Community banking

Community banking

-

The Pennsylvania company gained $67 million in assets under management as part of the acquisition.

November 12 - Banking brands

The company, which plans to become Altabancorp, said the initiative removes brand confusion and puts its size and scale on display.

November 12 -

Many in the industry have cheered regulators’ interest in improving the supervisory rating system, but they may shy from commenting publicly about their experiences in a confidential process.

November 11 -

Dealmaking through early November is slightly ahead of last year's clip thanks to a recent flurry of merger announcements. However, excluding BB&T-SunTrust, values and multiples are shrinking.

November 11 -

Community bank leaders at an ABA-hosted meeting questioned the timing for a new accounting standard for loan losses and discussed their struggles to keep pace with new technology.

November 11 -

Most consumers, even those in rural communities, have become accustomed to digital services. That's something certain community banks better face up to, panelists at the ABA conference said.

November 10 -

Scottsdale Community Bank's organizers took advantage of a state law letting them raise capital months before seeking deposit insurance.

November 8 -

The veteran banker succeeded Randy Sims, who recently retired. Sims had been the Arkansas company's CEO since replacing Allison in 2009.

November 7 -

Washington Trust warned that it could lose $3 million in annual revenue after two top advisers left to join a brokerage firm. Other banks are facing similar hits.

November 7 -

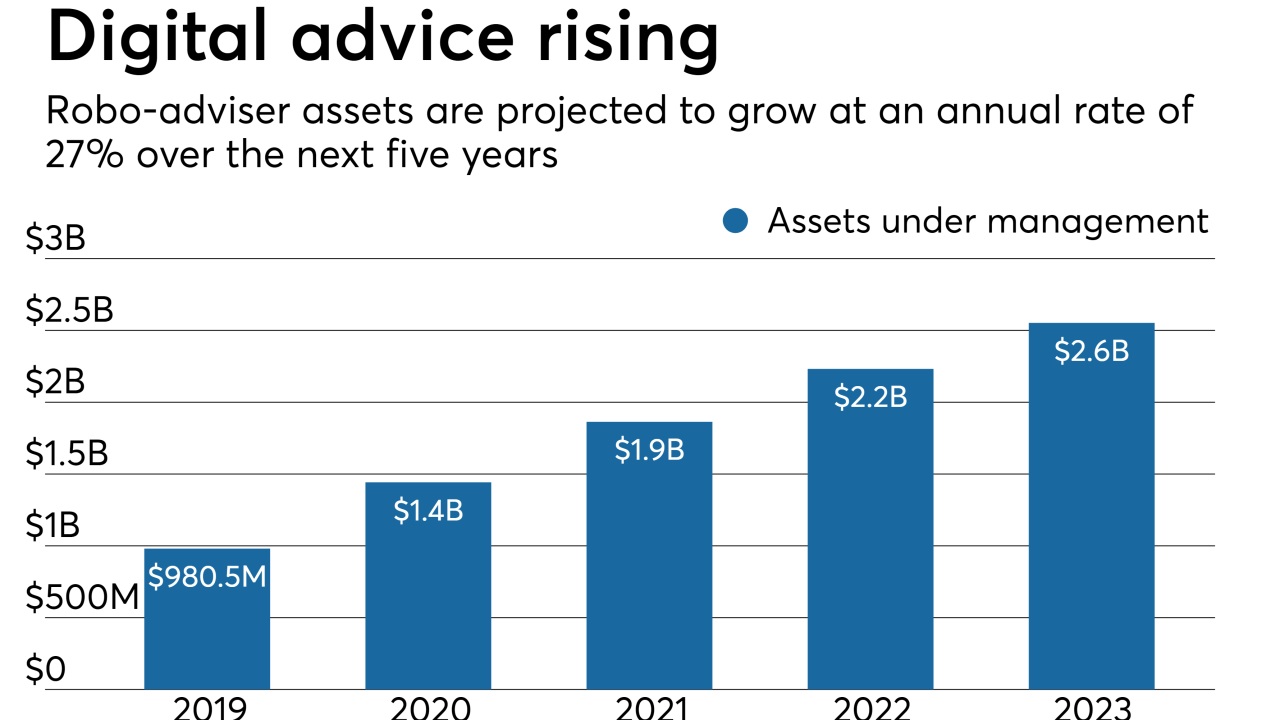

A new partnership will let some community banks and credit unions roll out robo-advice platforms without a significant investment of their own.

November 7 -

Clear communication is critical when banks undergo a leadership or operational change.

November 7 -

More details have surfaced about Interactive Brokers' planned bank. It would accept deposits and originate loans through an online channel only, its application says.

November 7 -

While layoffs at big banks get the headlines, small and midsize lenders are also trimming payrolls in response to lower rates and fears that a recession is getting closer.

November 6 -

The FDIC ordered the Seattle bank to pay a nearly $1.4 million fine tied to improper agreements with real estate brokers and homebuilders.

November 6 -

The Maryland company agreed to acquire Rembert Pendleton Jackson, which has $1.3 billion in assets under management.

November 6 -

Recent closings could portend a stiffer regulatory stance on capital adequacy and risk.

November 5 -

A group affiliated with Interactive Brokers Group has filed an application with the FDIC to form Interactive Bank.

November 5 -

Tri County Financial will pay an undisclosed amount for H.F. Gehant Bancorp.

November 4 -

The California company agreed to pay $14 million in cash for a bank with $131 million in assets.

November 4 -

First Horizon and Iberiabank solidified their resolve after BB&T and SunTrust announced their merger. Bryan Jordan, First Horizon's CEO, says he's convinced the earlier deal is having a similar influence at other regional banks.

November 4