-

With Democrats already opposing a bill by Rep. Jeb Hensarling, R-Texas, to roll back Dodd-Frank, his chances of long-term success depend on support by Donald Trump. The two met to discuss the plan on Tuesday.

June 7 -

Federal regulators issued a statement Tuesday reminding credit unions and banks how they can protect themselves from cyberattacks.

June 7 -

Sen. Dick Durbin, D-Ill., wrote to Visa on Tuesday to denounce an alleged new fee assessed by the company on credit and debit card issuers that see their business shift to a competing card network.

June 7 -

With Democrats already opposing a bill by Rep. Jeb Hensarling, R-Texas, to roll back Dodd-Frank, his chances of long-term success depend on support by Donald Trump. The two met to discuss the plan on Tuesday.

June 7 -

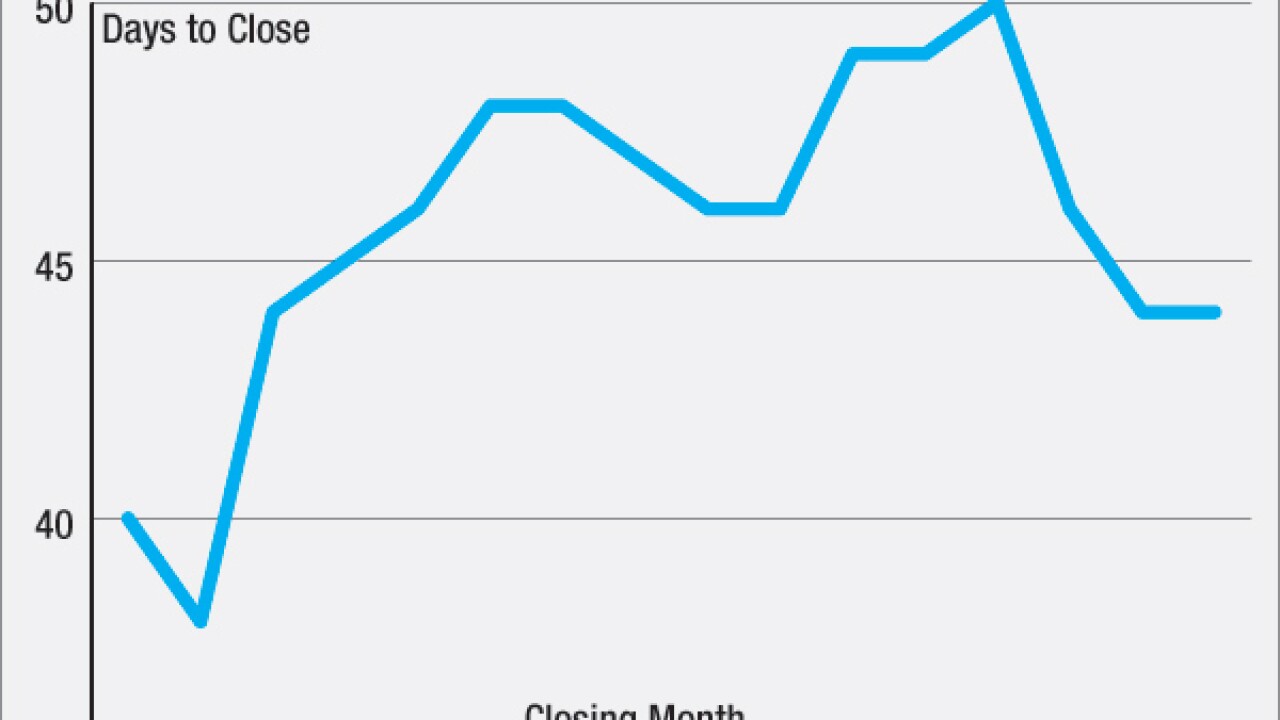

With the Consumer Financial Protection Bureau expected to clarify its integrated disclosure rules in July, lenders want to know how to remain compliant when unexpected changes come up right before a closing.

June 7 -

The Consumer Financial Protection Bureau's complex payday lending proposal is sparking concerns that state legislatures will try to repeal existing usury laws and allow a parade of pro-payday-lending bills to move forward.

June 7 -

House Financial Services Committee Chairman Jeb Hensarling R-Texas, is set Tuesday to unveil an ambitious plan to revamp the Dodd-Frank Act and replace it with a capital-based alternative during a speech in New York City.

June 7 -

House Financial Services Committee Chairman Jeb Hensarling R-Texas, is set Tuesday to unveil an ambitious plan to revamp the Dodd-Frank Act and replace it with a capital-based alternative during a speech in New York.

June 7 -

At a time when most banks are finding it harder to make money from overdraft fees, new data shows that Wells Fargo, Bank of America and JPMorgan Chase are bucking the industrywide trend. The numbers are renewing consumer-protection concerns ahead of a CFPB rule-writing process set to begin later this year.

June 6 -

WASHINGTON A bipartisan group of lawmakers is urging the Consumer Financial Protection Bureau to change how it calculates title insurance fees as part of the new integrated mortgage disclosures.

June 6 -

The Consumer Financial Protection Bureau filed a lawsuit Monday against payment processer Intercept Corp. and its two top executives for allegedly enabling clients to withdraw millions of dollars' worth of illegal charges from consumer bank accounts.

June 6 -

The Consumer Financial Protection Bureau filed a lawsuit Monday against payment processer Intercept Corp. and its two top executives for allegedly enabling clients to withdraw millions of dollars worth of illegal charges from consumer bank accounts.

June 6 -

It has been seven years, and its going to take about $16.1 million, but First Reliance Bancshares in Florence, S.C., says it is about to close a key chapter in its post-crisis recovery and is ready to ramp up growth.

June 6 -

To account for the heightened questioning and investigations around the Panama Papers hack, people need to legal-up and issuers, financial institutions and processors need to gear-up for expected spikes in work related to due diligence, more precise monitoring of transactions, payments and sanctions filtering, possible ad-hoc examination and possible fines.

June 6 GFT

GFT -

Comments by JPMorgan Chase's Jamie Dimon have added fuel to the long-discussed idea of a national database that would make it easier for banks to vet customers for anti-money-laundering and other risks.

June 3 -

Merchants sued Visa and MasterCard in 1996 when the card networks forced them to "honor all cards," and though the suit settled in 2003, the wounds are reopening with the spread of mobile wallets.

June 3 -

Sen. Elizabeth Warren, the founder of the Consumer Financial Protection Bureau, said Thursday she would fight back against congressional efforts to delay or revamp the agency's payday lending proposal even while she acknowledged the plan could have been tougher.

June 2 -

The National Retail Federation wants the Federal Trade Commission to do more than merely check up on the companies that routinely assess merchants for compliance with the Payment Card Industry Data Security Standards (PCI DSS).

June 2 -

Although the Consumer Financial Protection Bureaus long-awaited proposal to establish the first federal rules for payday, auto title and high-cost installment loans offers a nod to NCUAs Payday Alternative Loans (PALs) program, CUs are concerned the plan will stifle their ability to offer consumer-friendly alternatives to an often predatory market.

June 2 -

The Consumer Financial Protection Bureau's long-awaited proposal to establish the first federal rules for payday, auto title and high-cost installment loans did not include a provision that banks had planned would allow them to compete by offering small-dollar installment loans.

June 2