Community banking

Community banking

-

First Internet Bancorp in Indianapolis plans a secondary offering of about $20 million of common stock.

May 24 -

The Bancorp in Wilmington, Del., has selected a former Citigroup executive as its next chief executive.

May 24 -

A former Citibank payments specialist has been appointed to the board of Meta Financial Group in Sioux Falls, S.D.

May 24 -

WASHINGTON The House passed a bill by a voice vote Monday that will make it easier for mortgage originators to take a new job across state lines or move from a federally regulated bank to a nonbank lending shop.

May 23 -

Citizens Community Bancorp in Eau Claire, Wis., is searching for a new leader after its president and chief executive announced plans to resign this summer.

May 23 -

QCR Holdings in Moline, Ill., has agreed to buy Community State Bank in Ankeny, Iowa.

May 23 -

Nonperforming commercial-and-industrial loans are soaring, and loans to farmers and construction firms not just oil and gas companies are a big reason.

May 23 -

A proxy advisory firm has sided with Financial Institutions in Warsaw, N.Y., in its battle with an activist investor.

May 23 -

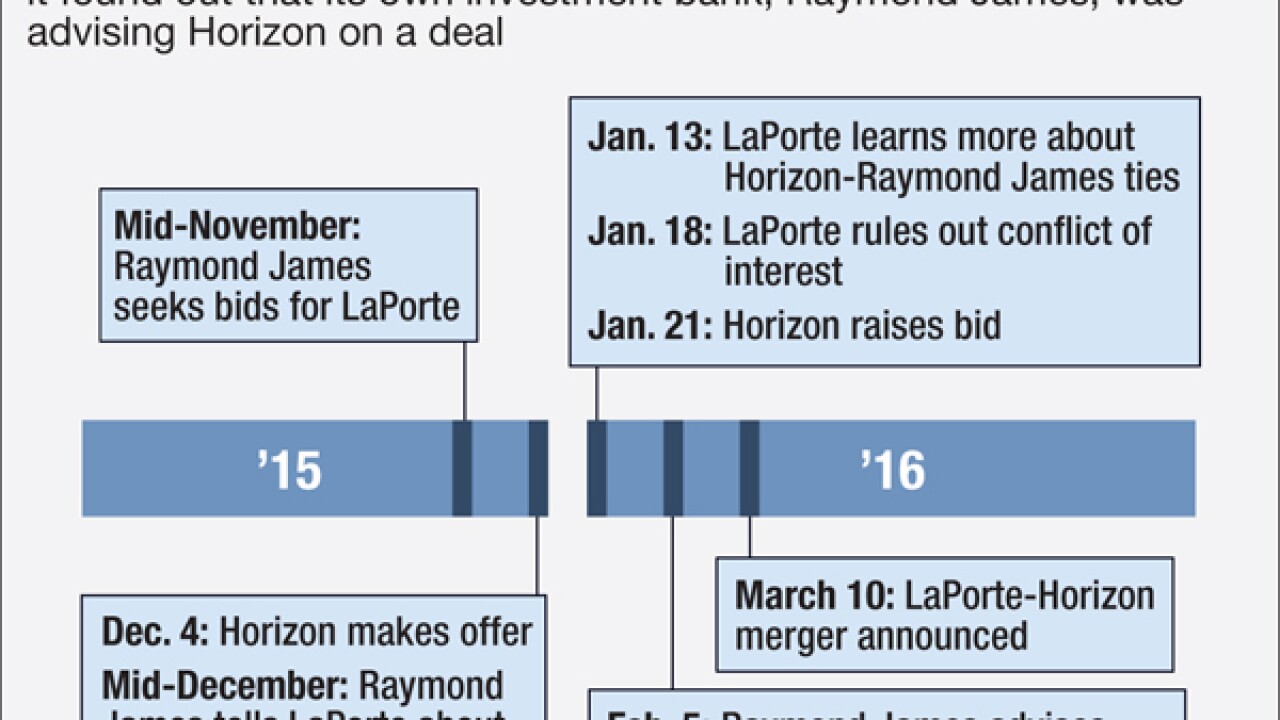

LaPorte Bancorp was poring over offers from potential buyers when Raymond James, the company's investment bank, notified LaPorte's board that it was also advising a potential acquirer on a separate deal. LaPorte requested more information before ruling out a potential conflict of interest.

May 23 -

Cattaraugus County Bank in Little Valley, N.Y., has named Salvatore Marranca chairman less than two years after he retired as its chief executive.

May 23 -

I bear no hard feelings for the JPMorgan Chase CEO, but our disagreement underscores a rift between how Wall Street firms and community banks view the post-crisis landscape.

May 20 -

HomeStreet in Seattle has raised $65 million from issuing senior debt. The $4.8 billion-asset company said in a press release Friday that the proceeds from the offering with support growth and other general corporate purposes.

May 20 -

Flagship Community Bank in Florida is facing pressure from its biggest shareholder to sell itself, either for cash or stock in a publicly held buyer. Management, however, believes the bank will fetch a better price if given time to improve profitability.

May 20 -

Scale is the goal of many banks dealing with compliance costs and revenue constraints. Success requires investing in management and systems without sacrificing culture.

May 20 -

National Commerce in Birmingham, Ala., has issued $25 million in subordinated debt.

May 20 -

State Bank in Atlanta convinced a jittery seller to work out a deal by promising to do an all-cash purchase if its own stock faltered.

May 20 -

Severn Bancorp in Annapolis, Md., has partially redeemed outstanding shares tied to the Troubled Asset Relief Program.

May 20 -

California Bank of Commerce in Lafayette has raised $9 million to help it exit the Small Business Lending Fund.

May 20