Community banking

Community banking

-

Northpointe Bancshares sold stock to an affiliate of Castle Creek Capital.

June 4 -

Michael Ward, a former CEO at Mrs. Fields Famous Brands, has been a Prime Alliance director for 14 years.

June 4 -

Someone reportedly was burning paper at the Texas bank on a recent Saturday night, and a state regulator cited "insider fraud and abuse" after Enloe was closed.

June 3 -

Year to date through Mar. 31, 2019. Dollars in thousands.

June 3 -

Year to date through Mar. 31, 2019. Dollars in thousands.

June 3 -

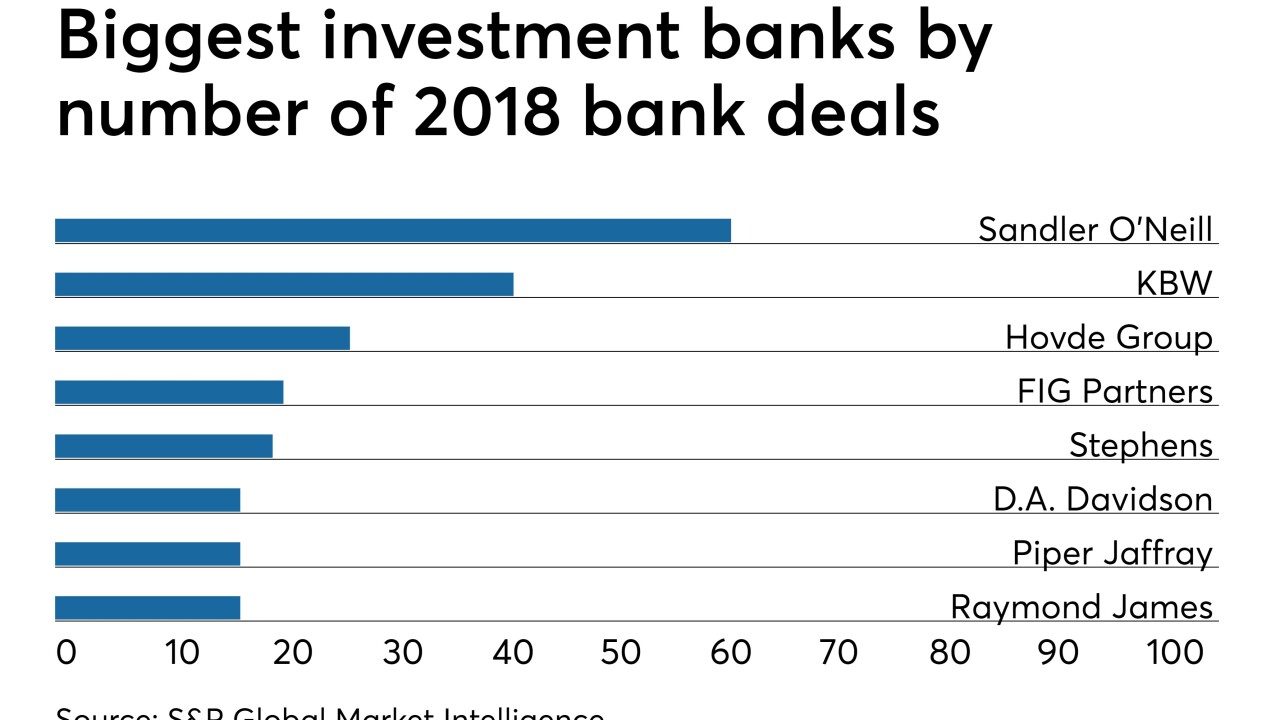

Kevin Fitzsimmons and David Bishop switched jobs shortly after FIG Partners sold to Janney Montgomery Scott.

June 3 -

Lori Bettinger is one of the organizers of NXG Bank, which has applied to open in Columbia, Md.

June 3 -

Midsize banks are more profitable overall than both their smaller and larger counterparts, and the strategy that some of the best performers in this group use to stand out is specialization.

June 3 -

The anti-bribery law that Stephen Calk is accused of breaking carries stiff penalties — up to 30 years in prison — but violations can be relatively hard to prove because prosecutors must establish the defendant had a corrupt state of mind.

June 2 -

Regulators closed The Enloe State Bank in Texas late Friday, marking the first failure in 17 months and the first in the Lone Star State in over five years.

May 31 -

While Noah Bank’s CEO has been accused of self-dealing in connection with SBA loans, its chairman says the directors had a succession plan ready to go and are rallying to rescue the bank’s reputation.

May 31 -

The bank will have about $1 billion in assets after it acquires Lighthouse Bank, which is also based in Santa Cruz.

May 31 -

Eric Meilstrup, who was named president last fall, will succeed Steve Foster as CEO next month.

May 31 -

Stress tests, capital buffers and liquidity levels are best ways to make financial system safe; HSBC plans to layoff “several hundred” from investment bank.

May 31 -

Its CEO says organic growth is preferable, but after spending five years tackling a series of enforcement actions tied to BSA compliance, the Pennsylvania bank has options.

May 30 -

The London firm lags the three largest U.S. vendors but bets its new open banking platform can win it more business.

May 30 -

Grasshopper Bancorp will target the innovation economy in New York City and other markets across the country.

May 30 -

Community and regional institutions' survival could hinge on their ability to access large troves of data.

May 30 -

West Florida Banking is made up of bankers who ran Jefferson Bank of Florida, which is now part of CenterState Banks.

May 30 -

Smaller banks are often not taking the extra step beyond traditional functions such as online bill pay, writes Alberto Hernandez, COO for the U.S. region at Valid.

May 30