-

As with most things related to 2020, COVID-19 will be a deciding factor as the Federal Reserve considers whether banks are able to increase their dividends or resume share buybacks.

December 16 -

Demand for food delivery has been strong during the pandemic, building on what already had been a strong demand for the $27 billion industry, according to NPD Group.

December 16 -

Bank of America is extending pandemic benefits for employees who need child or adult care services.

December 16 -

A new report from McKinsey says that cost-cutting alone won’t make up for the steep revenue declines brought on by low interest rates and sluggish loan demand. “For some banks,” argues the report’s author, “mergers might be the best way out.”

December 15 -

The Independent Community Bankers of America had planned to hold its annual conference in Hawaii before the coronavirus pandemic hit.

December 15 -

Cardtronics has benefited from a wave of branch closings during the pandemic by partnering with lenders looking to offer their customers access to cash even when a full-scale branch isn’t available.

December 15 -

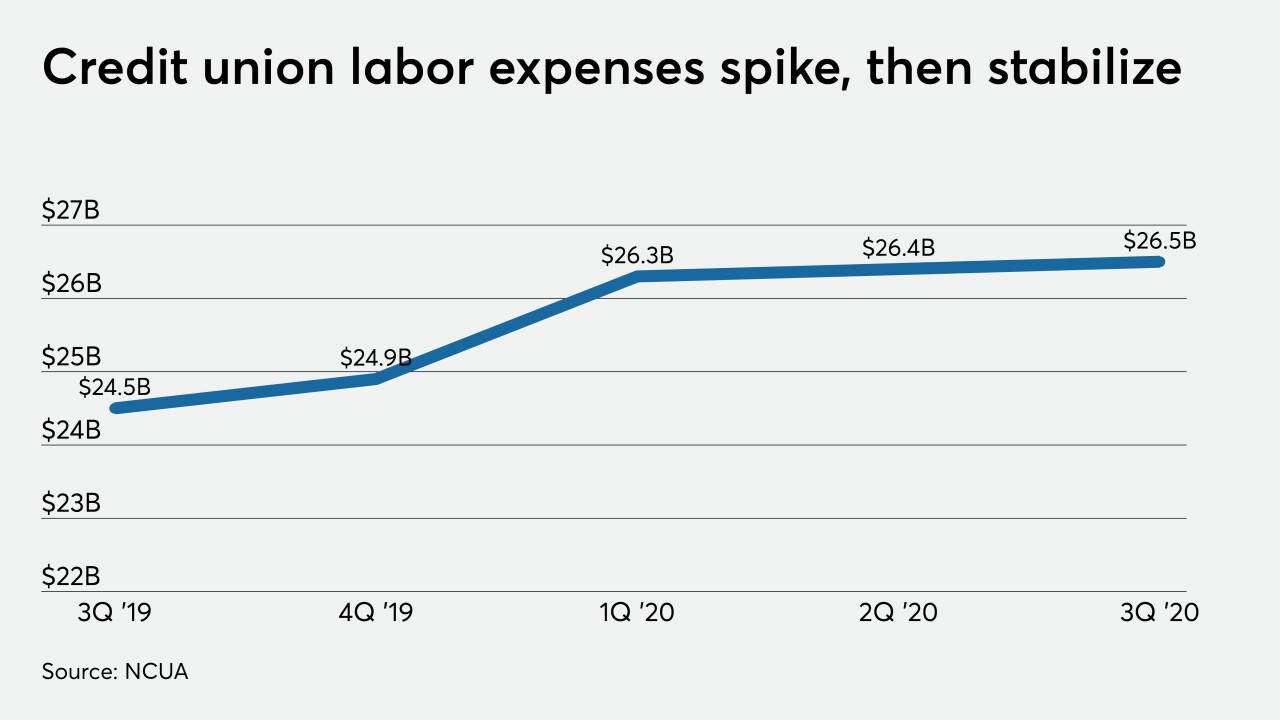

Some credit unions that gave bonuses to front-line staff at the onset of the coronavirus outbreak may be too cash-strapped to offer similar payouts during this latest surge.

December 15 -

The mobile banking and paperless habits bank customers picked up during the pandemic are here to stay, and financial institutions are working to strengthen their digital offerings, speakers at an American Banker conference said.

December 14 -

Banks are good at updating tech for customers but need to do it for staff

December 14 Ceridian

Ceridian -

Deutsche Bank is considering moving some of its 4,600 Manhattan staff to other hub cities across the U.S., but there are no concrete plans as yet.

December 14 -

The president-elect’s plan to eliminate $10,000 of debt would help borrowers meet other loan obligations, reducing their risk of default. Yet the banking industry seems wary of the precedent it could set.

December 11 -

The events of this year transformed banking, for better or worse. Smart bankers will build on the ways they learned to do their jobs better.

December 11

-

Credit unions that hope to fully reopen their facilities need to have a plan in place to ensure employees are being careful and not spreading the coronavirus.

December 10 Chelsea Health Solutions

Chelsea Health Solutions -

The emergence of vaccines has boosted travel forecasts — and crude prices. The expected bump at the pump could help oil and gas companies get back on track with loan payments.

December 10 -

The Biden administration could curtail federal support for farmers, even with bankruptcies and requests for loan workouts on the rise. Banks are hoping that increases in crop prices and exports to China could help avert a credit crisis.

December 10 -

As Morgan Stanley's bankers scattered from Manhattan's Times Square to their home offices during the pandemic, some asked: How are the coffee-cart vendors doing? The answer: terribly.

December 9 -

Speaking at an investor conference, Bank of America's CEO said that additional aid is needed to help consumers, businesses, nonprofits and local governments ride out the pandemic.

December 9 -

Lawmakers need to create a coronavirus relief program targeting owners of smaller businesses facing more hardship than larger competitors that received much of the aid from the Paycheck Protection Program.

December 9 Signature Bank of New York

Signature Bank of New York -

The COVID-19 pandemic has radically changed consumers’ attitudes and behaviors toward money and payments. What has changed?

December 8 -

Executives from U.S. banks continue to play down near-term expectations, but they say customers are growing more confident ahead of the rollout of coronavirus vaccines, and that key commercial lending segments could drive an economic rebound.

December 8