Community banking

Community banking

-

Joseph Campanelli, CEO of Needham Bank, wants to be ready to scoop up mutuals struggling with rising costs and yield curve challenges.

August 30 -

Bank Iowa will gain a branch in a neighboring market when it completes the acquisition.

August 30 -

Brad Dinsmore, who will also serve as the California company's president, once was in charge of several key lines at SunTrust, including consumer banking and private wealth management.

August 30 -

Farmers will pay $40 million for the bank, which is in an affluent area in northeast Ohio.

August 30 -

Malia Lazu, a former community organizer, is overseeing a cultural shift at the Boston company that includes a new program designed to make more loans to minorities.

August 29 -

Loyal Trust Bank is the seventh proposed bank in 2019 to secure the agency's approval for deposit insurance.

August 29 -

The Pittsburgh company will take a de novo approach to growth around Washington.

August 28 -

The company will pay $195 million for its first retail operations in the city.

August 28 -

The Cincinnati bank recently expanded its renewable energy banking business to include investment banking services. Its ambitious goals demonstrate the sector’s growing appeal to regional and community banks.

August 27 -

The Independent Community Bankers of America provided seed funding for Teslar Software, which supplies community banks with a platform to manage data from different internal systems.

August 27 -

Bond Financial Technologies' platform is designed for community and regional banks seeking fintech expertise.

August 27 -

The Plano bank, which is being sold to Prosperity Bancshares in one of the industry's biggest M&A deals this year, was also worried about credit quality, a regulatory filing shows.

August 27 -

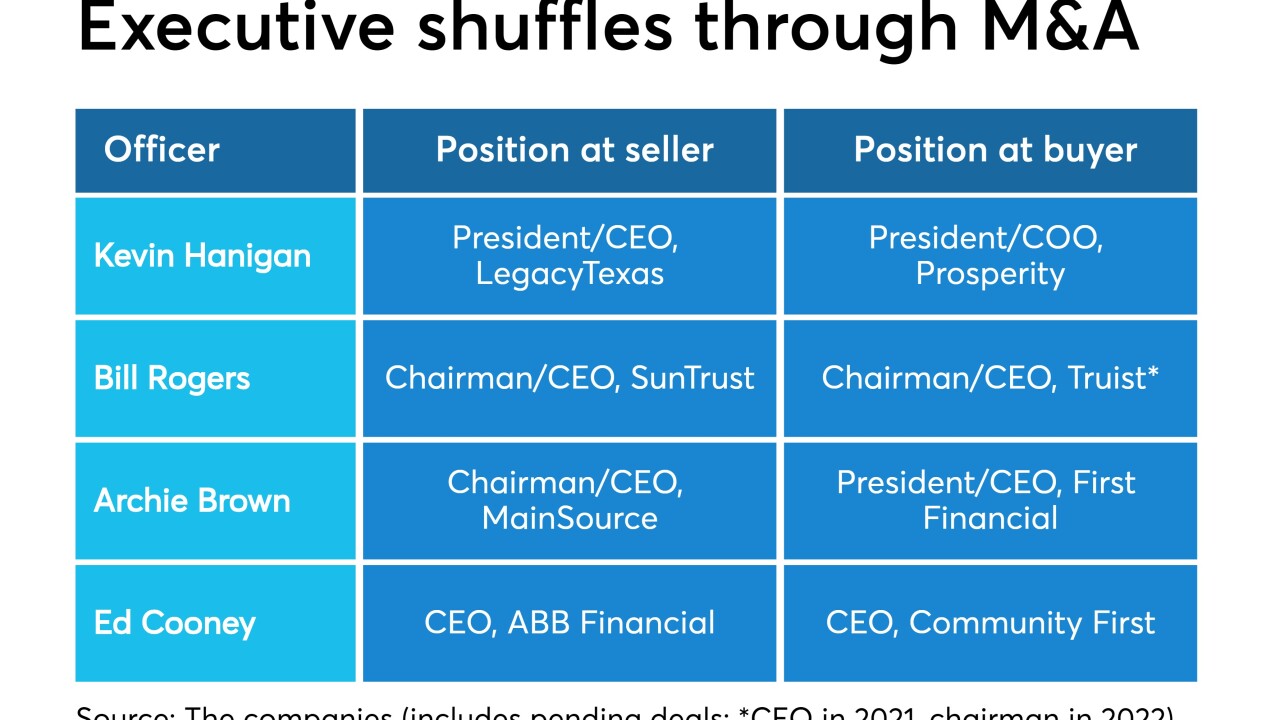

Intense competition for executives and top lenders has elevated the role acquisitions play in filling key positions.

