-

The fees have helped banks recoup costs of free or low-cost checking accounts for decades, but they can penalize low-income customers and drive them away from banking. Is there a better way?

October 7 -

As the coronavirus began to sweep through Europe and the U.S. during the early spring, Phillip McGriskin was in the middle of a crucial funding round.

September 10 -

Business-to-consumer payments are rapidly shifting to digital channels, replacing paper checks with a variety of instant-payment methods for gig work and corporate reimbursements.

September 4 -

The bank said the account is geared to consumers who want better control over their spending or are new to banking.

September 1 -

Members who use the account, which should be available starting in 2021, will manage it through Google Pay.

August 3 -

Suppliers that still need to receive physical checks should still be able to do so. Even if they do, the process remains electronic on the accounts payable side, says AP side so that customers can issue check payments in the same batch as other electronic payments, says Nvoicepay's Angela Anastasakis.

July 13 Nvoicepay

Nvoicepay -

Decentralizing staff makes strong internal controls even more important, Josh Cyphers and Derek Halpern of Nvoicepay write.

June 22Nvoicepay -

Even digitally savvy organizations face a vexing dilemma when sending emergency funds: The neediest recipients often have little other option than to receive paper checks.

May 28 -

There are several ways the coronavirus has shown that traditional manual, paper-based AP processes are not up to the task in 2020 and beyond.

May 28 Bottomline Technologies

Bottomline Technologies -

A new program is intended to reach individuals without a fixed address or checking account more easily access COVID-19 relief funds — and hopefully keep those consumers as members.

May 27 -

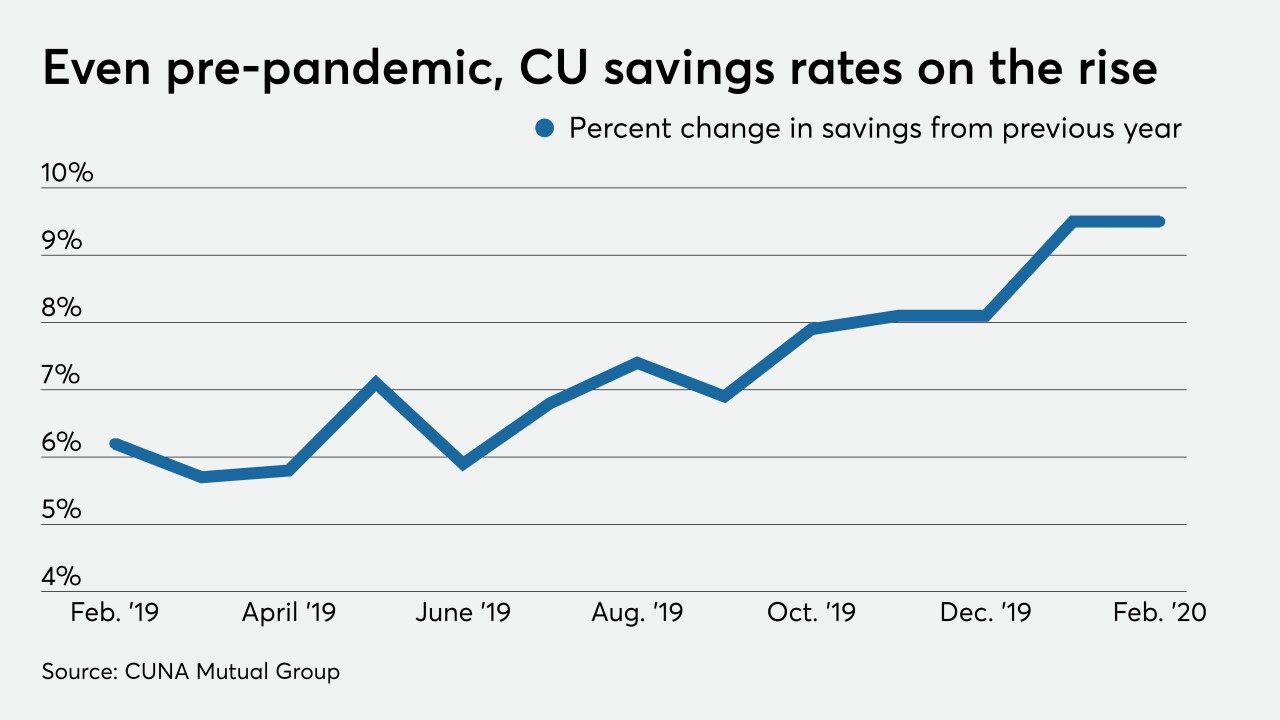

Recent tweaks to Reg D have blurred the line between checking and savings accounts, opening up the possibility for new innovation in those products.

May 20 -

The widespread impact from coronavirus could turn out to be a forcing mechanism that expedites innovation and adoption as businesses around the world look to overcome a new, shared, set of challenges, says Billtrust's Justin Main.

May 15 Billtrust

Billtrust -

Lots of consumers are using mobile checking for the first time, so it's important to provide extra help, says Mitek's Michael Diamond.

May 13Mitek Systems -

The failure to bring decades-old processes into the digital era not only continues to cost companies dearly but has become increasingly disruptive in the current COVID-19 environment.

May 11 Mastercard

Mastercard -

There is a need and opportunity here to rebuild the aging, legacy infrastructure in payments, at the IRS, and within the banking system. It is not a technology problem. It is an opportunity, says payments consultant Collin Canright.

May 1 Canright Communications

Canright Communications -

Whether presented at the teller line or through digital channels, the best way to prevent fraud is by triangulating items in real-time against a robust fraud database. To strengthen the database, fraud data needs to be contributed in return, says Advance Fraud Solutions' Ted Kirk.

April 29 Advanced Fraud Solutions

Advanced Fraud Solutions -

PayPal is temporarily waiving fees for consumers using its app to accept government and payroll checks during the coronavirus pandemic.

April 24 -

The trend to mobile is accelerating due to government stimulus checks, closed bank branches and the move to e-commerce, sayd Mitek's Michael Diamond.

April 20Mitek Systems -

As millions of U.S. consumers are beginning to see stimulus checks electronically deposited into their bank accounts as part of the CARES Act, many companies are wondering how Americans will spend these funds.

April 16 -

The two large banks are holding off for a month on collecting on negative balances to ensure that customers receive the full amount of government payments deposited into their accounts.

April 15