Community banking

Community banking

-

Community Bank of the Carolinas must raise about $4 million before becoming the state’s first new bank since the financial crisis.

March 29 -

Most banks have an array of charitable endeavors designed to get workers involved. But the ones on our Best Banks list have built an emotional connection with employees

-

Sure, M&A is a good option, but so are branch deals or key hires, say two veteran bankers who shared some of their successful strategies at American Banker’s

Retail Banking Growth Stories conference. March 27 -

Power Financial Credit Union's deal for TransCapital Bank marks the fourth time this year a bank has agreed to be sold to a credit union in the Sunshine State.

March 27 -

The system is designed to help banks deliver more personalized financial advice and is meant as a challenge to traditional bank technology vendors.

March 27 -

Some lenders, especially in markets like California, are preparing in case of a technology-industry stumble that hurts business, real estate and other loan segments. Whether those fears are well founded is a matter of debate.

March 26 -

Regional and community banks are working to finance the economic development districts created by the new law. But they have lots of questions about how the program works — and thoughts on how to improve it.

March 26 -

The deal between Performance Trust and Banks Street Partners is the second combination this month of investment banks that cater to commercial banks.

March 26 -

Alex Sanchez acknowledges that the U.S. has a lot of banks and many failed in the crisis, but he says a healthy economy needs a fresh supply of community lenders to nurture entrepreneurs.

March 25 -

On Dec. 31, 2018. Dollars in thousands.

March 25 -

On Dec. 31, 2018. Dollars in thousands.

March 25 -

University Bancorp gained a number of offices from Huron Valley Financial. It also hired lenders and staff with experience in reverse mortgages and wholesale lending.

March 23 -

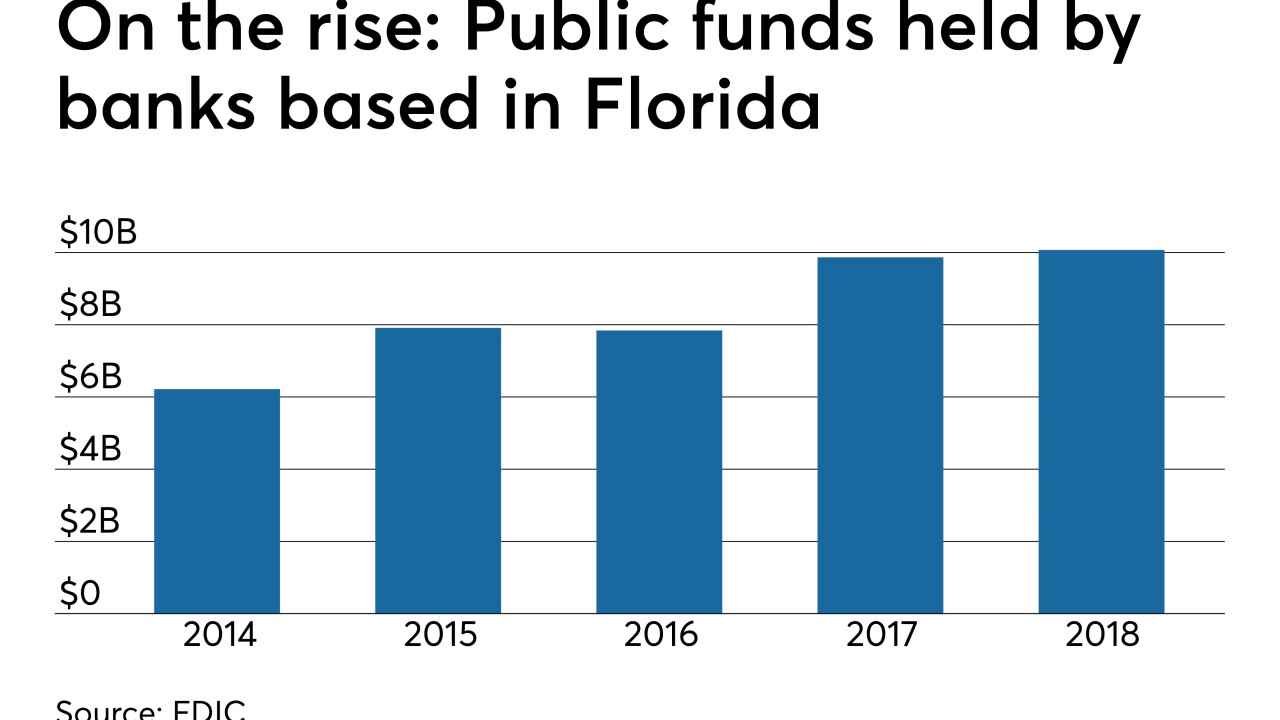

State law bars credit unions from accepting deposits from cities, counties and other government entities. Florida banks say it should stay that way unless tax advantages for credit unions are removed, but credit unions counter that banks are trying to stifle competition.

March 22 -

Financial startups are becoming important partners for community banks and credit unions, despite lobbying efforts to limit their growth.

March 22 -

Simple math only partly explains why smaller lenders are adding commercial and industrial loans at a faster clip than their larger counterparts.

March 21 -

Trying to keep pace with big banks that digitize as many processes as possible will undercut community banks’ strengths, according to speakers at this year’s ICBA convention.

March 21 -

Paul, one of American Banker's Community Bankers of the Year in 2012, made Eagle a formidable Washington-area institution.

March 21 -

Big banks’ edge lies in their sizable presence in faster-growing cities, not any unfair structural or regulatory advantages, according to a new report by the Bank Policy Institute, which represents large financial services companies. Community banks beg to differ.

March 20 -

First Bank is removing a competitor by agreeing to acquire Grand Bank for $19 million.

March 20 -

Mechanics Bank was close to buying Rabobank's U.S. unit last year, but pressed pause when the seller ran into serious legal troubles.

March 20