-

Midterm elections are just eight days away and credit unions are making efforts to help get out the vote. Meanwhile, one Virginia-based CU is back in court over alleged ADA violations.

October 29 -

Taxi medallion loans are going nowhere fast, but loans to drivers for ride-hailing services like Uber could help replace some of those losses on credit union lending portfolios.

October 29 Oak Tree Business Systems, Inc.

Oak Tree Business Systems, Inc. -

Christian Sewing calls out the German bank's senior managers for using rumors of a merger with Commerzbank to excuse poor performance; banks in China begin using smartphones to pick up on lie-detecting facial tics.

October 29 -

From Democrats winning control of Congress to an escalating trade war and technology companies applying for a fintech charter, there are plenty of scary prospects facing the industry.

October 28 -

The Human Account, a survey of 11,500 people, is intended to inspire banks and governments to come up with better ways to help low-income people.

October 26 -

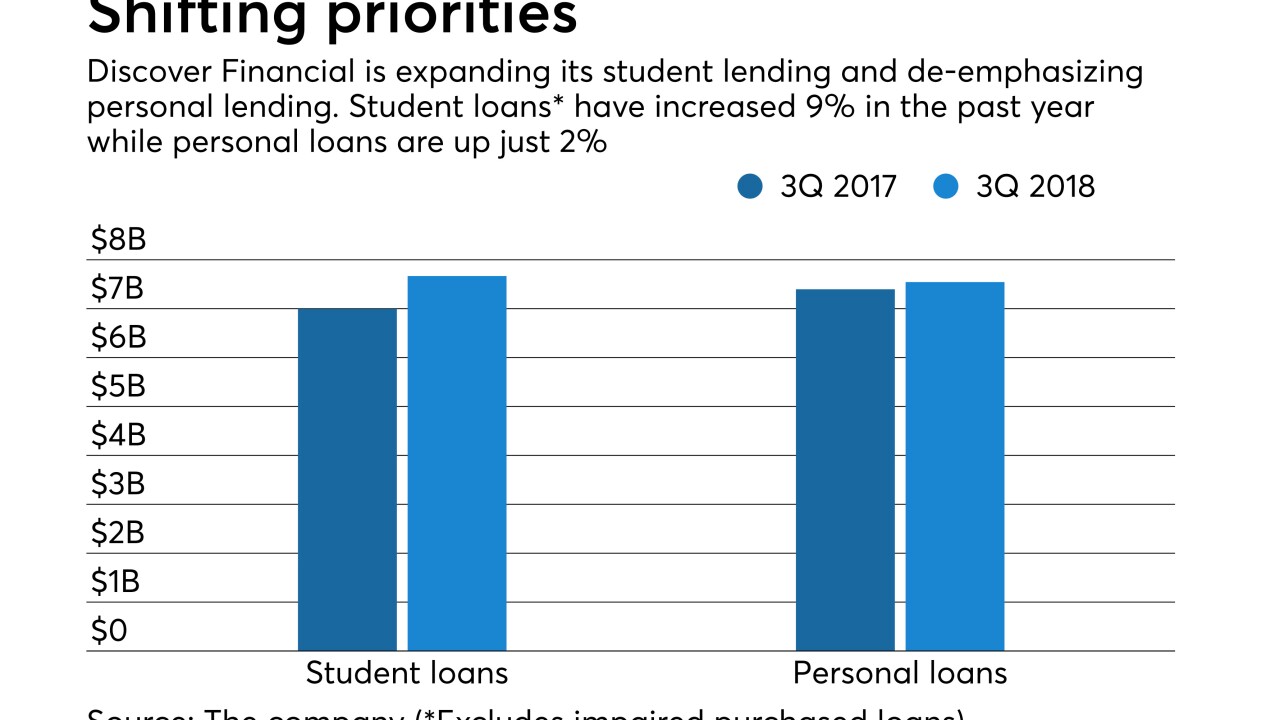

Personal loans are "tricky to underwrite" because consumer credit scores are high at the time of origination and then drift downward, says Roger Hochschild, who recently took over as the head of Discover Financial Services.

October 26 -

The agency wants to change underwriting requirements in the regulation that lenders say will put them out of business, and give companies a break on the compliance deadline.

October 26 -

The money manager plans a big expansion in Atlanta; agency makes now rare determination that debt-collection practices were “abusive.”

October 26 -

Double-digit gains in card volume offset an uptick in problem loans.

October 25 -

Deposits topped $100 billion during the quarter while profits climbed 34% thanks to higher loan yields and lower taxes.

October 25 -

Consumer Financial Protection Agency Acting Director Mick Mulvaney is winding down some of the efforts his predecessor worked hardest on: enforcement of payday and fair lending rules and the Military Lending Act. Reporter Kate Berry shares the latest.

October 25 -

Despite recriminations about how the crisis and ensuing regulations have tightened loan access, an actual assessment of mortgage credit availability finds the situation is more complicated.

October 24 -

Popular's 16% gain in deposits and a recent acquisition bode well for its future even though there has been a major net loss of residents since Hurricane Maria.

October 24 -

Cash Express LLC allegedly sent customers threats of legal action even though the time for taking legal action had expired.

October 24 -

A detailed breakdown released by the agency shows residents in California, Florida and Texas having submitted the most complaints about a financial institution, but D.C. had the most per-capita complaints.

October 23 -

A new credit score that includes consumers' cash flow alongside their credit score is winning praise for its potential to help expand access to credit, but some worry it gives the credit bureaus even more data that could be compromised.

October 23 -

The agency’s biennial survey showed gradual improvement in access to mainstream banks, but over 14 million adults lack ties to a federally insured institution.

October 23 -

Increased third-quarter revenue outweighed higher operating expenses at the Alabama regional.

October 23 -

Though consumer lending and C&I lending improved at the Cincinnati company, its corporate and mortgage banking revenues fell in the third quarter. Last year Fifth Third also posted a one-time gain of $1B associated with its sale of shares in Vantiv, complicating the comparison.

October 23 -

The Columbus, Ga., company ramped up its business and consumer lending even as it scaled back lending on construction and commercial real estate projects.

October 23