Community banking

Community banking

-

Stephen Gordon has long been known as an entrepreneurial banker, which helped him expand his California bank aggressively over a five-year period. A spike in chargeoffs that led to a third-quarter loss spurred Gordon to beef up credit oversight. The question is whether that effort will stymie loan growth.

December 23 -

Highlands Bancorp in Vernon, N.J., has raised $8.5 million through a sale of common stock.

December 23 -

American Banker predicted these five bankers would make news. Several delivered, mostly with small, strategic deals and finding ways to make money in spite of challenging conditions.

December 23 - Florida

Regions Financial President and CEO Grayson Hall and the CEO of a Miami bank have been elected to the board of the Federal Reserve Bank of Atlanta.

December 23 - Louisiana

Add Investar Holding in Baton Rouge, La., to the growing list of community banks filing shelf registrations.

December 23 -

From the election's policy implications for banking to deep analysis of the Wells Fargo scandal, here are some of our favorite stories of the year. Stay tuned for Part II.

December 23 -

The similarities between the mortgage crisis and subprime auto lending in 2016 are all too obvious, with constrained cash flows, defaults and investor losses all likely.

December 23 -

The Federal Reserve has freed Cole Taylor Bank from an enforcement action two years after the Chicago bank was acquired by MB Financial.

December 22 -

Sussex Bancorp in Rockaway, N.J., has raised $15 million by selling fixed- to floating-rate subordinated notes to an institutional investor. It did not name the investor.

December 22 -

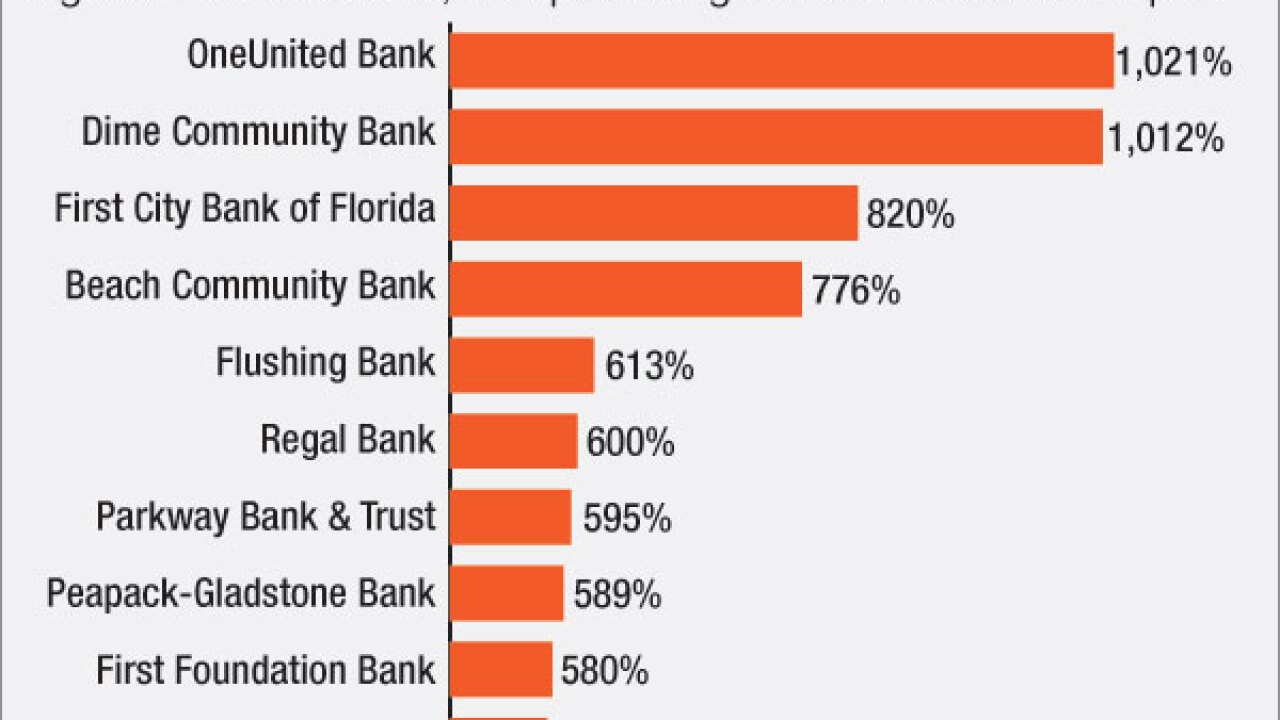

Regulators have warned about the dangers of high commercial real estate concentrations despite bankers' assertions that they are managing risk better than they did before the financial crisis. Still, CRE concerns could influence M&A and loan diversification in 2017.

December 22 -

With signs pointing to a possible rebound in de novo activity, the Federal Deposit Insurance Corp. released a guide to potential organizers about the application process.

December 22 -

FirstBank in Lakewood, Colo., named the successors to its CEO and president, who are both retiring after holding those titles for 17 years.

December 22 -

At a time when individual accountability at corporations is mounting, here is how compliance officers can detect and prevent fraud occurrences within their own firms.

December 22 -

Equity Bancshares in Wichita, Kan., has raised $35.4 million in a common stock offering and plans to use the proceeds to pay down a line of credit and support growth.

December 22 -

Lenders should be braced for some potential headaches as oil-related bankruptcies are expected to continue at a steady clip in 2017 and various market and political forces could influence oil supplies and prices.

December 22 -

The overall pace of consolidation slowed this year, but the average deal value increased from 2015 as bigger banks continued to get back into mergers and acquisitions. Several of this year's sellers were banks that had been backed by private equity in search of growth or a post-crisis turnaround.

December 22 - California

Castle Creek Capital has sold its entire stake in Heritage Commerce in San Jose, Calif.

December 21 -

First Midwest Bancorp in Itasca, Ill., has hired the former chief financial officer at Fulton Financial, about two weeks after he announced his resignation from the Lancaster, Pa., company.

December 21 -

The National Credit Union Administration acted appropriately, within its legal authority, when issuing its member business lending rule.

December 21 - Kansas

A former senior teller at Exchange National Bank & Trust in Atchison, Kan., has been sentenced to prison time and ordered to pay restitution after pleading guilty to an embezzlement scheme.

December 21