-

Alternatives Federal Credit Union is making loans to pay for gender-reassignment surgery, but the initiative has bothered some members.

August 19 -

Robert G. Cameron, a former official at the Pennsylvania Higher Education Assistance Agency, will succeed Seth Frotman as the bureau's point person on student lending complaints.

August 16 -

Deutsche Bank overhaul plan will put taxpayers and the financial system at risk; the San Antonio company names three women to key technology positions; issuers like Chase and Citi need to think beyond traditional card options; and more from this week's most-read stories.

August 16 -

Issuers like Chase and Citi that added installment features to compete with digital lenders will need to think beyond traditional card options.

August 16 FICO

FICO -

With declining interest rates, credit unions that rely heavily on interest income from their investment portfolios may struggle.

August 16 -

Readers react to states investigating payroll advance companies and the GOP's weak response to cannabis banking, heed a warning that nonbanks are prepared for CECL and more.

August 15 -

Borrower debt continues to rise, late payments are up and interest rates are at their highest levels since at least 1994. A new report raises questions about the sustainability of the card industry's boom.

August 13 -

Four advocacy groups questioned why the consumer bureau did not ask a judge to lift a stay of the rule's payment provisions.

August 12 -

Large banks are going from more rural areas to expand in cities like Pittsburgh. Credit unions in the affected markets will have to adapt to survive.

August 12 -

Issuers like Chase and Citi that added installment features to compete with digital lenders will need to think beyond traditional card options.

August 9 FICO

FICO -

A new survey from PenFed found that 40% of adults said that personal finances or job stability was the No. 1 factor when thinking about purchasing a home.

August 8 -

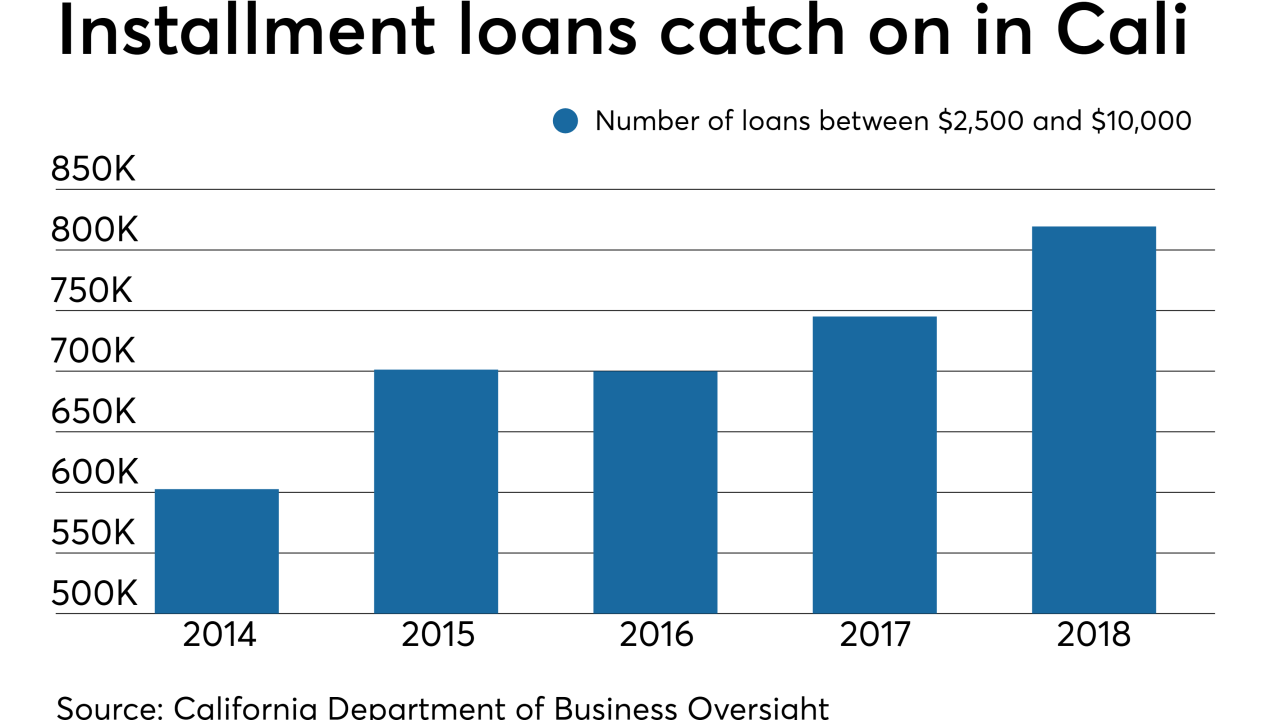

New data from the state shows that payday loans fell to a 12-year low in 2018. But the trend does not necessarily mean that consumers are paying less to borrow.

