-

One of the critical unanswered questions early in the Single Euro Payments Area process and the new Payment Services Directive in Europe was whether banks would pony up for needed technology upgrades.

August 1 -

In the next phase of India’s push to diminish the country’s heavy reliance on cash, the Reserve Bank of India has approved the rollout of a national electronic bill-payment system.

July 31 -

With the move, the Mississippi bank would no longer be regulated by the Federal Reserve. The decision comes after the bank struggled with Bank Secrecy Act and Community Reinvestment Act compliance.

July 28 -

A controversial move to stop Canadian CUs from using the words “bank” and “banking” has rallied the movement there, but U.S. institutions are left wondering if such a move could happen here, particularly in light of some recent states’ measures.

July 25 -

India is considering tracking digital currencies like bitcoin through the central bank and capital markets regulator along with intelligence agencies to monitor money laundering and terrorist financing, people with the knowledge of the matter said.

July 14 -

If nothing else, no one could ever accuse U.K. regulators of taking a hands-off approach to the country's payments operations.

July 14 -

Removing restrictions on companies such as Comcast, AT&T and Verizon could have clear repercussions for the payments industry.

July 13 -

Millennials -- a demographic credit unions badly want to capture -- are using P-to-P services to pay for drugs and gambling, and while CUs may not want their members paying for illegal activities with account-connected services, a growing number of institutions also want to be the FI of choice for legal drug businesses.

July 12 -

Mobile and online P-to-P services may be the popular, mainstream payments service of choice for young people who don't prefer cash, but it also has a seedy underbelly, according to new survey data.

July 12 -

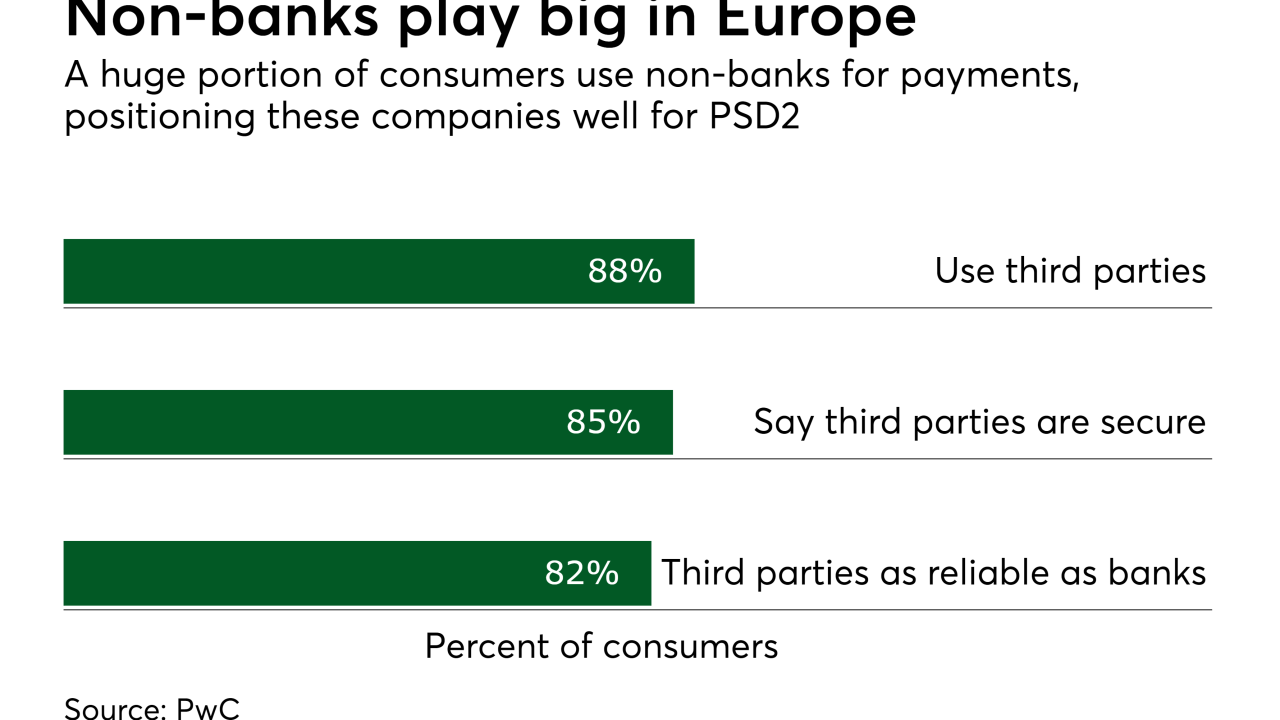

Information sharing is about to get much different in Europe, giving bank alternatives such as Klarna more to work with as they compete against the financial services establishment.

July 12