-

Larry Mazza, MVB’s chief executive, joined the board at BillGO.

January 11 -

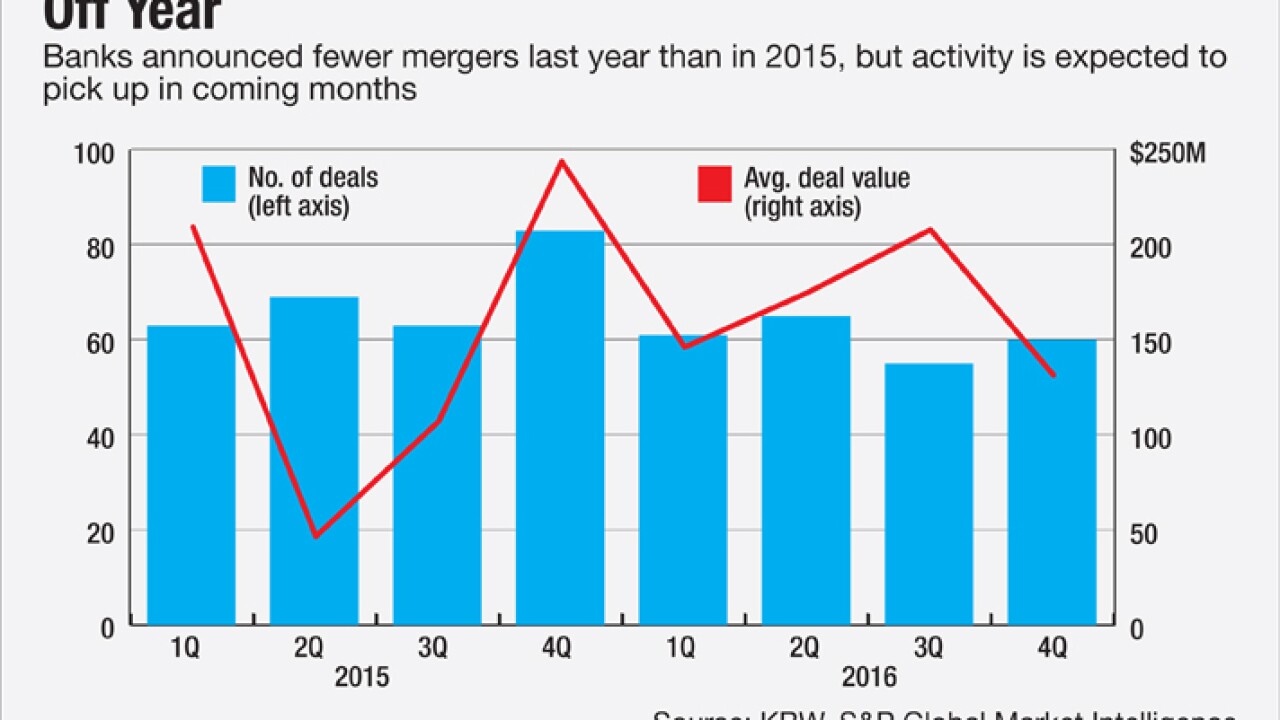

There is optimism that consolidation could bounce back from a lackluster 2016 as bank stocks rally. At the same time, expectations of regulatory easing and tax reform could entice more banks to stay independent, at least in the short term.

January 11 -

F.N.B., Iberiabank and Simmons First are among the banks entering new regions. A growing need for scale and increased use of technology are among the reasons for their aggressive moves.

January 9 -

Shivan Govindan, chairman of First NBC Bank in New Orleans, has taken on the task of salvaging a bank that is reeling from accounting issues and a substantial capital requirement from regulators.

January 3 -

Green Bancorp's aggressive plan to attack its credit quality troubles and do what few Texas banks once would have dreamed of quit energy lending make it a subject of debate and a community bank to watch closely in 2017.

December 29 -

Get out of the red six months from now. That is Fred Viaud's goal for Glen Rock Savings Bank in New Jersey, which on Tuesday said he would be promoted to president and CEO next week.

December 27 -

Deutsche Bank AG will have to clear a lower capital hurdle next year, joining other European lenders who are benefiting from a change in how the European Central Bank sets the requirements.

December 27 -

The Treasury Department has significantly reduced its stake in Broadway Financial in Los Angeles.

December 23 -

Stephen Gordon has long been known as an entrepreneurial banker, which helped him expand his California bank aggressively over a five-year period. A spike in chargeoffs that led to a third-quarter loss spurred Gordon to beef up credit oversight. The question is whether that effort will stymie loan growth.

