-

Executives from U.S. banks continue to play down near-term expectations, but they say customers are growing more confident ahead of the rollout of coronavirus vaccines, and that key commercial lending segments could drive an economic rebound.

December 8 -

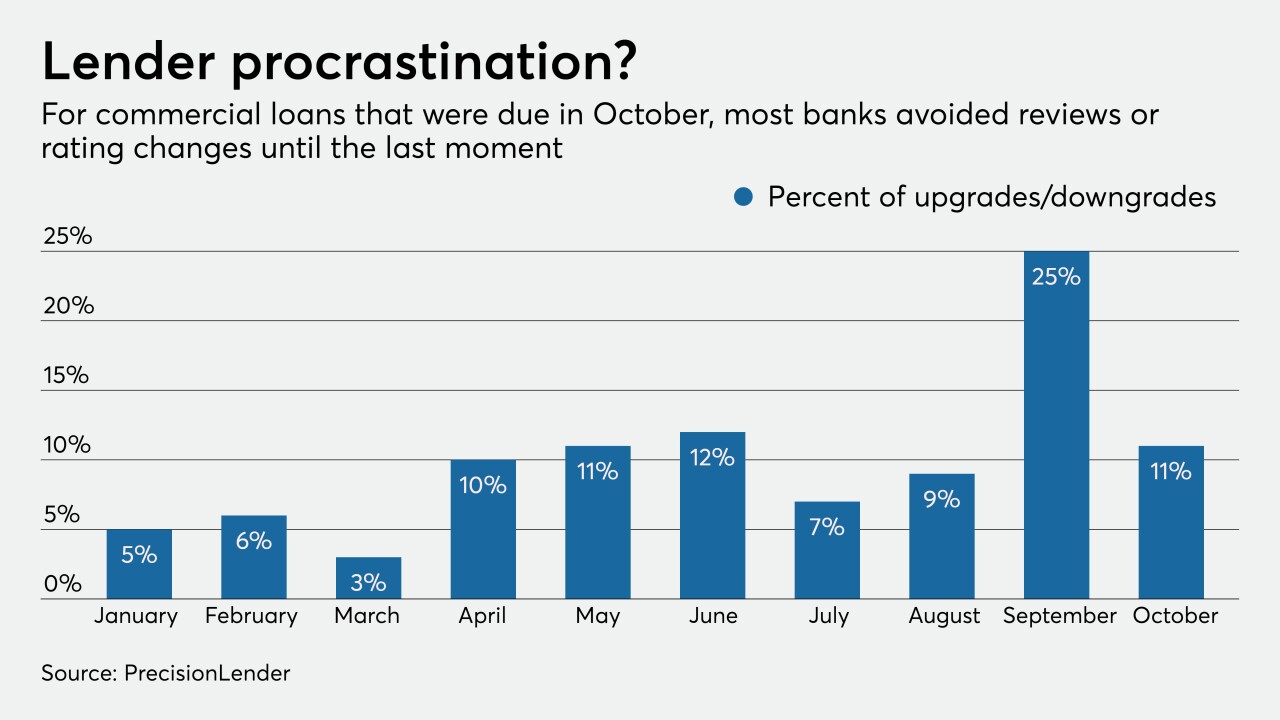

Some lenders are poring over commercial portfolios more frequently than normal — perhaps as often as once a month — to uncover problems hidden by payment deferrals and government stimulus before it's too late.

December 8 -

Montecito Bank in California began streamlining originations after a natural disaster decimated its community in 2018. The move paid off when the COVID-19 crisis hit and the bank had to quickly step up efforts to help clients.

December 8 -

On Sep. 30, 2020. Dollars in thousands.

December 7 -

On Sep. 30, 2020. Dollars in thousands.

December 7 -

The company hired two Atlantic Union bankers to run its bank and begin recruiting customers in and around Washington.

December 7 -

A trial to get underway this week over one of the biggest banking errors in recent memory will be closely watched on Wall Street, and its outcome could have a significant impact on the industry.

December 7 -

New analysis from S&P shows credit unions near $1 billion of assets and above continuing to dominate the industry's performance in the Paycheck Protection Program as some CUs dedicate a substantial portion of their portfolios to the effort.

December 3 -

Webster Bank and Customers Bank are among the lenders that have turned to alternative data sources and automated loan reviews to assess business customers' ability to weather the coronavirus pandemic.

December 3 -

The Georgia lender has hired bankers away from Wells Fargo to build a new ag lending team that will look to capitalize on soaring lumber demand in its home state.

December 2