-

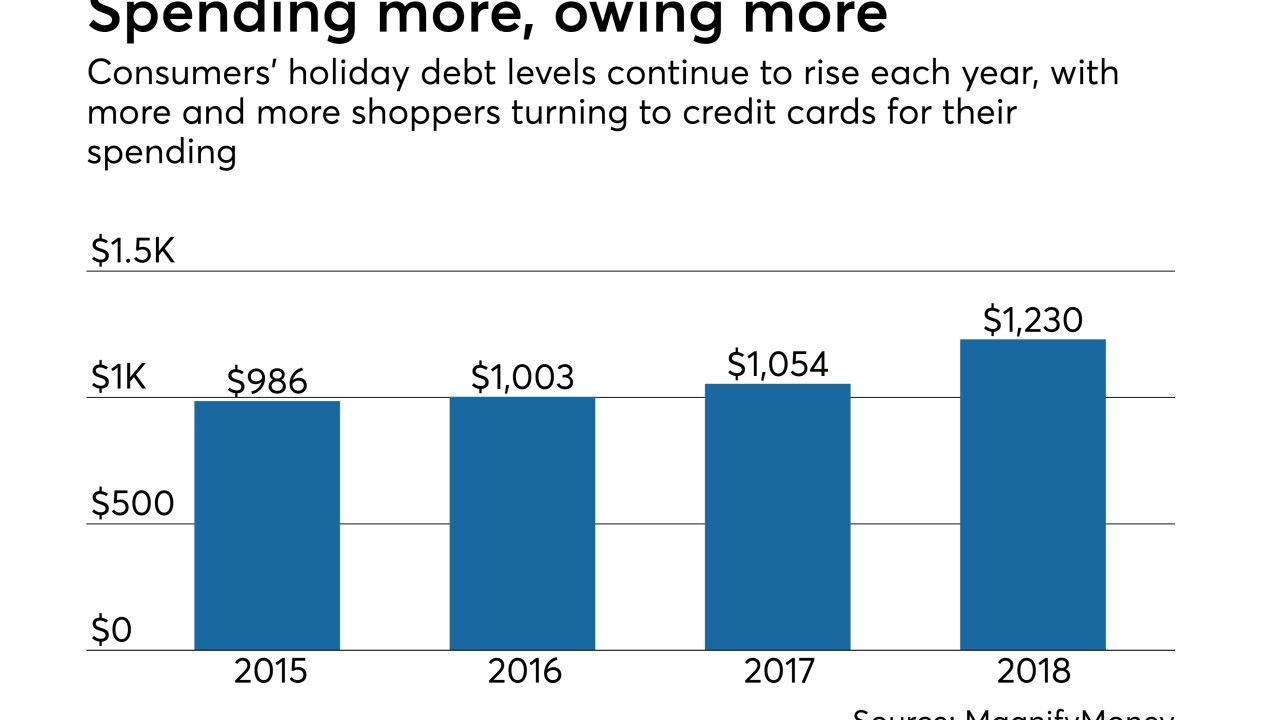

A pair of studies released Thursday show consumers once again added to their debt burden during the holiday season even as they admit to needing more financial education.

December 27 -

A bipartisan bill stirring in the Senate would prohibit lenders from mailing unsolicited checks that can immediately be converted into high-interest loans. Consumer groups call the loans predatory, but lenders say they are a lifeline for cash-strapped households.

December 27 -

Entering 2019, lenders must think carefully about how they expand their auto loan portfolio. Failure to do so could result in bad loans and bad reviews online.

December 26 EFG Companies

EFG Companies -

The industry could see a boost in mortgage lending from regulatory changes, but other factors may slow growth.

December 26 -

The biggest question is whether new CFPB Director Kathy Kraninger will deviate from the pro-industry policies of her predecessor, or bring continuity.

December 25 -

As head of Santander Bank’s retail network, Colleen Canny will be in charge of more than 600 branches and over 4,100 employees across eight states.

December 24 -

Rep. Maxine Waters, D-Calif., will take the gavel on the Financial Services Committee next term.

December 24 -

The Massachusetts-based institution has paid out over $10 million to its members since 1996.

December 24 -

Student loan debt — now at $1.5 trillion in the U.S. — is arguably the greatest pain point for consumers in their 20s and 30s. To court that demographic, banks are increasingly offering help with refinancing and repayment.

December 20 -

As part of the agreement with HSN, Synchrony has also extended its partnerships with HSN affiliates QVC and the e-commerce site Zulily.

December 20 -

Two groups are asking the agency to restrict collectors to "one live conversation per week" with a borrower and up to three phone attempts per week.

December 20 -

Maria Vullo is stepping down as head of New York's banking and insurance regulator after three years in which she created a national model for cybersecurity regulations at banks and fought back against federal attempts to chip away at payday-lending rules.

December 19 -

Recent data from NCUA showed a lot of positives for the industry, but it also revealed some potentially worrisome trends.

December 18 -

A U.S. District judge in Scranton denied the student lender's motion to dismiss the suit.

December 18 -

Lawrence Weinbach will replace David Nelms, who had already stepped down as CEO. The transition will take place Jan. 1.

December 17 -

U.S. student loan debt outstanding reached a record $1.465 trillion last month and one particular set of borrowers is having a hard time paying back their loans.

December 17 -

The Albany, N.Y., institution has made millions of dollars in mortgages through a program launched in July meant for those who do good in the world.

December 17 -

Former CFPB chief Mick Mulvaney had claimed the agency could not supervise firms for Military Lending Act compliance, but lawmakers want his successor to go in a different direction.

December 14 -

Readers sound off on fintechs entering the student loan market, the FDIC’s brokered deposit rules and a heated debate over the new CFPB leader.

December 13 -

New York legislators are pledging to change laws that have allowed predatory lenders to use the state court system to seize the assets of thousands of small businesses across the country.

December 13