Community banking

Community banking

-

Old National Bancorp in Evansville, Ind., has agreed to pay for $79.1 million to buy 16 branches and other offices that it had been leasing.

November 22 -

More than 41% of banks have bought into hyperconvergence a blend of integrated server, storage and networking technology that's easily managed by software and there's no sign of its popularity letting up. PeoplesBank, a community bank in Massachusetts, is one of those that caught the bug.

November 22 -

The pending purchase of Carlile Bancshares will lower Independent's concentration in commercial real estate, while introducing the company to fast-growing markets in Texas and Colorado.

November 22 - New Jersey

Sun Bancorp in Mount Laurel, N.J., the $2.1 billion-asset parent of Sun National Bank, said independent director Anthony Coscia will serve as chairman of both starting Dec. 31.

November 22 -

ACNB Corp. in Gettysburg, Pa., is planning to enter Maryland with its agreement to buy New Windsor Bancorp in Taneytown, Md.

November 22 -

Independent Bank Group in McKinney, Texas, has agreed to buy Carlile Bancshares in Fort Worth, Texas.

November 21 - New York

Bridge Bancorp in Bridgehampton, N.Y., is looking to raise $50 million by selling common stock.

November 21 -

First Tennessee Bank in Memphis is giving veteran regional leader Pam Fansler an unusual retirement present: a chairmanship.

November 21 - WIB PH

Courage. Sexism. Culture. Banking's leaders discuss some of the powerful influences on their daily decisions and their vision for moving the industry forward.

November 21 -

A number of states still have a disproportionately high percentage of unbanked and underbanked citizens. Bankers in those states hope that financial education, along with efforts to promote checking accounts and small-dollar loans, will get more people into the banking system.

November 21 -

A bill looming in Congress would require the Internal Revenue Service to accept electronic transmission of lending-related forms, which could speed up the lending process by days.

November 21 - Tennessee

Pinnacle Financial in Nashville, Tenn., has sold $120 million in subordinated notes and will use the proceeds to retire existing debt and bolster its capital levels.

November 21 -

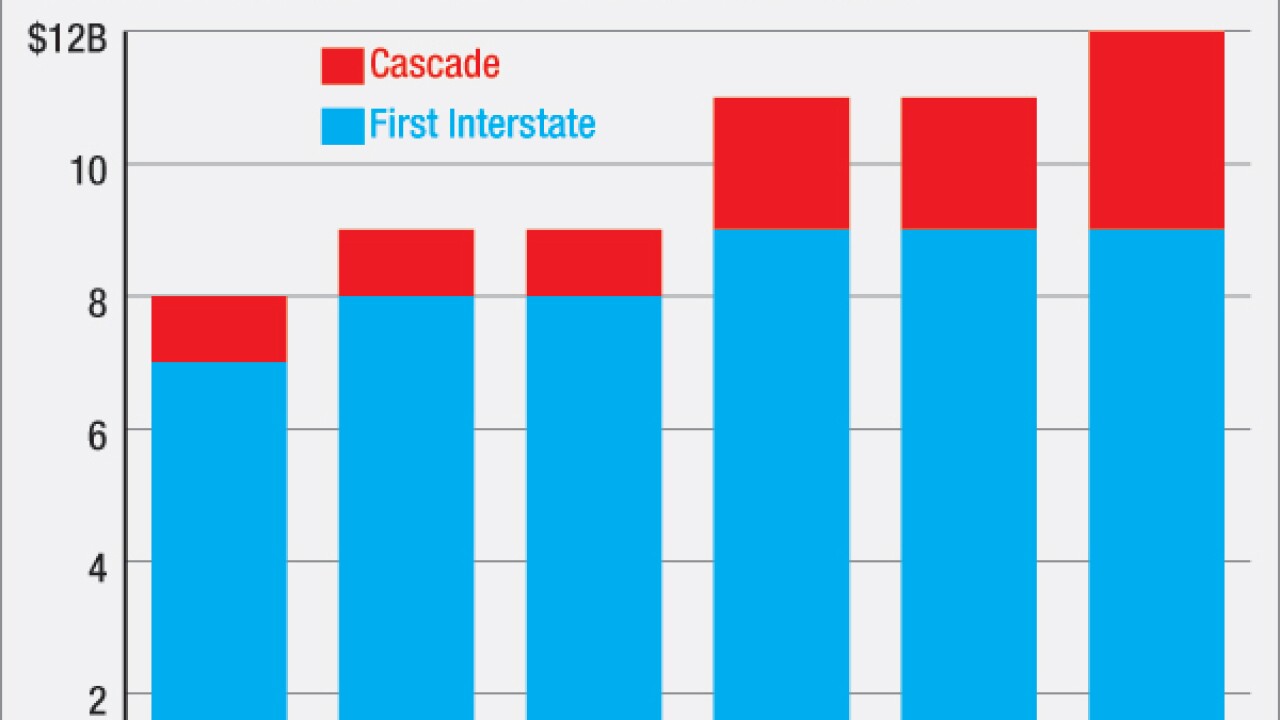

Montana's biggest bank will have to compete in cities such as Seattle and Portland, Ore., after buying Cascade Bancorp. But the company is arguably more excited about its chances to grow in central Oregon and Idaho, which are more like its existing markets.

November 18 -

Fifth Third Bancorp in Cincinnati has expanded its community development pledge to $30 billion.

November 18 -

Banks should focus on strategies to ensure their sales incentives programs actually help drive profits. Otherwise, their rewards programs are at risk of adding zero benefit to their bottom line.

November 18 -

The $1.1 billion-asset company said in a press release Friday that Richard Riccobono had also joined the board of unit First Financial Diversified Corp.

November 18 -

Smaller banks risk falling behind if they do not make space for financial innovation, Comptroller of the Currency Thomas Curry warned Friday.

November 18 - Louisiana

First NBC Bank Holding in New Orleans said in a press release Thursday that its bank entered into a consent order with the Federal Deposit Insurance Corp. and the Louisiana Office of Financial Institutions on Nov. 10.

November 18 -

Simmons First National in Pine Bluff, Ark., has agreed to buy the parent of First South Bank in Jackson, Tenn.

November 18 -

American Banker readers share their views on the most pressing banking topics of the week. Comments are excerpted from reader response sections of AmericanBanker.com articles and our social media platforms.

November 18