-

E-commerce payment fraud losses are mounting, giving merchants the opportunity to dump responsibility on their technology partners, but there's no surefire way to totally offload the financial hit.

May 21 -

China's mobile payment lessons for U.S. bankers; Steven Mnuchin's wishful thinking on GSE reform; unpacking Mick Mulvaney's CFPB relocation musings; and more from this week's most-read stories.

May 4 -

The provision would make it harder for criminals who use real Social Security numbers to create fake personas and then apply for credit.

May 3 -

The provision would make it harder for criminals who use real Social Security numbers to create fake personas and then apply for credit.

May 2 -

TransUnion’s analysis of credit card applications and transactions finds fraudsters continue to steal more, but the rate of increase is slowing.

March 8 -

Fiserv is rolling out a fraud-detection and decisioning service for issuers from Mastercard that aims to increase the accuracy of card transactions they approve or reject based on potential fraud.

March 6 -

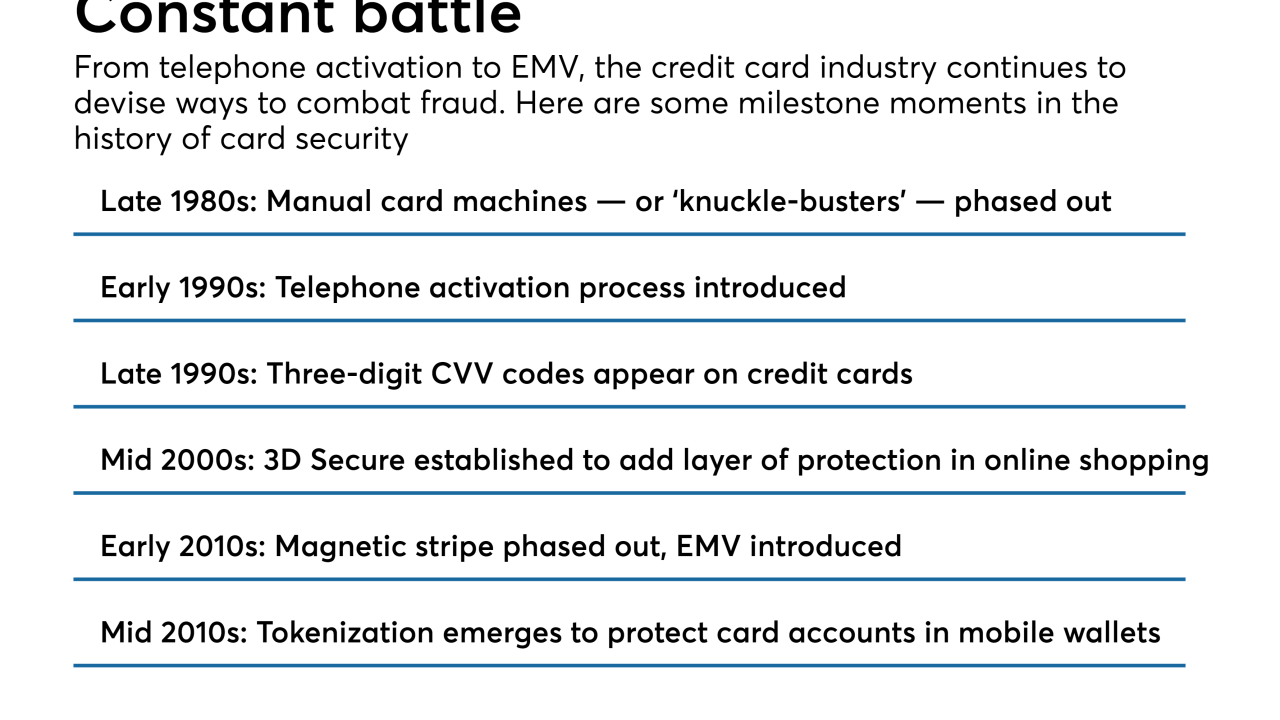

The card activation process is relatively low-tech, but since its introduction nearly three decades ago it has been hugely effective in preventing credit cards from falling into the wrong hands. Among its pioneers was Ash Gupta, American Express’ president of global credit risk, who is retiring next month.

February 16 -

More than 700 million global cyberattacks and 1.7 billion bot attacks took place in 2017, a 44% increase in the attack rate over 2016.

February 15 -

In recent weeks three surveys have been released that assess the U.S. fraud landscape across all of these audiences. These reports provide a holistic snapshot of where payments fraud in the U.S. is today.

February 7 -

The results suggest that even as financial institutions implement more sophisticated fraud-mitigation techniques, they have not been keeping pace with criminals.

February 6 -

Despite some declines, payments fraud remains a major concern for credit unions. Here's how experts suggest tackling the problem.

January 26 -

One New Jersey credit union is starting 2018 with an unexpected crash course in fraud prevention, but there may only be so much anyone can do to curtail the problem.

January 26 -

Breaches help crooks diversify, but stolen cards thrive in the black market, writes Angel Grant, director at RSA's fraud and risk intelligence unit.

January 18 RSA

RSA -

The anxiety that a crook is using a lost or stolen card can be a powerful lure to mobile technology, Citigroup has learned.

January 18 -

With most of the major card brands deciding to no longer require signature authorization on card transactions, merchants want to see more network rules go the way of the dinosaur.

January 8 -

The debit card is growing in popularity in the U.S. for retail transactions, and consequently FIs are making debit a top priority. However, the strength of debit is a double-edged sword.

January 3 -

American Express is falling in line with Mastercard and Discover in eliminating the signature requirement for authorization on all card transactions at the point of sale, starting in April of 2018.

December 11 -

Nearly half of the cardholders in the U.S. have had at least one card reissued in the past year, with those experiencing fraud multiple times saying they have had nearly five cards reissued.

November 28 -

Credit unions are taking steps to ward off fraud as holiday shopping season gets underway.

November 27 -

A week before he is due to resign, CFPB Director Richard Cordray sent a letter to 29 CEOs at banks, credit unions and other financial companies, urging them to help consumers exert more control over credit cards, debit cards and other payment methods.

November 21