Community banking

Community banking

-

Ann Arbor Bancorp had agreed to buy FNBH in February 2020 but backed off four months later amid economic uncertainty. The two sides have reunited, though the price tag rose.

August 9 -

On Mar. 31, 2021. Dollars in thousands.

August 9 -

On Mar. 31, 2021. Dollars in thousands.

August 9 -

On Mar. 31, 2021. Dollars in thousands.

August 9 -

Local financial institutions have fewer branches than big banks, and closing even one location makes it harder for them to serve their communities.

August 9 -

Ando, a challenger bank focused on sustainability, is helping Virginia Community Capital Bank expand its 5-year-old clean energy lending program by finding a bigger pool of depositors who are eager to fund solar loans.

August 6 -

Steven Schnall, the New York community development financial institution's founder and CEO, discusses its plans to let customers buy and sell bitcoin through their bank accounts, use a ring to make debit card purchases and have a better shot at a home loan.

August 5 -

First United Bank in Oklahoma bought a minority stake in Exencial Wealth Advisors instead of acquiring it outright to give the owners an incentive to stick around and help build the business — and to make it easier for the bank to bail if things don't work out.

August 5 -

Stacy Kymes, the bank's chief operating officer and a 25-year company veteran, will succeed the retiring Steven Bradshaw.

August 4 -

First National Bank of Omaha and Centime, a Boston software company, have developed a tool that banks rarely offer small businesses: a portal that forecasts cash flow, helps entrepreneurs anticipate shortages and provides a ready source of credit when they fall short.

August 3 -

“You need scale to keep up with necessary technology spend and regulatory costs,” CEO James Hillebrand said in explaining why the bank agreed to buy Commonwealth Bank & Trust just three months after it bought Kentucky Bancshares.

August 3 -

First Hawaiian and Bank of Hawaii are warning that a global spike in coronavirus cases could stunt the state's momentum and threaten credit quality.

August 2 -

The high cost of living in the state's bigger markets is limiting growth and turning off buyers. CVB Financial and TriCo Bancshares found sellers in the more affordable cities of Visalia and Bakersfield.

