management.

October 27