-

Bankers would be better off cleaning their own houses and focusing on deregulation efforts, instead of going after credit unions, suggests NAFCU's Carrie Hunt.

June 20

-

The online lender wants to provide instant payments and securitizations alongside instant loans, according to CEO Anthony Noto.

June 20 -

The Dallas company expects to report a higher loan-loss provision after the loans, which include two shared national credits, deteriorated in the second quarter.

June 19 -

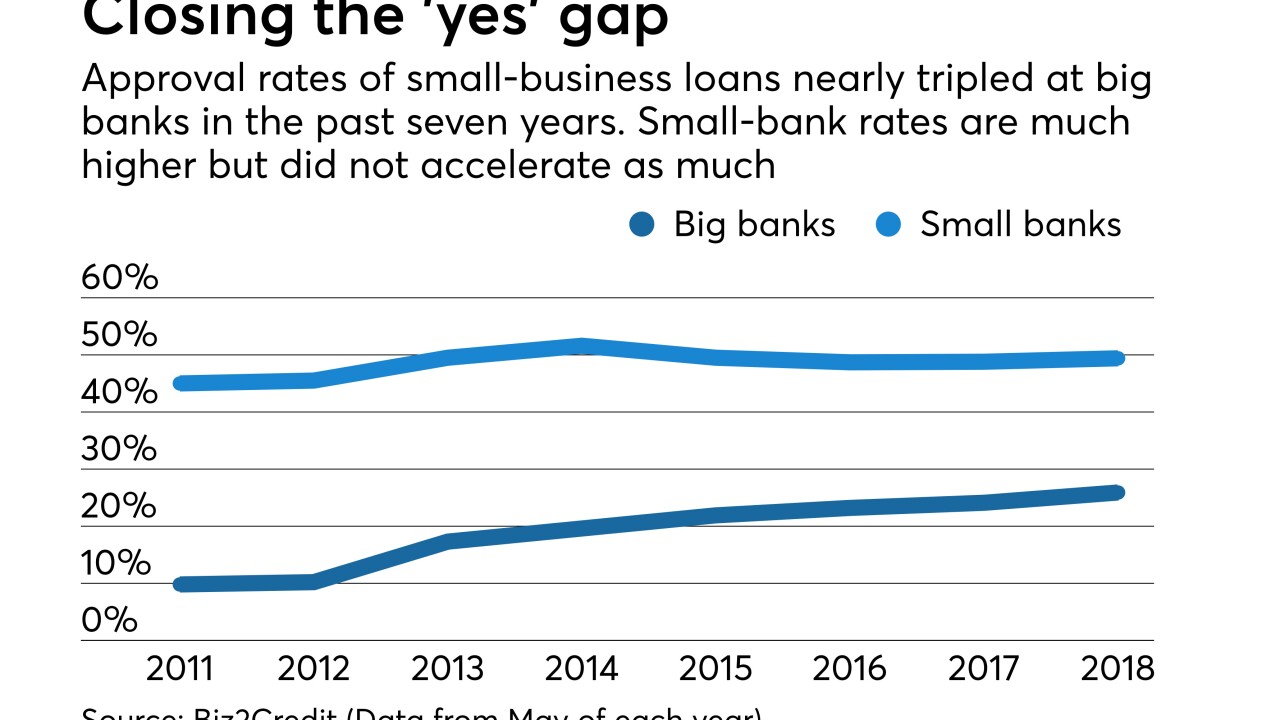

Approval rates for small-business loan applications were up at small and larger financial institutions as the labor market continued to improve.

June 15 -

The Canadian company's ambitions include opening a commercial banking office in Dallas and beefing up lending to the technology, construction engineering and the health care sectors.

June 15 -

With plenty of cash on hand, many commercial firms have had little need to tap existing credit lines.

June 14 -

The Atlanta bank has financed construction and other activities tied to nursing homes and related facilities mainly in its East Coast markets. It says the timing is good to tap into demand elsewhere in the country.

June 14 -

From YouTube test drives to subscription services, auto lending isn’t what it used to be – and credit unions need to ensure they’re keeping up with the times.

June 13 -

Nearly a third of the company's revenue will come from noninterest income after it buys SCB, which owns a large insurance and farmland management business.

June 12 -

A bill moving through the California Legislature seeks to tame the largely unregulated world of online small-business lending. If passed, it would be the first of its kind nationally, but so far it has failed to satisfy either the industry or its critics.

June 12