-

Despite strong performance in the industry overall, analysts expect regulators to shutter more institutions in the years ahead.

January 3 -

From the end of overdraft fees to the rise of banks that watch their customers' every move, there are several new banking trends on the horizon in 2019.

January 1 -

The year saw anxiety over how banks would respond to record consumer debt, disruptive glitches at TD Bank and SunTrust, ongoing scandal at Wells Fargo, and much, much more.

December 30 -

The cost of Wells Fargo's scandals continues to rise as regulators from all 50 states forced the institution to pay hundreds of millions in penalties for the creation of fake accounts, improper enrollment in life insurance, force-placed auto insurance policies and other activities.

December 28 -

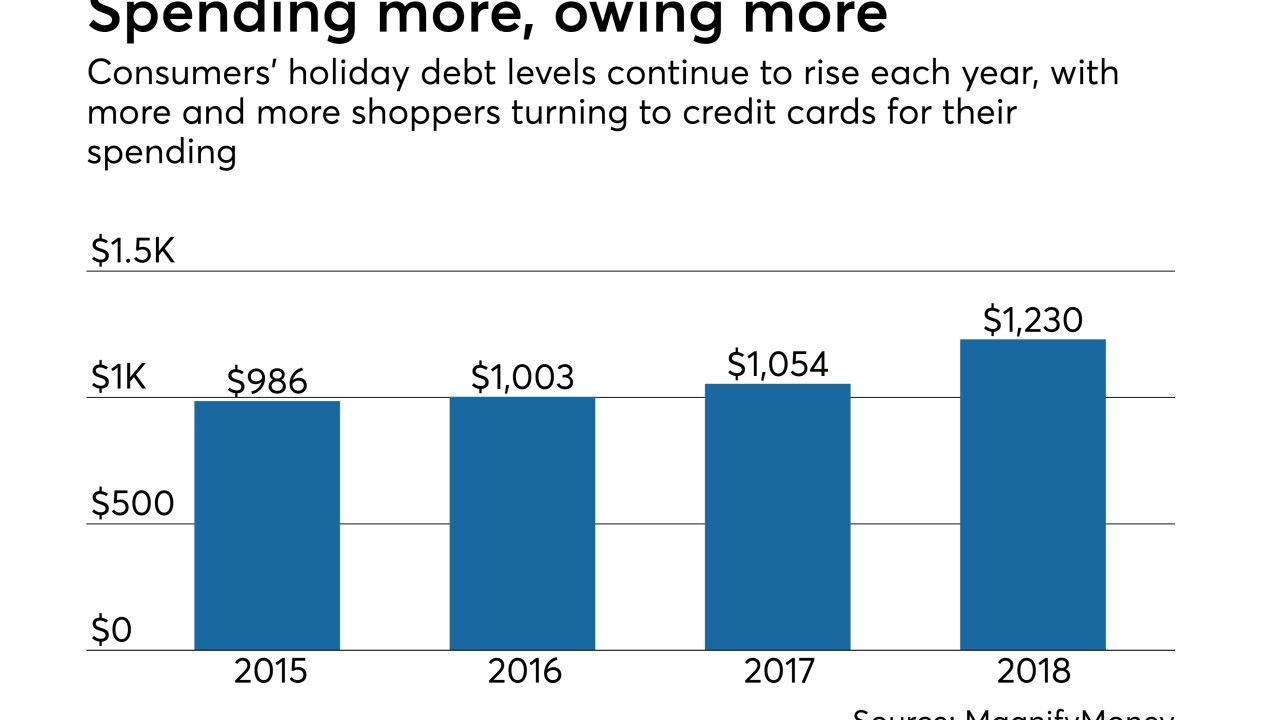

A pair of studies released Thursday show consumers once again added to their debt burden during the holiday season even as they admit to needing more financial education.

December 27 -

A bipartisan bill stirring in the Senate would prohibit lenders from mailing unsolicited checks that can immediately be converted into high-interest loans. Consumer groups call the loans predatory, but lenders say they are a lifeline for cash-strapped households.

December 27 -

Entering 2019, lenders must think carefully about how they expand their auto loan portfolio. Failure to do so could result in bad loans and bad reviews online.

December 26 EFG Companies

EFG Companies -

The industry could see a boost in mortgage lending from regulatory changes, but other factors may slow growth.

December 26 -

The biggest question is whether new CFPB Director Kathy Kraninger will deviate from the pro-industry policies of her predecessor, or bring continuity.

December 25 -

As head of Santander Bank’s retail network, Colleen Canny will be in charge of more than 600 branches and over 4,100 employees across eight states.

December 24