-

The move is aimed at boosting services avaialble to the credit union service organization's member-owners.

February 27 -

In an interview during his first day on the job, Anthony Noto also spoke about improving the firm's culture and the prospects for an IPO.

February 26 -

On Sep. 30, 2017. Dollars in thousands.

February 26 -

On Sep. 30, 2017. Dollars in thousands.

February 26 -

The clock starts ticking this week on a busy agenda of financial services priorities on Capitol Hill, including passing reforms to Dodd-Frank, overhauling the housing finance system and confirming key regulators.

February 25 -

The war of words between acting Consumer Financial Protection Bureau Director Mick Mulvaney and Sen. Elizabeth Warren, D-Mass., the agency's architect, is escalating.

February 23 -

Harrison Finance has 35 offices, nearly 140 employees and about $95 million of outstanding loans.

February 22 -

The bank will allow its customers to apply for car financing online and receive a decision within minutes.

February 22 -

The Arizona-based online auto dealer has partnerships with 35 credit unions – and is looking to expand.

February 22 -

William Parsley was most recently PNC's chief investment officer and treasurer and had previously served as head of consumer lending.

February 22 -

The subprime auto lender paid $2.9 million to Connecticut consumers and a $100,000 fine for miscalculating balances owed on repossessed cars and for charging improper fees. It says the settlement is part of an effort to clean up "legacy issues."

February 20 -

The online lender continues to contend with the fallout of a 2016 scandal that led to the ouster of its founder and CEO.

February 20 -

Bank’s alleged lax controls enabled a former customer to launder money in a payday lending scheme; digital currency has made back a chunk of its recent decline.

February 16 -

The Pew Charitable Trusts has released a set of 10 standards for banks and credit unions that want to to offer small loans to subprime customers. Among its ideas: keep monthly payments at or below 5% of the borrower’s paycheck and make loans available quickly through digital channels.

February 15 -

The Pew Charitable Trusts has released a set of 10 standards for banks and credit unions that want to offer small loans to subprime customers. Among its ideas: keep monthly payments at or below 5% of the borrower’s paycheck and make loans available quickly through digital channels.

February 15 -

Popular will acquire $1.5 billion in auto loans amid questions about the potential for loan losses following Hurricane Maria. The deal also coincides with Wells Fargo's need to stay inside a growth cap imposed by regulators.

February 14 -

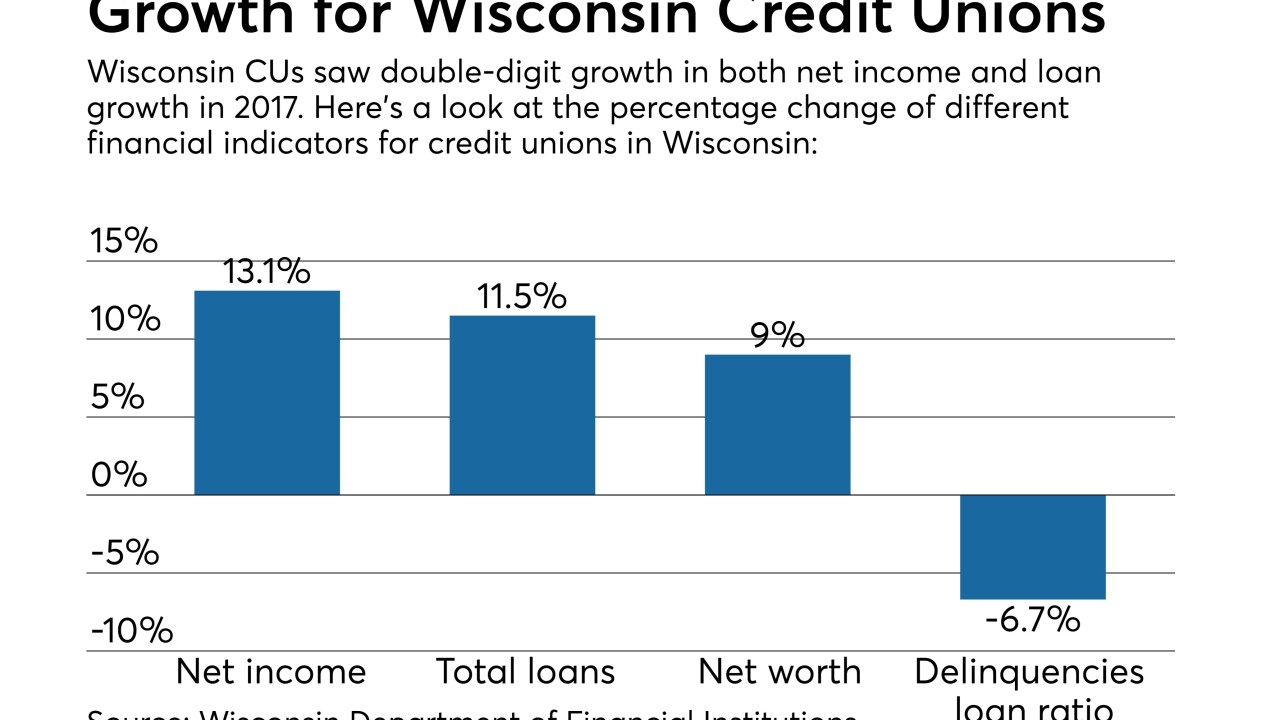

On top of a banner year for lending, delinquency rates in the state are at historic lows.

February 14 -

Sen. Elizabeth Warren, D-Mass., asked Wells Fargo's chief executive to address recent reports that the bank's efforts to compensate customers for unnecessary fees is falling short.

February 14 -

The acting director of the Consumer Financial Protection Bureau on Tuesday had his first taste of the withering congressional criticism endured by his predecessor on trips to Capitol Hill.

February 13 -

In some states, total mortgages outstanding are at all-time highs, but in others hard hit by the financial crisis they remain well below their 2008 peaks, the New York Fed said Tuesday in its quarterly report on household debt.

February 13