-

Mark Calabria said Fannie Mae and Freddie Mac are currently equipped to handle elevated delinquencies, but they might need congressional or Federal Reserve help if fallout from the coronavirus persists.

March 19 -

Over the past year, buy now, pay later schemes have risen to become the trendiest method of retail payments in the U.K.

March 19 -

The pandemic has upended staffing plans, sparked concerns about servicers’ capacity to handle the expected crush of missed payments, and even raised questions about their ability to stay afloat.

March 17 -

Sens. Sherrod Brown and Elizabeth Warren criticized Director Kathy Kraninger for not issuing any public enforcement actions against auto lenders during her tenure.

March 17 -

The Australian firm agreed to pay around $1 million in connection with allegations that it broke the law by operating without a license in the nation's largest state.

March 17 -

Bankers say they understand the need for an extraordinary government response to the coronavirus outbreak, but worry that even slashing interest rates won’t stimulate demand.

March 16 -

Banks typically don't offer loans to cash-strapped consumers, and are poorly positioned to start doing so on an emergency basis — unless the government steps in to help.

March 13 American Banker

American Banker -

Facebook and other social media platforms are a powerful way to connect members and loan officers, but lenders must ensure they first have a culture of compliance.

March 13 Gremlin Social

Gremlin Social -

No-interest loans and overdraft forgiveness are among the lifelines banks are offering to consumers and small businesses whose livelihoods are being upended by the economic fallout.

March 12 -

Habis, who joins the bank from MUFG Union Bank, will replace Michael Cleary, who left Santander last fall and recently joined Wells Fargo.

March 12 -

The move come a day after the Bank of England cut rates and introduced a series of emergency measures, including capital requirements and a lending program for smaller companies.

March 12 -

Firms such as Afterpay that offer financing to shoppers have been enjoying rapid growth. But their model is under scrutiny from regulators, being mimicked by credit card lenders and faces heightened risks in a downturn.

March 11 -

Banks may be protected from a direct hit, but they have invested in vehicles that include such loans, potentially exposing them to defaults.

March 11 -

Kathy Kraninger was grilled about whether her agency and others were doing enough to cushion consumers from the economic blow of the coronavirus crisis.

March 10 -

There may only be so much institutions can do if the outbreak affects borrowers' ability to repay credit.

March 10 -

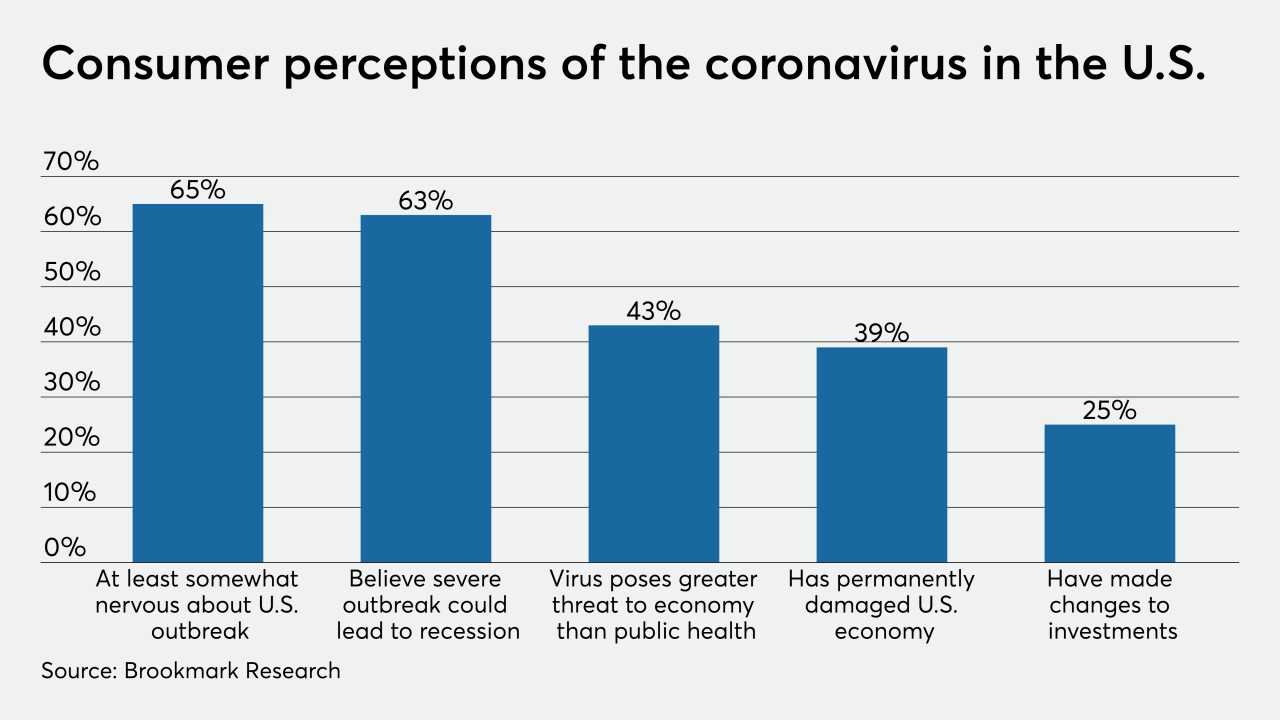

Concerns about the economic fallout of coronavirus have mostly focused on supply chain disruptions. But fears are growing that weakening consumer demand could spark a recession.

March 9 -

Brendan Coughlin, head of consumer banking, explains how Citizens established its relationships with Apple and Microsoft for point of sale financing and how they've evolved.

March 9 -

The Consumer Financial Protection Bureau will have a busy week starting with Director Kathy Kraninger testifying before lawmakers on Tuesday.

March 9 -

Maybe Congress shouldn’t be so quick to change laws without real-world input.

March 9 Community Financial Services Association of America

Community Financial Services Association of America -

With prices rising rapidly and loan terms increasing, some institutions may want to consider adding a leasing option to their auto loan portfolio.

March 6 Credit Union Leasing of America

Credit Union Leasing of America