-

The rise of contactless cards could eclipse mobile payments adoption, experts predicted, while evolving fraud threats may give rise to increased account controls for consumers.

December 31 -

While fraud is a year-round concern, credit unions need to be extra vigilant during the holiday season.

December 11 Advanced Fraud Solutions

Advanced Fraud Solutions -

-

In hundreds of cases, the prepaid card program run by the bank allegedly sent users’ funds to fraudsters who had stolen their data. The security lapse has now caught the attention of the Democratic senator.

October 16 -

With technology tightening defenses against account fraud, scammers increasingly turn to what they view as the weakest link: the human being at a call center.

September 18 -

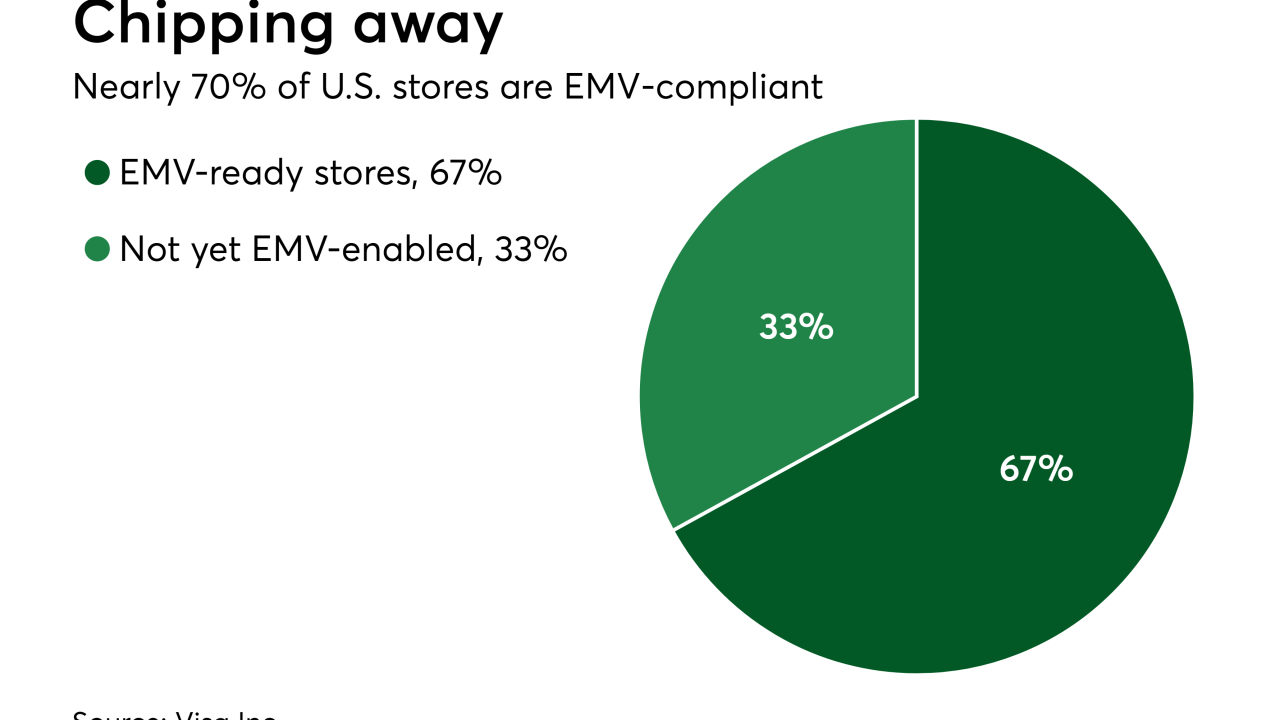

U.S. EMV coverage has gaping holes—including smaller financial institutions that haven’t fully converted to EMV and millions of merchant locations still not accepting chip cards.

September 12 -

How the 'Best Banks to Work For' get employees to love their jobs; Comerica works to address fraud in prepaid benefits program; how to tell if you're banking a pot business; and more from this week's most-read stories.

August 31 -

The Texas bank, which partners with the U.S. Treasury to dispense federal benefits via prepaid cards, is alleged to have dropped the ball as hundreds of cardholders say their money was forwarded to fraudsters posing as them.

August 26 -

CO-OP Financial Services is currently pilot testing the new data-driven tool with credit unions in its shared branching network.

August 17 -

In an age of quick processing for digital payments, transaction disputes can still take weeks for a resolution or chargeback — an unacceptable time frame for e-commerce. To hasten dispute resolution, some vendors are beginning to offer financial incentives to merchants that agree to speed up the process.

May 24