-

Accounts that offer high interest rates can bolster fee income and lower noninterest expenses, though credit unions have to carefully watch these products to ensure they actually make money.

July 24 -

Several wealth management firms, including Marcus by Goldman Sachs and Wealthfront, have launched banking products to complement their investment services.

July 23 -

The bank will reduce its footprint to its German roots; U.S. banks are offering cash bonuses to keep customers from fleeing to higher-yielding accounts.

July 8 -

New York Attorney General Letitia James said there is “no basis to believe” that the overdraft rule has harmed small banks and credits unions.

July 2 -

The move figures to generate more low-cost funding for the firm’s consumer lending businesses without sacrificing substantial revenue.

June 17 -

Over time, real-time payments could become the predominant payment type while virtually eliminating cash and checks.

June 6 Citizens Bank

Citizens Bank -

While in its infancy in influencing B2B payments, AI ultimately will change the way businesses of all sizes run their financial operations, writes Rene Lacerte, CEO of Bill.com.

May 16 Bill.com

Bill.com -

The agency launched a review to gauge whether the regulation requiring consumers to opt in to overdraft protection “should be amended or rescinded” to minimize the effects on smaller financial institutions.

May 14 -

The agency launched a review to gauge whether the regulation requiring consumers to opt in to overdraft protection “should be amended or rescinded” to minimize the effects on smaller financial institutions.

May 13 -

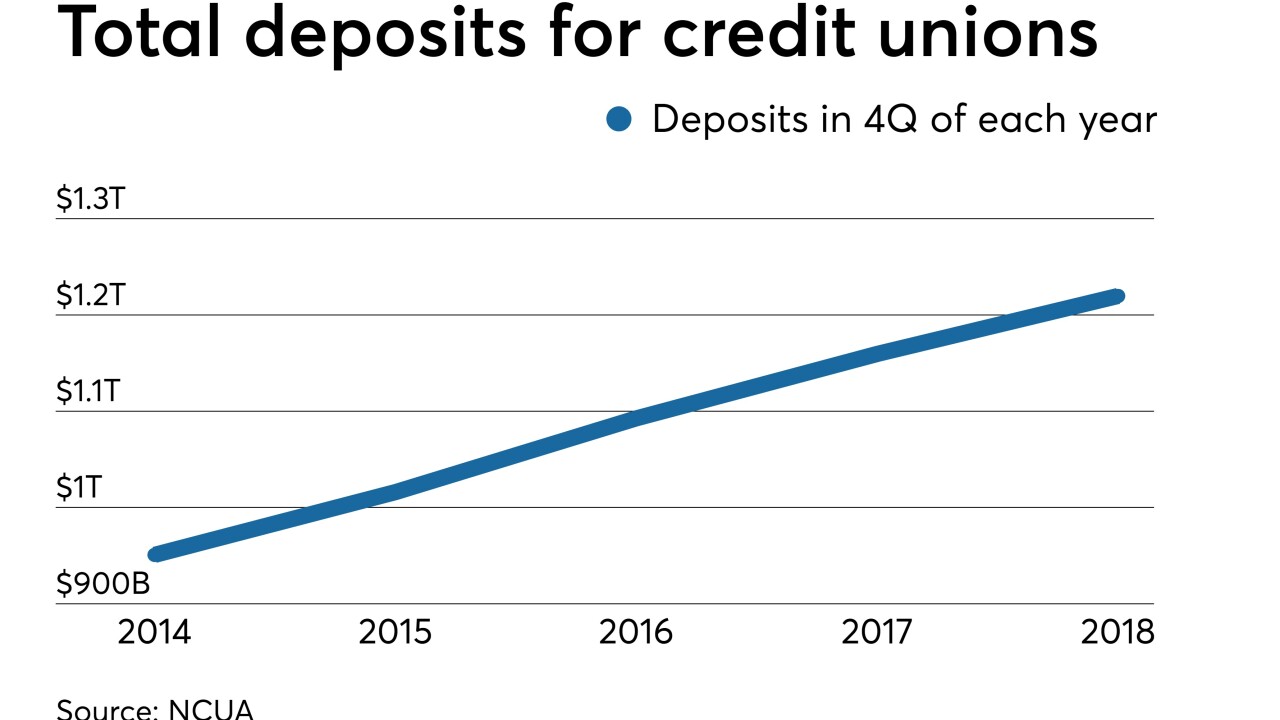

As credit unions attempt to bring in deposits to fund more loans, one institution's success story could offer a path for others.

May 1 -

While a majority of business payments are still made by checks, faster payments and increased cash flows will pressure a move to digital options, contends UMB's Brian Hutchin.

April 30 UMB

UMB -

In a unique deal, organizers of Village Financial Cooperative received $500,000 from the Minneapolis City Council as they aim for a June opening.

April 8 -

Paper's costly, and also error prone. Yet most invoices are still paper-based, writes Art Sarno, product marketing manager for Kofax.

March 12 Kofax

Kofax -

As blockchain and other emerging innovation pour into the B2B market, Bottomline Technologies believes bank collaborations with smooth deployment and user experience can lure anxious businesses away from checks.

February 20 -

By adopting faster payments, businesses have more flexibility to make last-minute payments and emergency payrolls, or gain a larger window for early-payment discounts.

January 3 -

Younger consumers today have a very different view of, and utility for, general purpose bank and private label retail credit cards when compared to older generations.

December 26 -

The promotion of “insured” accounts by nonbanks and fintechs is a worrying trend, because it could leave customers falsely believing their accounts are just as safe as FDIC-insured ones.

December 21 Consumer Bankers Association

Consumer Bankers Association -

Robinhood Financial has rebranded its service, deleted tweets about its launch and scrubbed the page from its website.

December 15 -

Robinhood Financial, one of the most valuable private companies in the financial technology space, is rolling out its take on the traditional bank account starting on Thursday.

December 13 -

After incorporating big data, tweaking existing products and reducing barriers for new members, the Mass.-based credit union saw increased checking usage, more deposits and higher PFI levels.

November 16