December 23 -

Highlands Bancorp in Vernon, N.J., has raised $8.5 million through a sale of common stock.

December 23 -

American Banker predicted these five bankers would make news. Several delivered, mostly with small, strategic deals and finding ways to make money in spite of challenging conditions.

December 23 -

Add Investar Holding in Baton Rouge, La., to the growing list of community banks filing shelf registrations.

December 23 -

Sussex Bancorp in Rockaway, N.J., has raised $15 million by selling fixed- to floating-rate subordinated notes to an institutional investor. It did not name the investor.

December 22 -

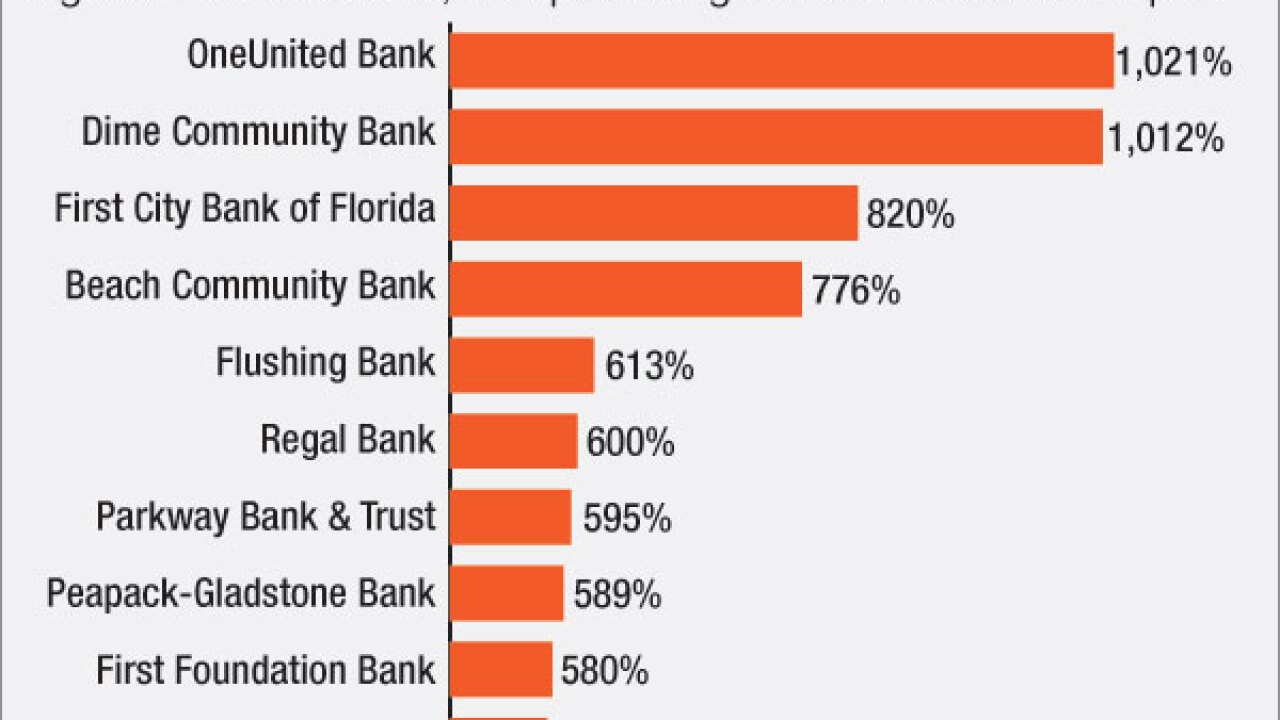

Regulators have warned about the dangers of high commercial real estate concentrations despite bankers' assertions that they are managing risk better than they did before the financial crisis. Still, CRE concerns could influence M&A and loan diversification in 2017.

December 22 -

Equity Bancshares in Wichita, Kan., has raised $35.4 million in a common stock offering and plans to use the proceeds to pay down a line of credit and support growth.

December 22 -

Prosperity Bancshares in Houston filed a shelf registration to sell a variety of shares.

December 22 -

Peapack-Gladstone Financial in Bedminster, N.J., has filed a shelf registration statement to sell as much as $100 million in securities.

December 20 -

City Holding in Charleston, W.Va., is looking to raise up to $55 million in a stock offering.

December 20 -

Ameris Bancorp in Georgia wanted to buy a premium-finance business but settled for a joint venture, blessed by its regulators, after being flagged for insufficient Bank Secrecy Act compliance.

December 20 -

The banking system ultimately needs a balanced approach to capital, which allows banks to efficiently function while also maintaining financial stability.

December 20 Brookings Institution

Brookings Institution