-

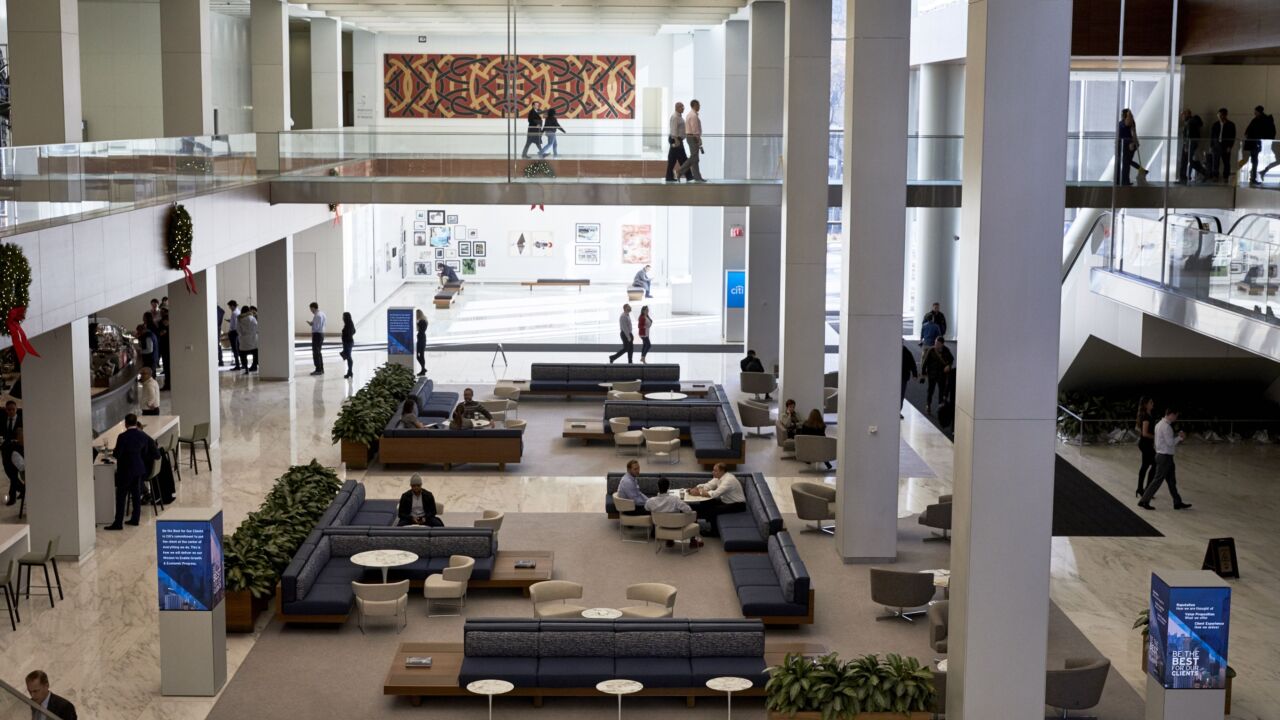

A survey sent to workers in New York, New Jersey and Connecticut last month found that most wanted to start by returning to the office just a few days a week.

October 13 -

The findings of a recent TD Bank survey suggest that targeting millennials for new credit cards will require surgical risk-management as the economy lurches toward an uneven recovery.

October 13 -

Citigroup posted its biggest quarterly profit of the pandemic after reaping another windfall from trading bonds and expressing newfound confidence in the resilience of its loan book.

October 13 -

Cash, Treasurys and other securities effectively guaranteed by the federal government now make up more than 35% of the combined balance sheets of the 25 biggest U.S. banks, according to data compiled by the Fed. That’s the biggest share in records dating to 1985.

October 9 -

The JPMorgan Chase CEO, among the biggest Wall Street proponents of returning workers to the office, doesn’t see life returning to some form of normal until mid-2021 at the earliest.

October 9 -

Lenders welcomed the move as a helpful first step but are still urging policymakers to develop a broader, simpler process for expediting the approvals of loans extended to troubled small businesses under the Paycheck Protection Program.

October 9 -

What Jason Gardner, founder and CEO of Marqeta, has learned leading a 450-person fintech from home.

October 8 -

Federal Reserve Bank of Boston President Eric Rosengren said the long period of low interest rates before the coronavirus pandemic is contributing to the depth of the current recession.

October 8 -

The pandemic has caused a massive shift in corporate expenses, turning the company dime upside down as plane tickets give way to home office equipment. It’s a complication for those who track, approve and pay for these expenses, requiring a new approach in the back office.

October 8 -

U.S. consumer borrowing unexpectedly fell in August as credit card balances declined for a sixth consecutive month with the coronavirus pandemic continuing to limit some purchases amid elevated unemployment.

October 7 -

Many consumers are taking to the highways and the water for safe getaways during the pandemic — powering one of the few bright spots in lending. However, bankers warn that boomlets usually come with distinctive credit risks.

October 7 -

The service signals the start of a broader shift in retailers directly challenging Amazon and threatening the platform as a shopper's default choice, says Bolt's Greg Greiner.

October 7 Bolt

Bolt -

The industry says the 2017 cut in the corporate rate helped position lenders to support the economy when the pandemic hit. But a plan proposed by Democratic nominee Joe Biden could strain banks' capital investment and hiring, observers say.

October 6 -

The Small Business Administration has been covering six months of principal, interest and fees for loans that existed on Sept. 27. There are concerns the moves are masking weaknesses in lenders' 7(a) portfolios.

October 6 -

Bank bill-payment sites have become less relevant over the last decade as more people go to billers’ websites to pay directly or use billers' mobile apps — often at the last minute. But the COVID-19 pandemic could flip the script on the $4.6 trillion bill-payment sector.

October 6 -

Federal Reserve Chair Jerome Powell said the lack of additional stimulus is creating "unnecessary hardship for households and businesses."

October 6 -

Bank bill-payment sites have become less relevant over the last decade as more people go to billers’ websites to pay directly or use billers' mobile apps — often at the last minute. But the COVID-19 pandemic could flip the script on the $4.6 trillion bill-payment sector.

October 6 -

The trends were already pushing new payment experiences, which now seem less futuristic, says VeriTran's Omar Arab.

October 6 VeriTran

VeriTran -

The industry has long talked about embracing digital technology — but the time for talk may be over.

October 6 -

The threat has been exacerbated during the pandemic, as shelter in place orders forced consumers inside and businesses to close their physical doors, while simultaneously opening online ones, says Sift's Kevin Lee.

October 6 Sift

Sift