-

In a move to increase the security of card transactions, the Reserve Bank of India (RBI) is requiring all advanced features such as contactless to be turned off for new and re-issued cards until the user opts-in.

January 23 -

Some of the world’s major central banks are teaming up to assess potentially developing their own digital currencies, acknowledging that their role is being challenged by new technologies and private sector initiatives such as Facebook Inc.’s Libra.

January 21 -

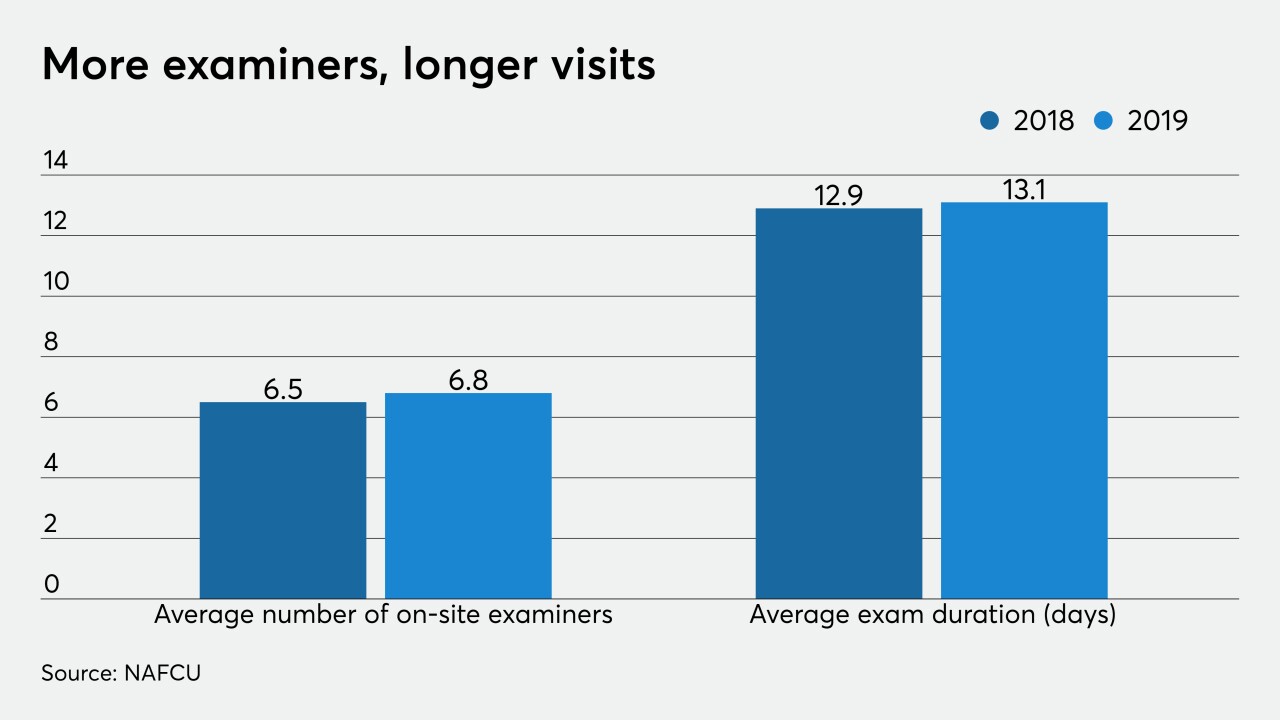

The National Credit Union Administration promised qualified credit unions under $1 billion in assets would be on an 18-month exam timeline by the end of 2019. A recent report says that hasn't happened.

January 21 -

European Union privacy watchdogs are gearing up to police digital assistants after revelations that Amazon.com Inc. workers listened in on people’s conversations with their Alexa digital assistants.

January 17 -

While not as large as the U.S. both in number of people and number of credit card owners, the U.K. remains a very lucrative market for issuing banks and card networks, as well as a host of alternative financial service providers catering to younger, underserved consumers.

January 17 -

Lenders grew more optimistic that Congress will undo or narrow the loan-loss accounting standard after members of a House subcommittee assailed Russell Golden for approving the rule without studying its impact on credit availability.

January 16 -

Data security and infrastructure custodian Very Good Security (VGS) received a strategic investment from Visa, which has been spending heavily this week on fintech.

January 16 -

Plaid may be a more problematic acquisition than Visa made it out to be. But without Visa, those problems were likely to get a lot worse.

January 16 -

The Bay State is the latest to push its lawmakers to modernize how CUs do business in order to help state charters remain competitive with federal charters.

January 15 -

The specific impetus for the Federal Trade Commission's inquiry into Visa and Mastercard's debit transaction routing processes is not entirely clear, but it likely stems from the effect that advanced payments technology has had on Durbin amendment compliance.

January 15