August 8 -

New York and 10 other states are looking into whether companies in the fast-growing sector are violating payday lending laws.

August 7 -

The card company is buying the corporate-services businesses of Danish payments provider Nets A/S; the online lender’s stock plunged after it missed second quarter earnings expectations.

August 7 -

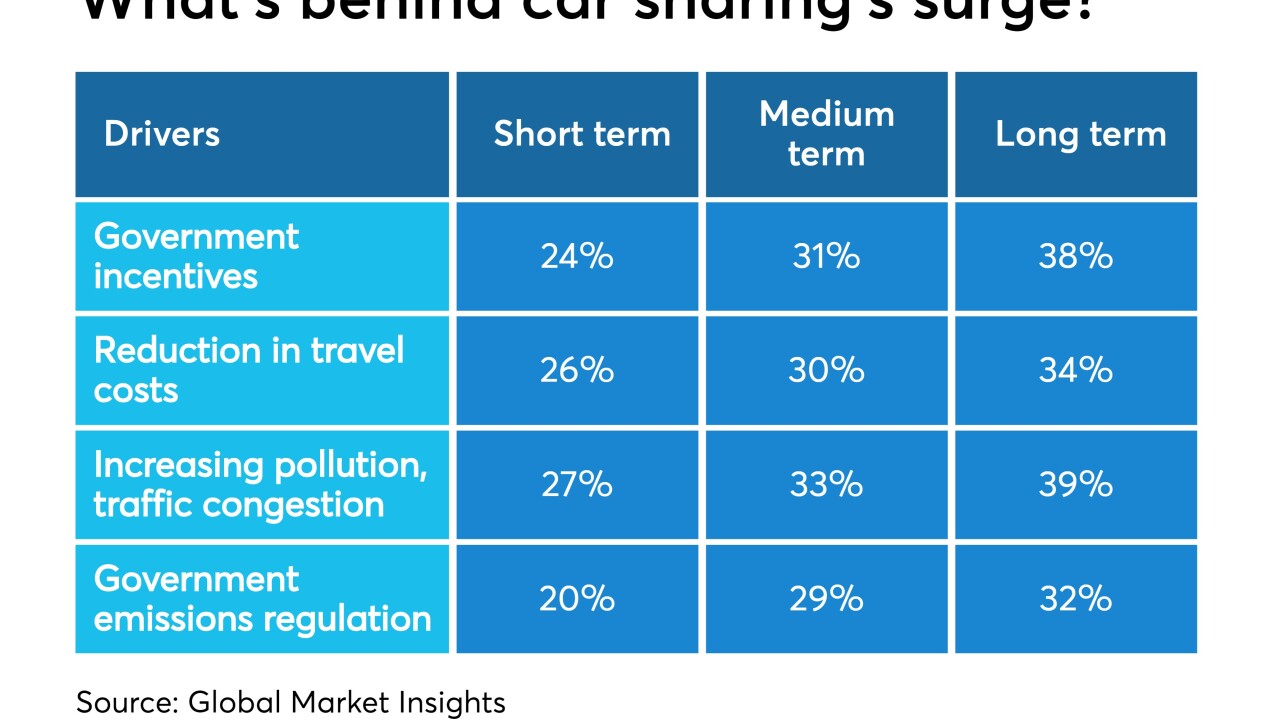

The industry faces additional risks when members take out auto loans and then list their new vehicles on apps for others to rent.

August 7 -

The CFPB is giving the public an additional 30 days so consumer groups have more time to respond.

August 2 -

“Digital Vault” will allow customers to store encrypted documents on third-party servers; bank accuses Orcel of misdeeds.

July 26 -

State and federal authorities say the network of firms in upstate New York sought debts that consumers weren't obligated to pay and impersonated government officials, among other things.

July 25 -

Total loan volumes at institutions in both states increased by more than 1%, far above the national rate.

July 24 -

The hiring of Tim Wennes was one a series of leadership changes announced Wednesday by the holding company for the bank and the auto lender Santander Consumer.

July 24