-

Personal loan balances hit an all-time high in 2018, while fintech lenders widened their market share lead over banks and credit unions, according to new data from TransUnion.

February 21 -

Banks earned $59.1 billion in the fourth quarter, a 133% year-over-year increase, due to a one-time charge in the year-earlier quarter and a lower effective tax rate throughout 2018.

February 21 -

Personal loan balances hit an all-time high in 2018, while fintech lenders widened their market share lead over banks and credit unions, according to new data from TransUnion.

February 21 -

More than three dozen organizations are asking the FDIC to reject Square’s pending application to become an industrial loan company, according to a letter filed Tuesday.

February 20 -

Amid widespread concern about their exposure to leveraged lending, the debt rating agency says banks have sufficient earnings and capital cushions to continue investing in the sector.

February 20 -

The agency has required restitution in just one of six settlements under its new director, raising questions about whether the pattern will continue.

February 20 -

Credit card issuers would have to set aside more in reserves because of higher loss histories, according to research by Keefe, Bruyette & Woods on the impact of the new loan-loss standard.

February 20 -

The online consumer lender trimmed its losses in the fourth quarter and says an adjusted, non-GAAP metric suggests it's on the path to getting out of the red later this year.

February 19 -

The agency’s proposed changes to its standard for small-dollar loans will help ensure underbanked consumers still have access to credit. Concerns about predatory lending are overstated.

February 19 Consumers' Research

Consumers' Research -

Recent data from the Federal Reserve suggests lenders are growing pessimistic about the credit environment. But is that a sign of trouble ahead, or just sound risk management?

February 18 -

The company's expansion into new business lines could help offset recent declines in loan volume.

February 15 -

The Small Business Administration should consider partnering with fintechs, which have the capacity to approve loans quickly, to help avoid the kind of application backlog the agency faced after the last government shutdown.

February 15 Funding Circle

Funding Circle -

A group of state regulators has signed off on 14 recommendations, developed by the fintech industry, aimed at streamlining multistate licensing and supervision.

February 14 -

Regulators should clarify rules around deposit-advance products so that banks can serve consumers seeking short-term loans, like those affected by the recent partial closing of the government.

February 14

-

Barclays, BMO, Citibank, Goldman Sachs and ING contributed to the online student lender, which last year made over $1 billion in loans.

February 14 -

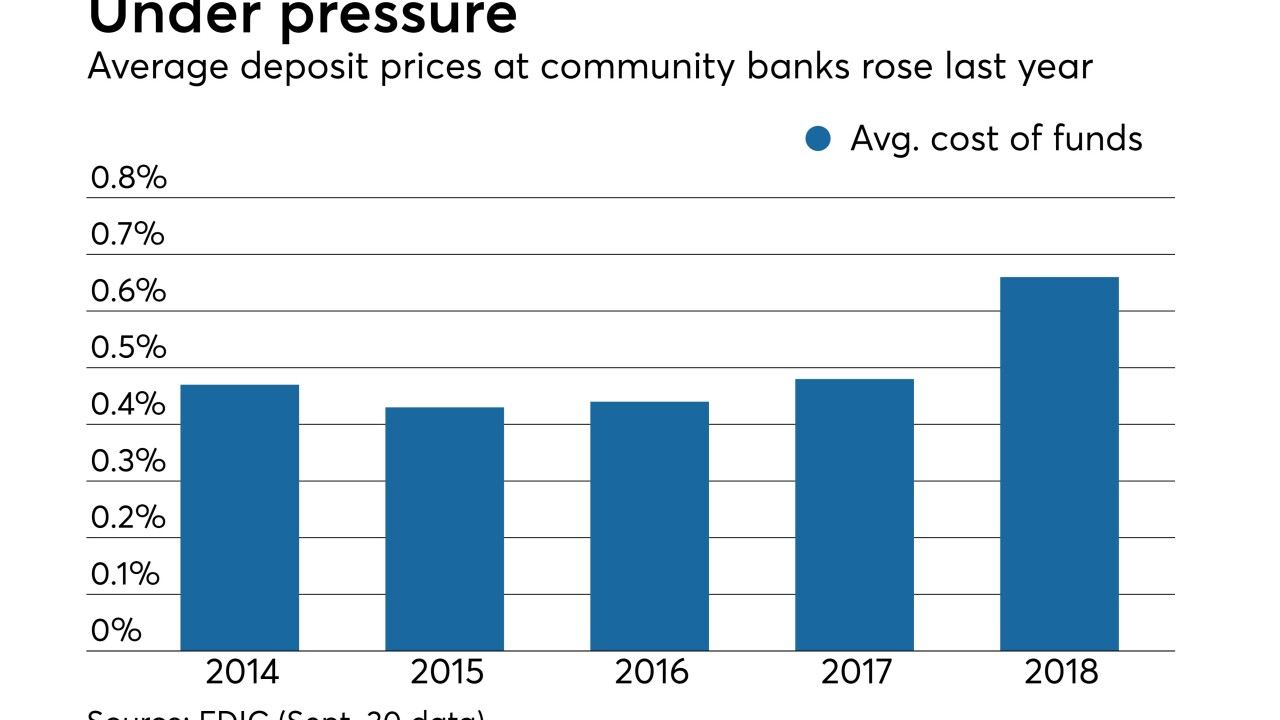

Banks and credit unions are experimenting with ways to maximize margins in an environment where the yield curve is flat, depositors want them to pay up and they fear the Fed could actually cut rates.

February 13 -

The Salt Lake City company, which connects small-business owners with lenders like JPMorgan and BofA, plans to use the funds to expand its partnerships and customer base.

February 12 -

The vast majority of comment letters to the FDIC support the fintech’s banking venture, in stark contrast to the public outcry over the pre-crisis ILC bids by large retailers.

February 12 -

The bureau wants to further remove the threat of legal liability for firms that test products benefiting consumers, but the attorneys general say the agency cannot provide immunity from state law.

February 12 -

The agency's update is good news for banks digesting data suggesting that nonbanks cut into their share of small-business loans during the partial government shutdown.

February 12