-

As chief credit officer, Horton oversaw the bank's certification as a Small Business Administration lender and participation in the Paycheck Protection Program.

May 5 -

Most executives are comfortable crossing over $1 billion of assets, where more frequent exams are the biggest supervisory change. But few are eager to take on the compliance burdens that accompany the jump above $10 billion.

May 5 -

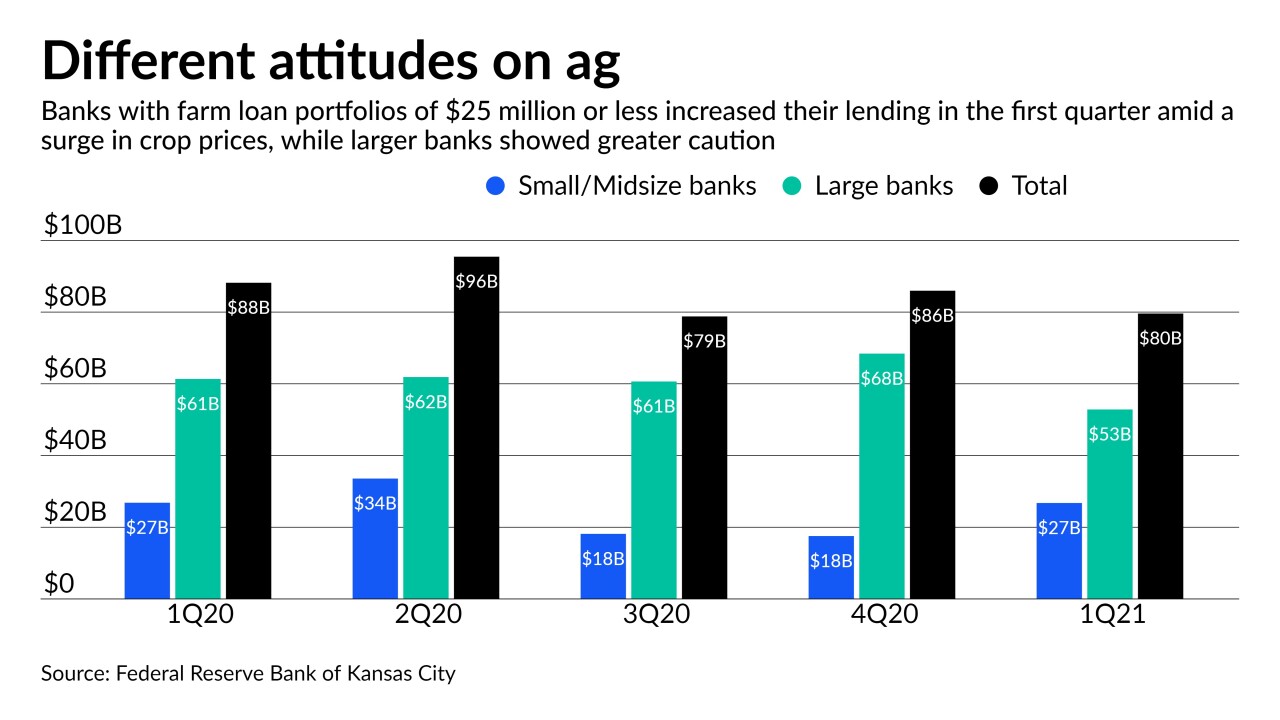

Smaller lenders have proved more aggressive than their larger rivals in making new loans during the farm country rebound. Market watchers warn that the price boom may not last.

May 5 -

The Paycheck Protection Program has about $8 billion remaining, with those funds earmarked for community development financial institutions, minority depository institutions and other mission-driven lenders.

May 5 -

Lenders including Howard Bancorp and First Carolina Bank are shunning acquisitions as a route into new markets, to avoid overpaying for targets and inheriting potential loan problems.

May 5 -

The specialty lender provides leases for preowned Ferraris, Porsches, McLarens, Lamborghinis and other luxury cars.

May 4 -

With the Paycheck Protection Program likely winding down at the end of the month, many lenders are seeing heightened demand for the Small Business Administration’s 7(a) and 504 loans.

May 3 -

The Tennessee bank's deal for Fountain Leasing is set to close this month.

May 3 -

The fintech credit card provider is pitching to banks the same software it uses to determine borrowers' creditworthiness. But whether banks are ready for technology that emphasizes cash-flow analysis over traditional credit scoring is open to debate.

April 28 -

The Arkansas bank is turning to asset-based lending and loans to venture capital and other investment groups to help fill a void created by a shortage of new, big-ticket commercial real estate deals.

April 28