Community banking

Community banking

-

Organizers of Silver River Community Bank must raise $17 million before opening.

August 26 -

The bank started buying more Treasurys and mortgage-backeds over a year ago, long before talk about rate cuts. What did it know that its rivals didn't?

August 25 -

How is the Pennsylvania bank trying to differentiate itself in wealth management? By assembling a team of private bankers to cater to the complex needs of high-net-worth clients.

August 22 -

Recent studies offer a dire outlook for water levels in drought-prone states. Some banks are bracing for this risk with changes to underwriting of real-estate-related loans.

August 21 -

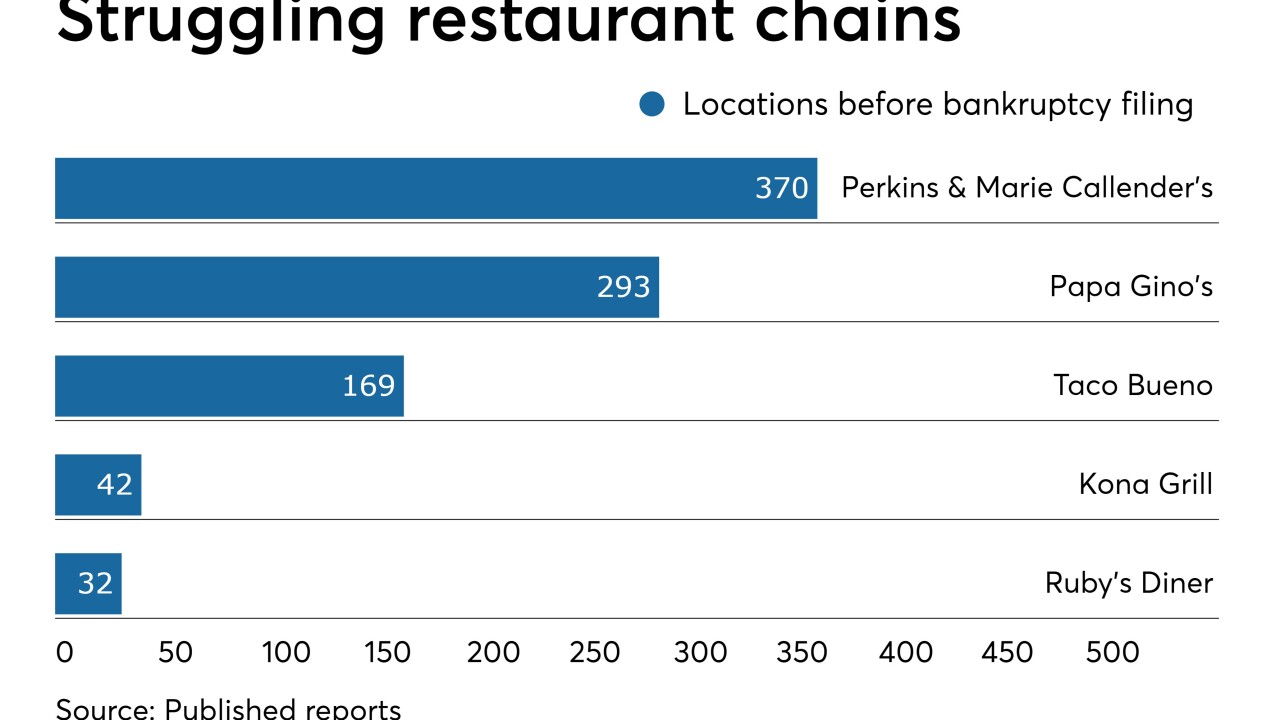

As a growing number of chains go bankrupt, loan charge-offs are rising.

August 21 -

Hove, who spent 11 years on the Federal Deposit Insurance Corp. board, was the agency's acting chairman three different times during the 1990s. He held several jobs in banking, including chairman and CEO of Minden Exchange Bank & Trust, which had been led by his father.

August 20 -

First Mutual Holding is buying the tiny Blue Grass Federal and keeping its charter. The deal will allow the seller to save costs and maintain its autonomy.

August 20 -

A panel of federal appeals court judges reversed a district court’s decision on the NCUA’s controversial field-of-membership rule, but saw merit in bankers’ claims of potential redlining.

August 20 -

The company has agreed to buy Albany Bancshares, which has four branches near the Iowa border.

August 20 -

The agency is trying to update its rate-cap policy for institutions that fall below "well-capitalized." But it remains to be seen if the proposed changes fully address community bankers' concerns.

August 20 -

The Louisiana company will enter two new markets after it buys the locations.

August 20 -

Community First will pay $40 million in cash for the parent of Affinity Bank.

August 20 -

Competition for deposits is tight, the outlook for loan demand is uncertain, and regulatory relief is slow-moving. Yet community bankers are feeling better about the economy than they have in two years, a Promontory Interfinancial Network survey found.

August 19 -

Lenders insist they will be able to ramp up commercial loans and mortgage refinancings without skimping on underwriting.

August 19 -

Professional Bank and Marquis Bank, both of Coral Gables, have been competing against each other for more than a decade. Now they are merging in hopes of landing larger clients and making better use of technology being developed in Professional's innovation lab.

August 18 -

ZSuite Technologies digitizes a number of services that banks provide to landlords.

August 16 -

The company will pay $113 million for a commercial lender based in its backyard.

August 16 -

With long-term interest rates at historic lows, mortgage refinancing is coming on strong. But that additional revenue may not be enough to offset net interest margin pressures and lost servicing income.

August 15 -

Christopher Maher is kicking the tires on an "acquisition of size" that would propel the New Jersey bank across the $10 billion-asset mark.

August 15 -

People’s United offered 30% more in the summer of 2018 for United Financial than it agreed to pay in a deal announced last month. What followed the initial talks is a textbook lesson in the impact of indecision and the unexpected in bank M&A.

August 14