-

Recent tweaks to Reg D have blurred the line between checking and savings accounts, opening up the possibility for new innovation in those products.

May 20 -

The widespread impact from coronavirus could turn out to be a forcing mechanism that expedites innovation and adoption as businesses around the world look to overcome a new, shared, set of challenges, says Billtrust's Justin Main.

May 15 Billtrust

Billtrust -

Lots of consumers are using mobile checking for the first time, so it's important to provide extra help, says Mitek's Michael Diamond.

May 13Mitek Systems -

The failure to bring decades-old processes into the digital era not only continues to cost companies dearly but has become increasingly disruptive in the current COVID-19 environment.

May 11 Mastercard

Mastercard -

There is a need and opportunity here to rebuild the aging, legacy infrastructure in payments, at the IRS, and within the banking system. It is not a technology problem. It is an opportunity, says payments consultant Collin Canright.

May 1 Canright Communications

Canright Communications -

Whether presented at the teller line or through digital channels, the best way to prevent fraud is by triangulating items in real-time against a robust fraud database. To strengthen the database, fraud data needs to be contributed in return, says Advance Fraud Solutions' Ted Kirk.

April 29 Advanced Fraud Solutions

Advanced Fraud Solutions -

PayPal is temporarily waiving fees for consumers using its app to accept government and payroll checks during the coronavirus pandemic.

April 24 -

The trend to mobile is accelerating due to government stimulus checks, closed bank branches and the move to e-commerce, sayd Mitek's Michael Diamond.

April 20Mitek Systems -

As millions of U.S. consumers are beginning to see stimulus checks electronically deposited into their bank accounts as part of the CARES Act, many companies are wondering how Americans will spend these funds.

April 16 -

The two large banks are holding off for a month on collecting on negative balances to ensure that customers receive the full amount of government payments deposited into their accounts.

April 15 -

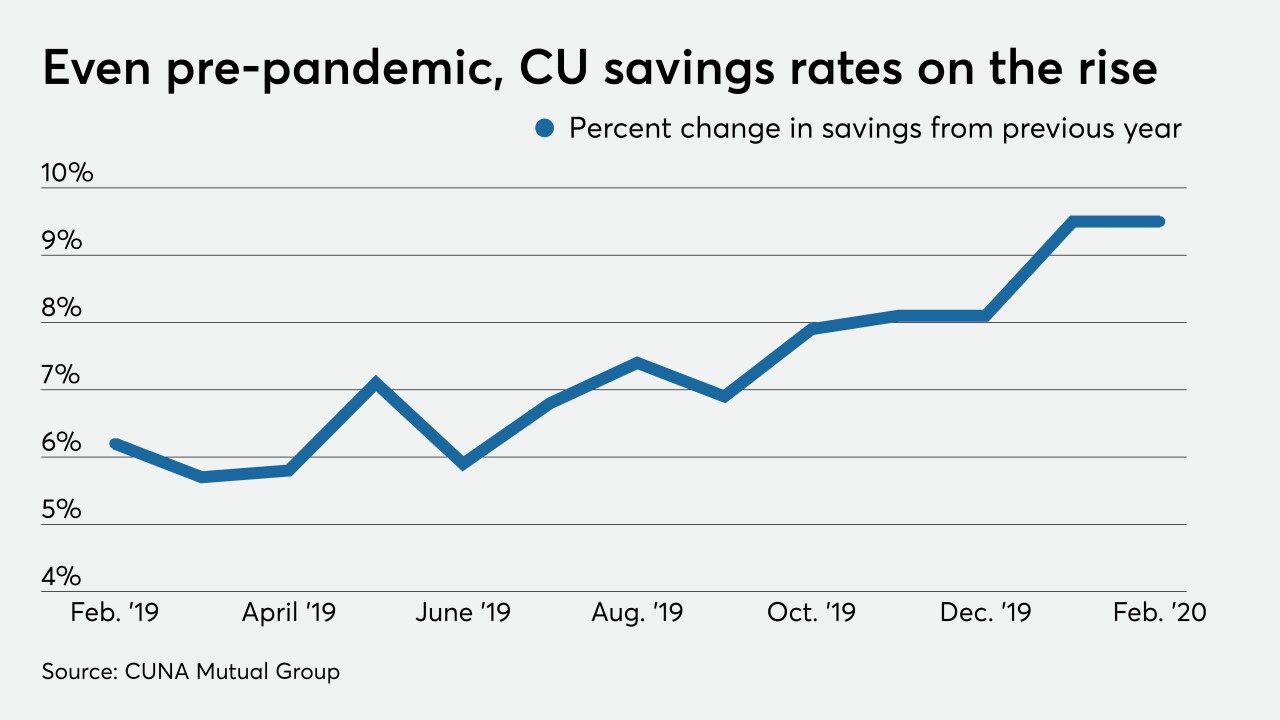

Credit unions intensified their focus on gathering deposits in 2019 but many institutions are still looking for cheaper core funding.

March 12 -

If a checking account doesn’t come with checks anymore, can it still be called a checking account? It’s a valid question that the financial services industry should be asking itself.

March 9 -

Deluxe has spent many years working to diversify beyond paper checks, which are in an inevitable decline. But that diversity led to confusion.

February 27 -

The shift from person-to-person deposits to digital options – including mobile, ATMs and RDC – has created new challenges to fraud prevention efforts.

February 4 Advanced Fraud Solutions

Advanced Fraud Solutions -

The investment bank's new CashPlus Account comes with a mobile banking app, a debit card, online bill payment and other banklike features.

January 23 -

After a decline, fraud has recently spiked. But there are measures companies can take to stay ahead of the crooks, says Nvoicepay's Alyssa Callahan.

January 21 Nvoicepay

Nvoicepay -

CEO William Demchak said the bank has witnessed "a lot of mischief" among customers who open checking accounts to collect bonuses and then never use the accounts again.

January 15 -

Fiserv has sold a lockbox processing unit to Deluxe, the second such acquisition for Deluxe in as many months.

December 20 -

The challenger bank might use the proceeds from its latest funding round to buy other fintechs that would allow it to add more products and services, its CEO said.

December 6 -

Citizens Bank's Bruce Van Saun is our Banker of the Year; shake-up continues at Wells Fargo with poaching of Santander's CEO; the Navy commander behind the credit union banks love to hate; and more from this week's most-read stories.

December 6