Community banking

Community banking

-

The community bank said it would will not renew their employment contracts, which terminate March 20, but that it intends to keep them as executives.

December 28 -

To strengthen ties with entrepreneurs, Citizens Bank of Edmond in Oklahoma and the de novo Genesis Bank in California offer co-working, education and other resources.

December 27 -

These executives are adapting to changing customer demands amid rebounding M&A and coronavirus-related challenges.

December 22 -

The state Department of Financial Protection and Innovation issued a cease-and-desist order against Nano Banc, saying the troubled bank violated an earlier consent agreement when it replaced five board members and appointed a new CEO without the regulator’s permission.

December 21 -

The Oklahoma bank is eager to take the ground some competitors are ceding in oil and gas financing.

December 21 -

Alloy Labs Alliance, a consortium of community banks, is working with the fintech Payrailz on a project called "Chuck" that would route peer-to-peer payments over different networks, based on which is least expensive for each transaction.

December 20 -

The acquisition would give Avadian, which is based in Birmingham, two more locations in its home state and increase its assets to approximately $1.2 billion.

December 20 -

The Arkansas bank is working with 10 universities' athletic departments to create programs for women it hopes will one day join its ranks.

December 16 -

The Louisiana-based Home has agreed to pay $66.6 million for the $445 million-asset bank.

December 15 -

FNB Bank in the hard-hit community of Mayfield lost its headquarters during the catastrophic storms. It and other financial institutions are aiding local residents who are now taking stock of the damage.

December 15 -

More than 180 community development financial institutions and minority depository institutions will receive the federal funds under a pandemic-era program. “It’s a lifesaver,” a credit union CEO said.

December 14 -

The National Association of Federally-Insured Credit Unions' new campaign highlights $243 billion in fines slapped on Wall Street banks. The group says it's responding to political attacks, but the banking industry says NAFCU is trying to distract from criticism of its tax exemption.

December 13 -

The Atlanta bank said the deal will accelerate its small-business and commercial and industrial lending while expanding its presence in point-of-sale financing.

December 13 -

For the third time since the start of the pandemic, the Richmond, Virginia, company will close branches to contain costs in what it calls a “challenging macroeconomic environment.”

December 10 -

Driver Management says CEO Vernon Hill’s aggressive deposit-gathering strategy is not paying off for shareholders and wants the company to merge with a bank that would deploy the deposits into higher-yielding loans.

December 10 -

Facing a lawsuit from a disgruntled investor, the Arkansas company has released additional information about how it arrived at the $919 million price it’s paying for Happy Bancshares.

December 9 -

The $85 million acquisition of Metro Phoenix Bank would more than double Alerus Financial’s loans and deposits in the nation’s fifth-largest city.

December 9 -

Business and regulatory pressures were already weighing on aging executives before the onset of the pandemic led many to delay retirement plans. Now as the crisis eases, an increasing number are finally stepping down.

December 7 -

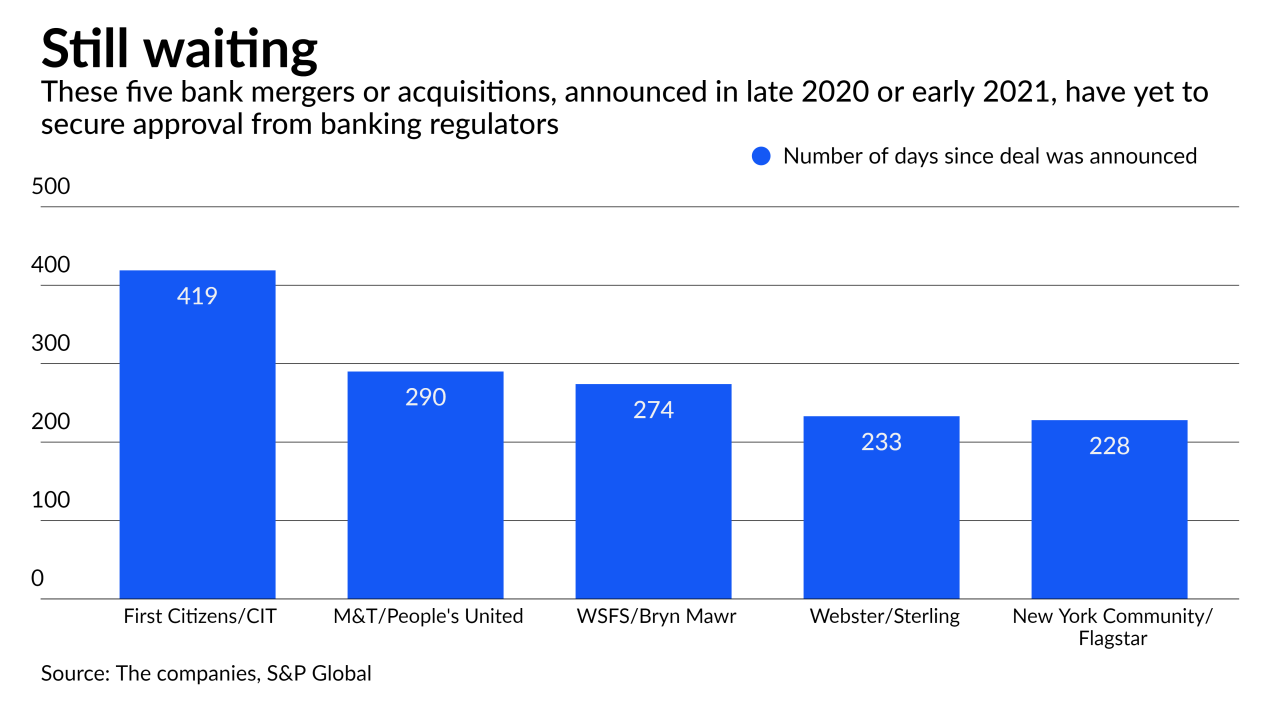

Bankers say the Biden administration’s call for regulatory greater scrutiny of mergers and acquisitions is causing holdups and could slow dealmaking activity in 2022.

December 7 -

On Sep. 30, 2021. Dollars in thousands.

December 6