-

A group of state regulators has signed off on 14 recommendations, developed by the fintech industry, aimed at streamlining multistate licensing and supervision.

February 14 -

Regulators should clarify rules around deposit-advance products so that banks can serve consumers seeking short-term loans, like those affected by the recent partial closing of the government.

February 14

-

Barclays, BMO, Citibank, Goldman Sachs and ING contributed to the online student lender, which last year made over $1 billion in loans.

February 14 -

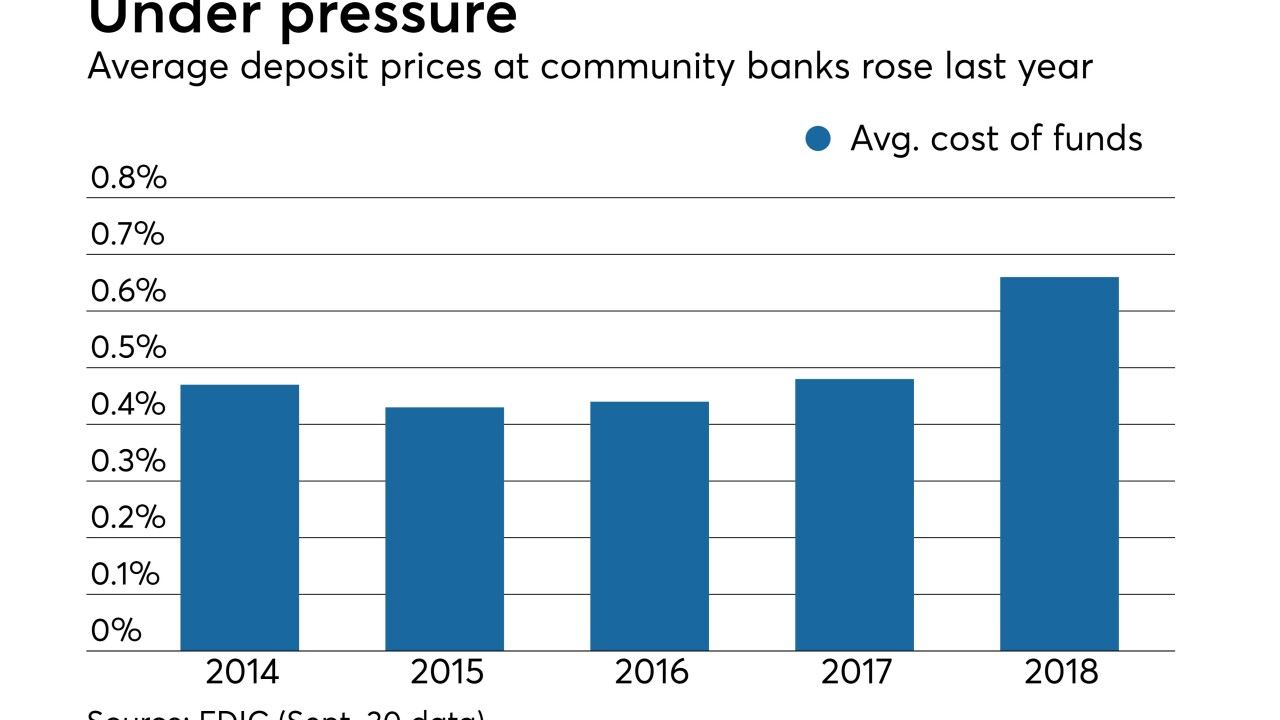

Banks and credit unions are experimenting with ways to maximize margins in an environment where the yield curve is flat, depositors want them to pay up and they fear the Fed could actually cut rates.

February 13 -

The Salt Lake City company, which connects small-business owners with lenders like JPMorgan and BofA, plans to use the funds to expand its partnerships and customer base.

February 12 -

The vast majority of comment letters to the FDIC support the fintech’s banking venture, in stark contrast to the public outcry over the pre-crisis ILC bids by large retailers.

February 12 -

The bureau wants to further remove the threat of legal liability for firms that test products benefiting consumers, but the attorneys general say the agency cannot provide immunity from state law.

February 12 -

The agency's update is good news for banks digesting data suggesting that nonbanks cut into their share of small-business loans during the partial government shutdown.

February 12 -

The online small-business lender reported record loan originations in the fourth quarter, but its CEO is warning that loan growth could slow in 2019.

February 12 -

The installment lender, which bills itself as an alternative to payday lenders, targets underserved communities and operates through a network of retail partners.

February 12