-

People appear to be storing cash amid the coronavirus outbreak, according to a study that seeks to debunk the notion that the pandemic was hastening the demise of paper money due to e-commerce or fears of infection.

July 2 -

The murder of George Floyd shocked the national psyche to its core, spotlighting the persistent, systemic racism that exists in many American institutions, which continues to disenfranchise those who live within the Black community.

June 19 -

Federal Reserve Chair Jerome Powell took a question Wednesday about something that doesn’t come up very often in congressional hearings about monetary policy: coinage.

June 17 -

Even though some organizations are now saying they don’t believe cash is a major culprit behind the spread of COVID-19, those taking extra precautions can rest assured they can continue to use contactless payments, while benefiting from the added fraud protection it presents, says FICO's TJ Horan.

June 15 FICO

FICO -

Even in the face of a threat as substantial as coronavirus, cash is not apt to ever fully go away.

June 12 CreditPilot

CreditPilot -

Electronic payments are spiking during the coronavirus, but access to different automated versions is needed, says Qualpay's Penny Townsend.

June 12 Qualpay

Qualpay -

The ATM industry was already mired in the painful transition away from hardware to digital technology, and now it must try to persuade consumers and merchants that cash isn’t unsafe to handle.

June 10 -

Coronavirus has made traveling a dicey proposition to begin with, but when U.K. consumers do venture beyond their homes during the pandemic, far fewer plan on using cash for payments.

June 8 -

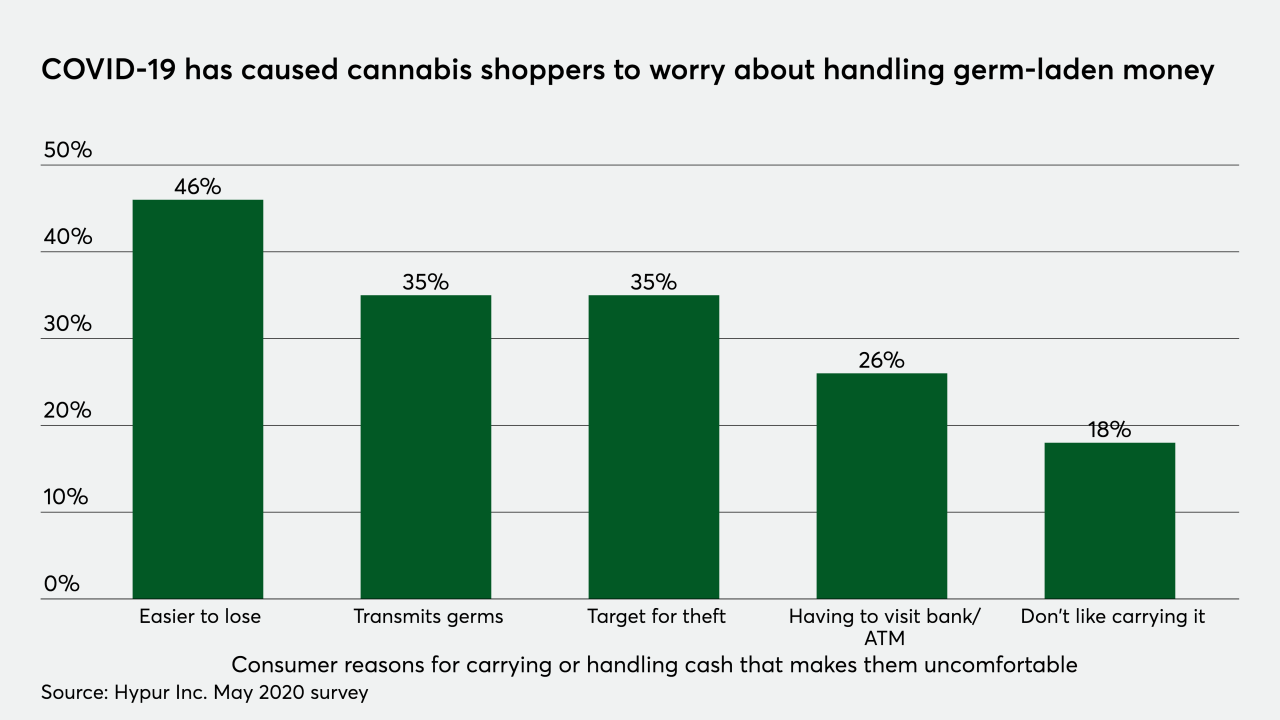

The coronavirus pandemic has changed the way many industries conduct business — and that's especially true of the legal cannabis industry, which was already struggling in the U.S. to find the best way to handle noncash payments.

June 4 -

The coronavirus pandemic has made paper money literally a dirty word, causing a rush to digital payments that may be too fast for Western Union and MoneyGram to keep up with as separate companies.

June 2 -

The global coronavirus outbreak has up-ended daily life for many consumers, including where they shop and how they pay for things. The U.K. is no exception, as issues of health and hygiene have now been introduced as important factors when it comes to both planned and impulse shopping.

June 2 -

The agency is trying to get small lenders to help underserved businesses get the loans; although the British government is guaranteeing small-business loans, banks are required to collect on delinquents.

June 1 -

Money transfer agent Remitly has launched a cash deposit service for its digital bank account holders on the Green Dot retailer network.

May 27 -

To get a better handle on the coronavirus-driven boom in Latin American e-commerce, cross-border processors are ramping up digital alternatives for shoppers who pay cash for online purchases.

May 20 -

Contactless, mobile and a retreat from cash are just the start. The coronavirus will upend the entire payments process, said Icon Solutions' Simon Wilson.

May 12 Icon Solutions

Icon Solutions -

The path away from cash and plastic was well underway before the pandemic, and will deeping during the crisis and beyond, says Paysafe's Daniel Kornitzer.

May 4 Paysafe

Paysafe -

Visa pulled its financial outlook for the rest of the year, but it already has visibility into permanent changes that result from the coronavirus — such as an aversion to handling cash.

April 30 -

U.K. ATM operator LINK reported that its cash withdrawals have fallen by 60% over the past month ending April 27 when compared to the same period one year earlier.

April 29 -

Think about all the people who started depositing their paper checks through a mobile app. Who tried that out and then thought, “Gee, I really preferred driving 15 minutes to the bank and waiting in a line”?

April 29 BlueSnap

BlueSnap -

Businesses have turned to workarounds to accommodate the coronavirus’ impact on brick-and-mortar stores, emergency measures that will likely become permanent in order for these businesses to survive into the future.

April 22