August 26 -

On Mar. 31, 2019. Dollars in thousands.

August 26 -

Organizers of Silver River Community Bank must raise $17 million before opening.

August 26 -

The bank started buying more Treasurys and mortgage-backeds over a year ago, long before talk about rate cuts. What did it know that its rivals didn't?

August 25 -

How is the Pennsylvania bank trying to differentiate itself in wealth management? By assembling a team of private bankers to cater to the complex needs of high-net-worth clients.

August 22 -

Recent studies offer a dire outlook for water levels in drought-prone states. Some banks are bracing for this risk with changes to underwriting of real-estate-related loans.

August 21 -

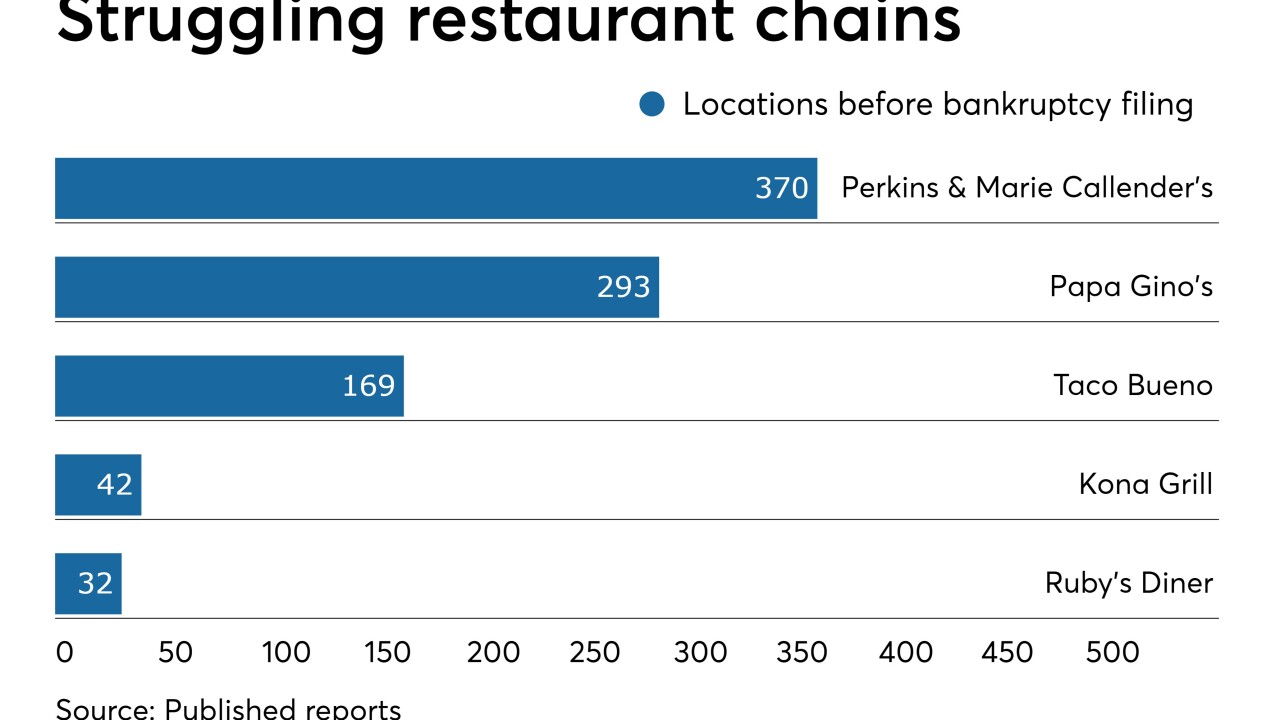

As a growing number of chains go bankrupt, loan charge-offs are rising.

August 21 -

Hove, who spent 11 years on the Federal Deposit Insurance Corp. board, was the agency's acting chairman three different times during the 1990s. He held several jobs in banking, including chairman and CEO of Minden Exchange Bank & Trust, which had been led by his father.

August 20