-

Climate activists are starting to map out a coordinated campaign to oppose the potential renomination of Federal Reserve Chair Jerome Powell, because they view his record on fighting climate change through the banking system as scant and not aggressive enough.

August 13 -

The fintech startup Aspiration is in talks to go public through a merger with a blank-check firm in a transaction that’s slated to value the combined entity at more than $2 billion, according to people with knowledge of the matter.

August 12 -

Ando, a challenger bank focused on sustainability, is helping Virginia Community Capital Bank expand its 5-year-old clean energy lending program by finding a bigger pool of depositors who are eager to fund solar loans.

August 6 -

Sen. Patrick Toomey, the ranking Republican on the Banking Committee, has argued that research by the Federal Reserve into these topics could result in “mission creep.” Fed officials have said their job includes fostering inclusive economic growth and ensuring the banking system is girded against financial risks posed by climate change.

August 4 -

Until recently, only the largest financial services firms were tallying the risks from climate change and opportunities in the green economy. But a new report from Regions Financial suggests the practice is gaining wider traction.

August 3 -

BlackRock and other major financial institutions are working on plans to accelerate the closure of coal-fired power plants in Asia in a bid to phase out the use of the worst man-made contributors to climate change.

August 3 -

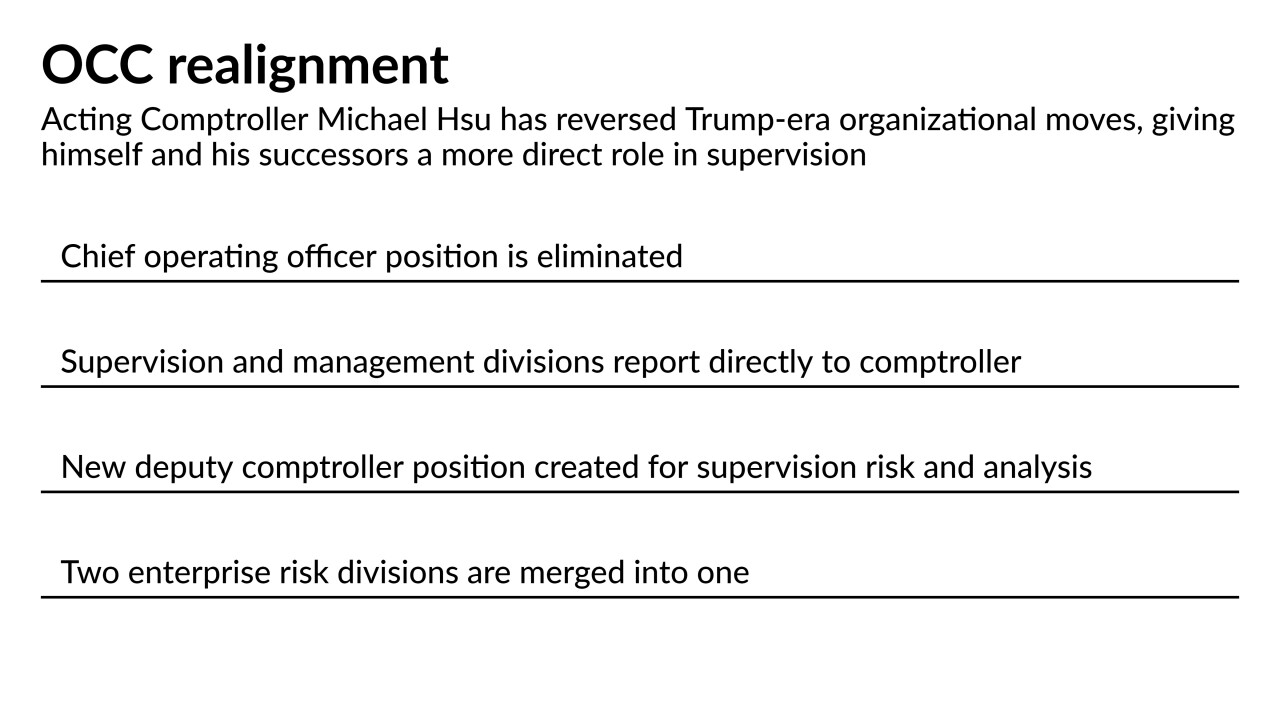

Michael Hsu is reorganizing the Office of the Comptroller of the Currency so that he directly oversees staffers who develop examination strategy. Some analysts suggest the move could result in more aggressive oversight by an agency long accused of being too cozy with national banks.

July 21 -

The European Union’s planned Green Asset Ratio, intended to reveal how much a bank lends to climate-friendly companies and projects, will offer a distorted picture of reality, according to a Bloomberg survey of some 20 major European banks.

July 20 -

As attitudes about corporate responsibility evolve, regulators will expect banks to take a more proactive approach to environmental, social and governance issues. That means going beyond assessing climate-related risks to incorporate a focus on ethics, culture, inclusion and customer protection.

July 9 Treliant

Treliant -

Jennifer Eastes is tasked with spearheading and accelerating environmental, social and governance efforts at the Cleveland-based company.

July 8 -

The issues associated with environmental, social and governance policies cut across all the traditional concepts of risk facing bank executives and will endure for years.

July 7 Treliant

Treliant -

All public companies could be on the hook for detailing climate-related risks — including those of clients. The data-gathering burden might be especially heavy for banks, industry officials say, because they lend to and invest in so many companies across so many industries.

July 2 -

Sixty-one percent of executives at large U.S. banks said their institution would be prepared to comply with the kind of testing now happening in the U.K., according to a new survey. But experts question whether bankers are underestimating the data-gathering challenges ahead.

June 29 -

The huge buffers that banks built up over the pandemic are protecting the financial system from looming threats, regulators told President Biden during a meeting that also touched on climate change, extension of credit to the underserved and other topics.

June 22 -

The largest financial institutions say the agency’s proposal to require public companies to disclose their contributions and vulnerability to climate change is consistent with investor demand. Community banks say it would create an unnecessary regulatory burden.

June 14 -

Mark Carney, a onetime Bank of England governor, argued that banks should not cut ties with polluting businesses, but rather work with clients to help them minimize their impact on the environment.

June 7 -

Amid GOP criticism about the Federal Reserve’s focus on climate change issues, Chair Jerome Powell said the central bank is striking the right balance by educating the public about risks to the financial system while not taking actions he says are better left to elected officials.

June 4 -

While the industry is facing greater pressure to scrutinize the environmental risks associated with its financing activities, many banks also sense opportunities in climate change. Here are some examples.

June 2 -

Despite concerns about the scope of information that companies would have to provide about risks linked to climate change, some of the largest institutions are seeking to collaborate with the agency as it develops a framework for informing investors.

May 24 -

The White House directive may lead regulators to develop new mortgage underwriting standards, stress-test requirements and flood insurance policy, observers said.

May 21