Community banking

Community banking

-

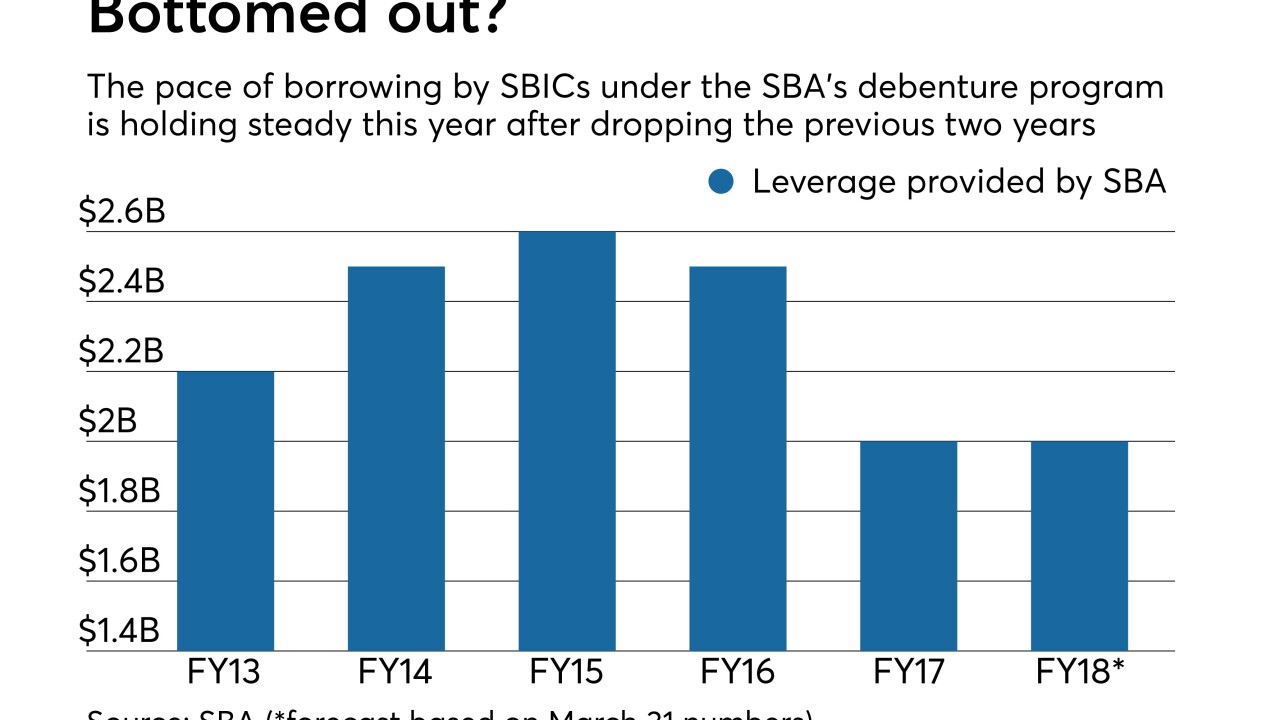

While the Small Business Investment Companies program has reported disappointing results since its 2015 peak, participating funds are getting more looks from curious bankers.

July 12 -

The New Jersey company will pay $76 million for a bank with a low loan-to-deposit ratio and an SBA lending platform.

July 12 -

The West Virginia company will pay a total of $118 million for Poage Bankshares and Farmers Deposit Bancorp.

July 12 -

Good times end eventually. And it is inevitable that some new approach to banking will cause financial institutions to fall flat in a downturn.

July 11 -

Moxy Bank would focus on low- and moderate-income depositors in the nation's capital, while operating a lending platform in North Carolina.

July 11 -

The sale includes 160,000 accounts and more than $400 million in deposits.

July 10 -

The Orlando, Fla., bank has bought Allied Affiliated Funding in Dallas in an effort to branch out beyond traditional commercial and consumer lending.

July 10 -

A former chief financial officer at Hanover Bancorp is trying to separate the roles of chairman and CEO as part of a sweeping demand for change.

July 10 -

Flagstar Bank, which is in the process of buying more than 50 branches from Wells Fargo, has hired Ryan Goldberg as a director of retail banking.

July 10 -

Jeff Deuel will take over as CEO of Heritage Bank in Olympia, Wash., for Brian Vance, who will remain as the head of the holding company until next year.

July 10 -

Branding can help define a de novo's strategy — and be costly and confusing to change if not done well.

July 10 -

Coastal Financial in Everett, Wash., said that it could be active in M&A with capital from its IPO and that it has already identified several possible targets.

July 10 -

Level One Bank in Farmington, Mich., has hired a team of mortgage bankers from MB Financial, which previously announced it was shutting down this business line.

July 10 -

Despite some criticisms of the strategy, community banks should continue to pair up with fintech companies that can help them expand their digital offerings.

July 10 -

Woodforest National in Texas has relied heavily on hundreds of in-store branches and overdraft fees to boost revenue. That is starting to change.

July 9 -

First Western Financial in Denver could use the roughly $31 million it is hoping to raise to pay off debt and redeem preferred shares.

July 9 -

VisionBank is the second de novo effort that would focus on the nation's capital.

July 9 -

A money-laundering scandal at Denmark's largest bank has prompted increased regulatory scrutiny at larger banks, so criminals may try to filter dirty money at smaller institutions, a regulator warned.

July 9 -

A new court filing suggests that Stephen Calk was named to a 13-member economic advisory team in 2016 in exchange for approving a $9.5 million loan to former campaign manager Paul Manafort.

July 6 -

Provident Financial said it increased its allowance against a commercial loan after discovering that the borrower overstated the value of its collateral.

July 6