July 28 -

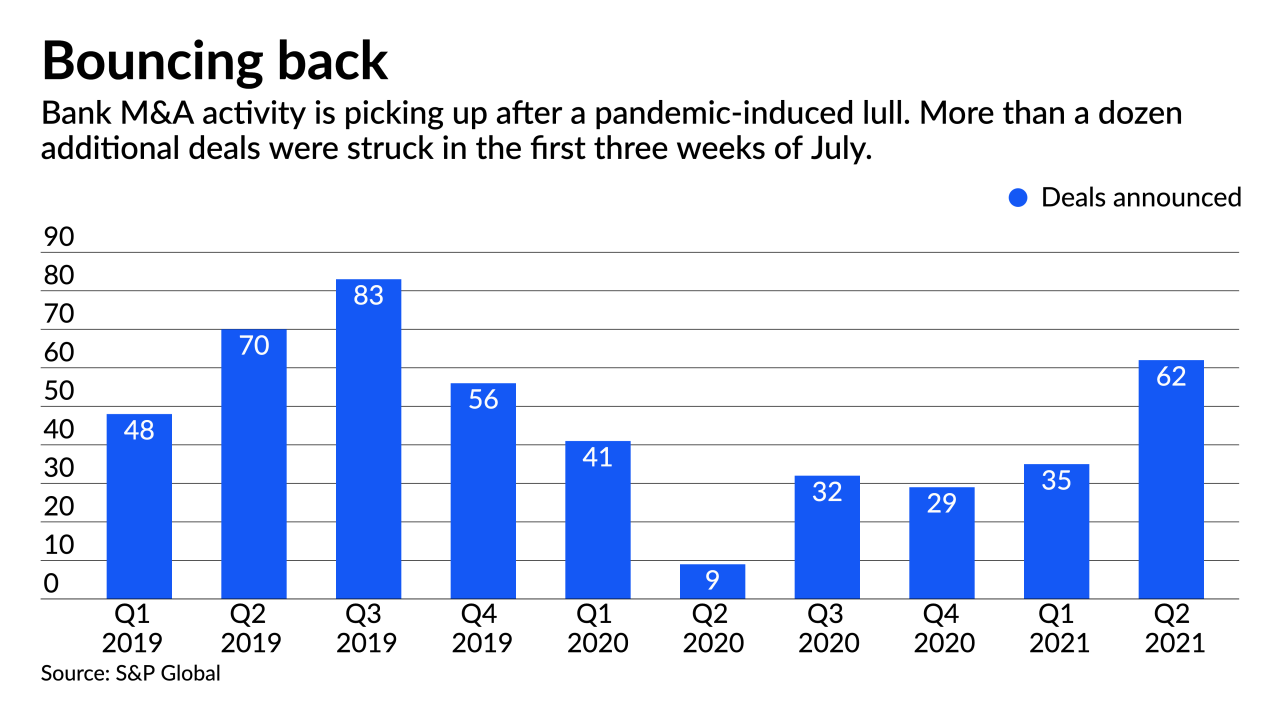

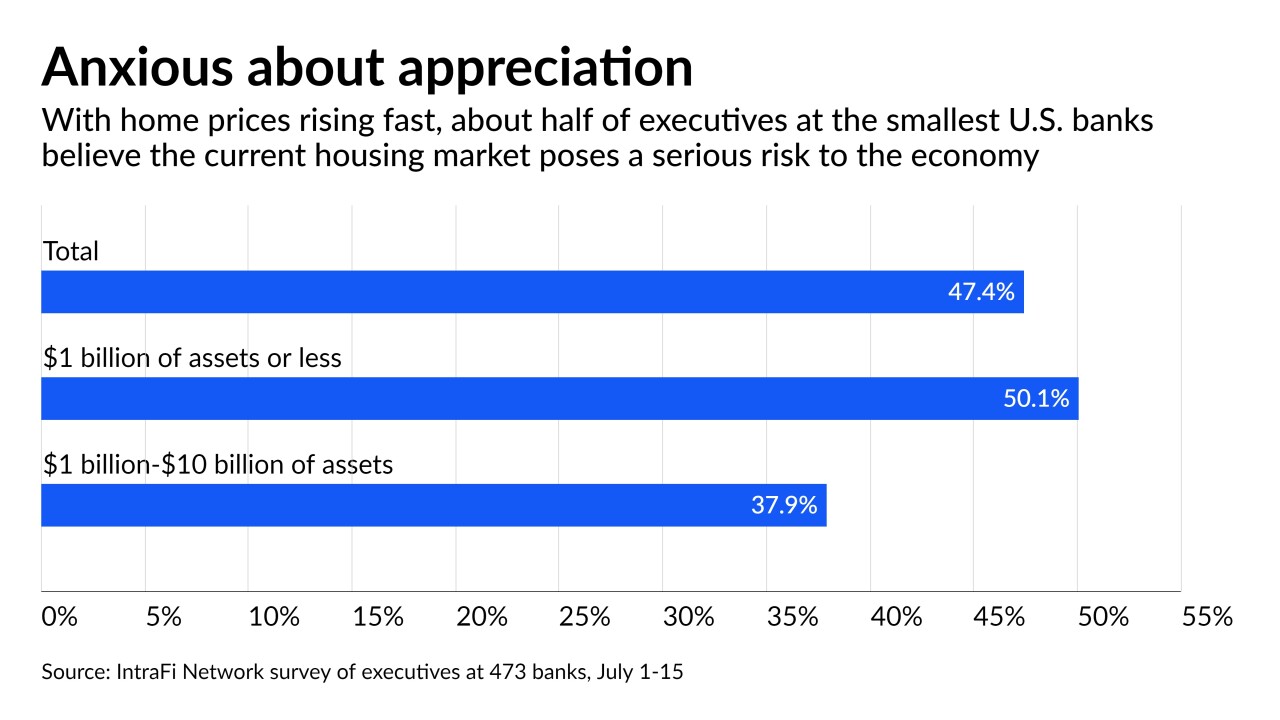

The very smallest banks, whose numbers shrank during the financial crisis, were most likely to express concern that the housing market will imperil the broader economy.

July 27 -

Wintrust has developed a specialty financing insurance premium payments for companies and individuals while PacWest and Signature Bank are meeting strong demand for loans to venture funds that invest in technology firms.

July 27 -

Community banks, which rely more on the charges than their larger counterparts do, were instrumental in staving off new regulation during the Obama era. But much has changed since Democrats last held power in Washington.

July 27 -

The Aurora, Illinois-based buyer said it would pay $297 million to acquire West Suburban Bancorp in Lombard, Illinois.

July 26 -

The $542 million acquisition would more than double the Florida-based bank's assets and deposits in one of the nation's most competitive markets.

July 23 -

The best performers in our annual ranking of banks with $10 billion to $50 billion of assets benefited from a big lending push. But like their peers, the top 10 as a group saw their profitability slip last year compared with 2019.

July 23 -

Small Business Administration lenders have reported strong quarterly results, but those gains could evaporate later this year. Here’s why.

July 23