-

The central bank will increase support for credit issued through the Main Street Lending Program while providing midsize firms with more flexibility on the amounts they receive.

June 8 -

On Mar. 31, 2020. Dollars in thousands.

June 8 -

Lenders have a role to play in the national reconciliation that must follow the recent racial unrest — providing greater access to capital for African Americans and other underserved groups so they can build wealth, activists said at a panel discussion hosted by Berkshire Bank in Boston.

June 5 -

As part of its commitment, the Minneapolis company said it will provide $100 million in capital to African American owned and operated businesses and organizations.

June 5 -

The challenger bank OakNorth has been peddling its lending platform to U.S. banks for a year. When it saw COVID-19 on the horizon, it retooled to include a ratings system predicting how borrowers will be affected by the pandemic.

June 5 -

Bankers said legislative fixes to the small-business rescue program should help more borrowers secure loan forgiveness, though new demand will likely remain tepid because the process is still extremely cumbersome.

June 5 -

Bankers have become more uncertain about how to serve marijuana businesses owing to confusion about which states deem them essential.

June 4 FS Vector

FS Vector -

Representatives of lenders as well as businesses that received pandemic bailout money told an oversight board Wednesday that delayed and confusing instructions from the government hampered the effectiveness of the main rescue program for smaller companies.

June 4 -

The demonstrations following George Floyd's death in police custody are forcing the industry to grapple with how it can — or if it should —advocate for equality and better race relations.

June 4 -

The bill, which passed the House last week on a 471-1 vote, now heads to President Trump’s desk for his signature.

June 3 -

Two years ago, the Tulsa, Okla., company expanded its Native American casino lending business nationwide. It seemed like a great plan until the coronavirus pandemic struck.

June 3 -

The changes being sought would benefit both small businesses and banks, which would avoid the cost of servicing many low-yielding loans.

June 2 -

An interagency notice meant to encourage lenders to offer small consumer loans also provides federal agencies too much say on what constitutes “reasonable” pricing.

June 2

-

Bankers spent Monday cleaning up damaged branches, wondering if their small-business clients will need more emergency aid and contemplating how the racial and economic inequalities highlighted by days of violent protests nationwide can be corrected.

June 1 -

Acting Comptroller of the Currency Brian Brooks took the extraordinary step of wading into the debate over when it was appropriate to reopen businesses.

June 1 -

The Federal Reserve set up a liquidity facility to help banks meet demand for emergency small-business loans through the Paycheck Protection Program, but it's gone largely unused.

June 1 -

The agency is trying to get small lenders to help underserved businesses get the loans; although the British government is guaranteeing small-business loans, banks are required to collect on delinquents.

June 1 -

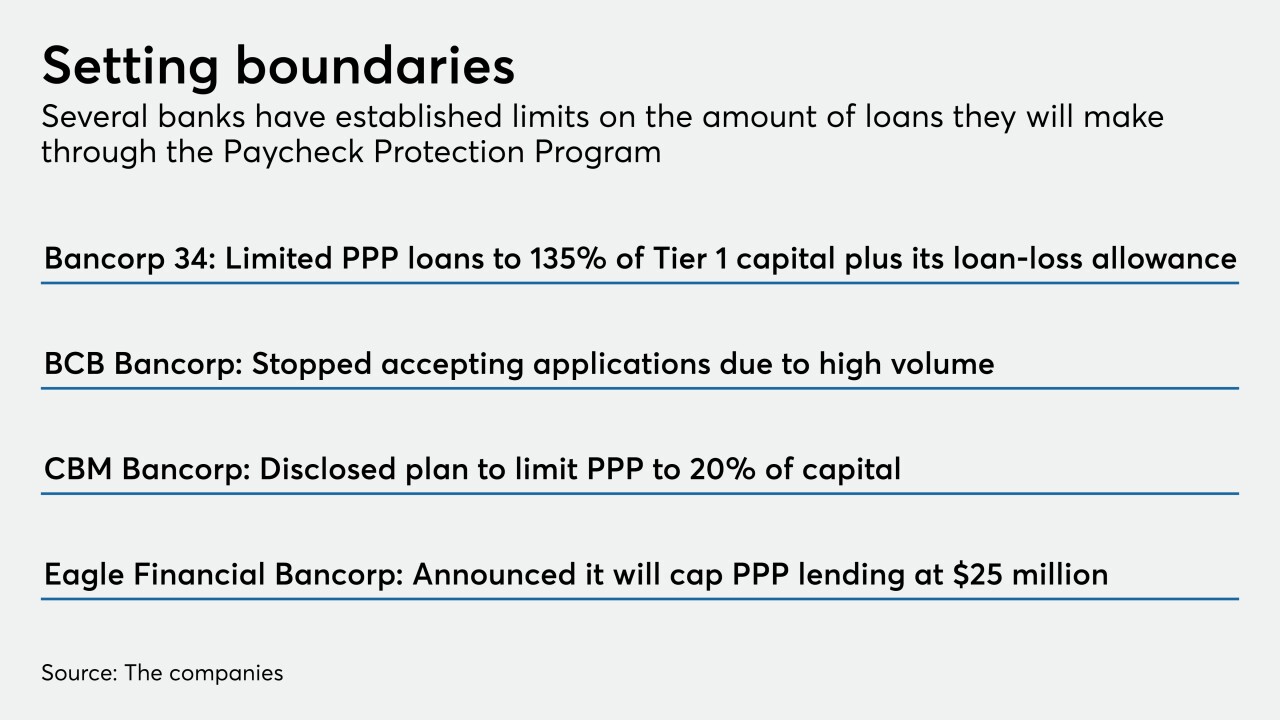

Many lenders are paying close attention to liquidity and capital ratios. Others are trying to avoid overtaxing employees who process, service and handle forgiveness of the loans.

May 29 -

The new regulation is intended as a workaround for banks affected by the 2015 decision that created legal uncertainty for loans sold across state lines.

May 29 -

European authorities have told banks for the first time to take account of environmental risks in lending decisions, ramping up pressure on the financial industry to respond to climate change.

May 29