-

Transit systems are suffering a dramatic loss in ridership, and must find a way to welcome back riders after the coronavirus pandemic ends, since many commuters will have canceled their monthly passes.

March 27 -

Mastercard is part of an expanding trend toward easing restrictions to entice consumers to choose contactless payments over cash and plastic during the coronavirus.

March 25 -

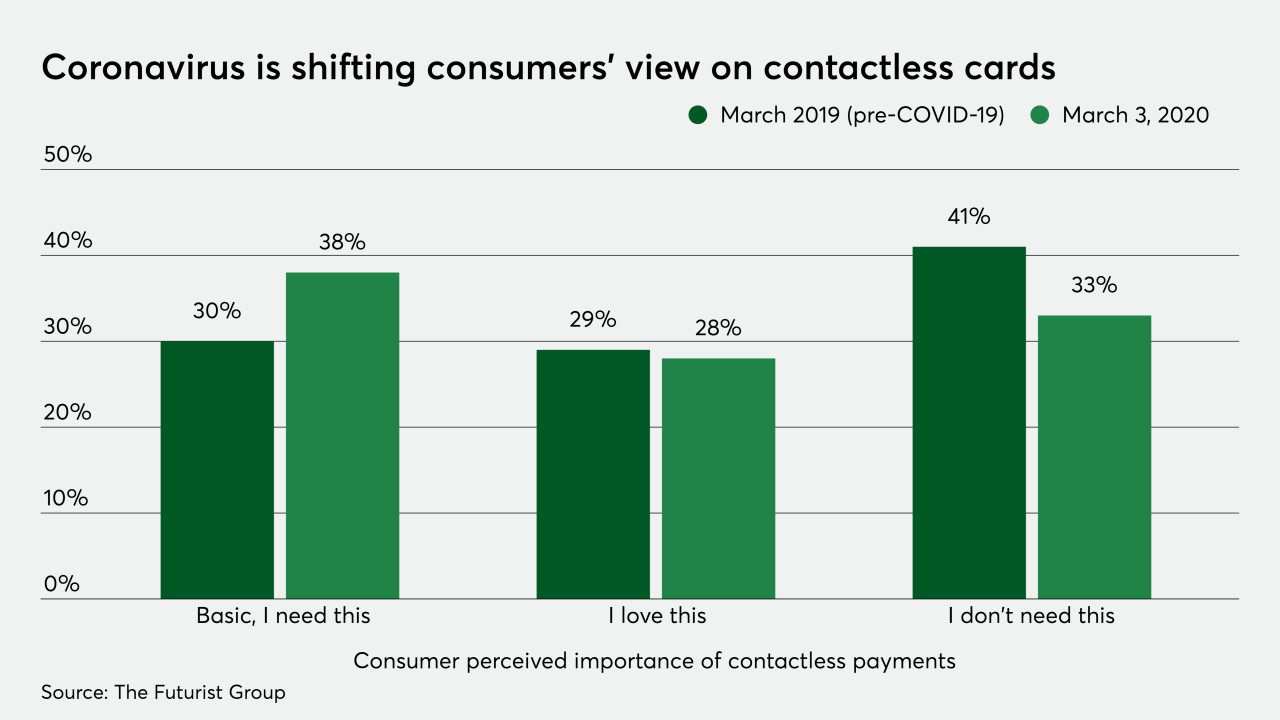

Targeted marketing efforts must go beyond explaining the functionality and instead educate consumers about all benefits that contactless can offer. Responsible communication should prioritize those who are at the highest risk for infection, says The Futurist Group's Demitry Estrin.

March 25 The Futurist Group

The Futurist Group -

Growing recognition that coronavirus can survive on hard surfaces for up to 72 hours — making it riskier to use PIN pads and touchscreens at the point of sale — is causing merchants around the world to rethink payment technology, especially at supermarkets.

March 23 -

Contactless cards are a potential refuge for consumers who fear plastic and cash are carrying COVID-19.

March 10 -

If a checking account doesn’t come with checks anymore, can it still be called a checking account? It’s a valid question that the financial services industry should be asking itself.

March 9 -

Coronavirus, also called Covid-19, is wreaking havoc on the stock market, with a heightened effect on the travel industry. It could also cause a drastic change in payment habits, as consumers shift to digital channels to reduce their risk of infection from handling cash.

March 2 -

The decisions made five years ago are creating problems for contactless payments today.

February 26 -

It’s an odd, and unwelcome, test of new retail technology that allows consumers to shop with minimal interaction with others.

February 21 -

Like its rival Mastercard, payments volume is on the rise at Visa, but the coronavirus complicates the near-term economic outlook and makes China an even tougher market.

January 30