-

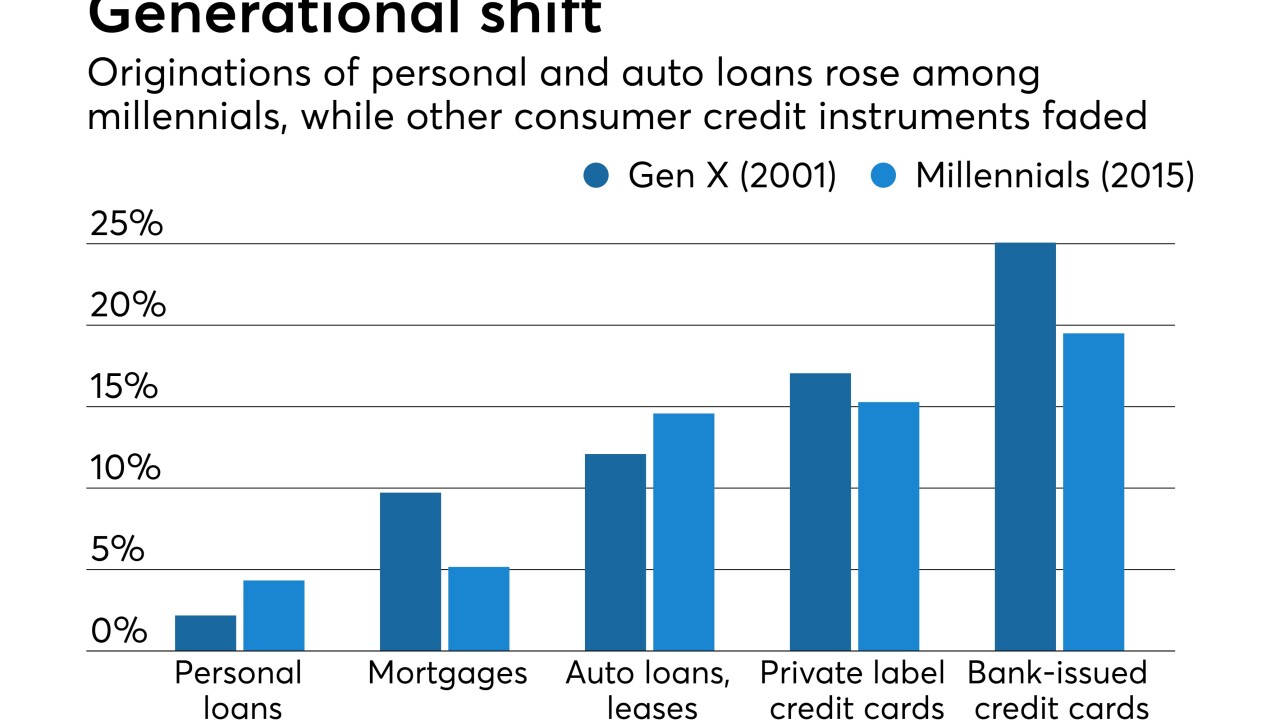

Millennials — many of whom joined credit unions in recent years as the movement's membership expanded — are relying more heavily on personal loans than their Gen X predecessors while paring back on credit cards and mortgages.

September 11 -

Readers opine on Square’s applying for an industrial loan company charter, the Federal Reserve’s role in faster payments, assumptions about operational security, and more.

September 7 -

It’s highly debatable whether the artificial intelligence engines that online lenders typically use, and that banks are just starting to deploy, are capable of making credit decisions without inadvertent prejudices.

September 7 -

Given the scale of damage to the region’s homes and cars, bankers are guarding against an expected spike in missed payments by extending loan terms, deferring payments and making other concessions.

September 7 -

The Wall Street giant on Wednesday played up its customer service skills, saying that representatives of its Marcus personal-loan unit answer calls within 10 seconds.

September 6 -

The Consumer Financial Protection Bureau has fined a California-based lead aggregator and its owner hundreds of thousands of dollars for allegedly directing consumers toward illegal loans that would be void in their states.

September 6 -

The company said it could use the proceeds to fund acquisitions and to make more loans.

September 5 -

Snap Finance provides credit at the point of sale, primarily to consumers with bad credit.

September 5 -

It sounds like a crazy mix, but Fifth Third says its new app would help young consumers round up debit card purchases and apply the money to their burdensome student debts. The motivation to attract millennials is clear, but will it work?

September 4 -

The largest generation of Americans is set to inherit over $59 trillion in assets, but the federal financial regulators are behind in hiring millennials and focusing on issues of concern to them.

August 31 Pickard, Djinis and Pisarri LLP

Pickard, Djinis and Pisarri LLP