-

A number of banks are tapping the brakes on commercial real estate lending, giving others an opportunity to make more loans at better terms.

February 3 -

On Sept. 30, 2016. Dollars in thousands.

January 31 -

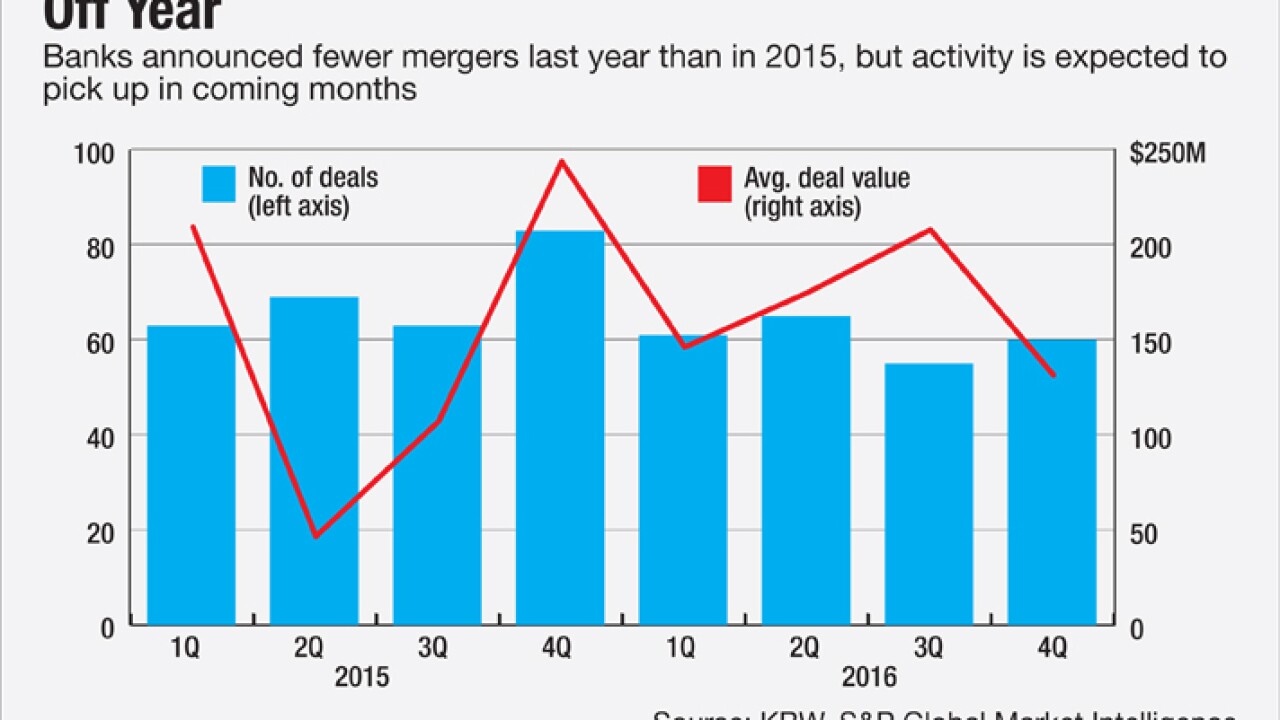

There is optimism that consolidation could bounce back from a lackluster 2016 as bank stocks rally. At the same time, expectations of regulatory easing and tax reform could entice more banks to stay independent, at least in the short term.

January 11 - New Jersey

Weakness in the energy sector and a surge in new construction are pushing up vacancy rates at offices and hotels, leading to a spike in delinquencies on loans tied to them. The safer bet, bankers say, is lending on industrial properties.

January 5 -

First Midwest Bancorp will move its headquarters to Chicago from Itasca, Ill., next year. The $11.6 billion-asset company will open an 80,000-square-foot office in the spring of 2018.

January 3 -

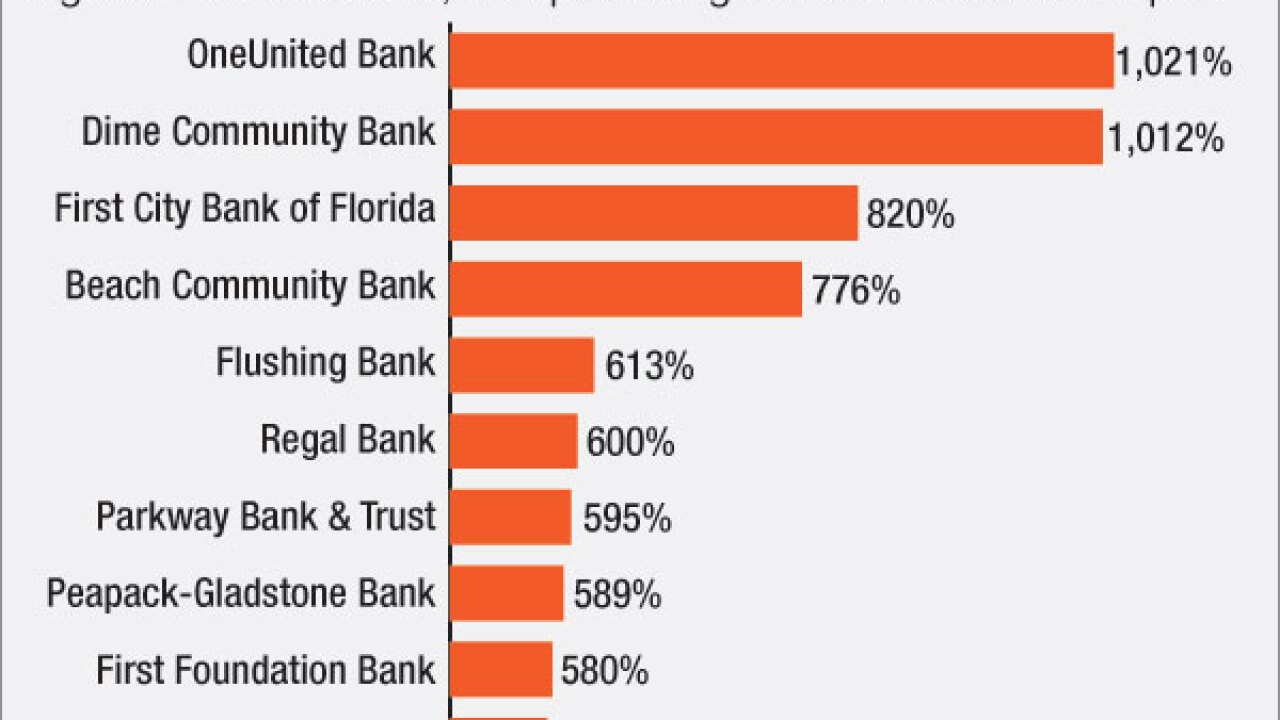

Kenneth Mahon, the new CEO of Dime Community Bank, wants to reduce the 152-year-old institution's multifamily exposure by diversifying into other asset classes. But finding new business amid already fierce competition could be an immense challenge for Dime and other community banks in 2017.

December 30 -

The commercial-and-industrial loan space is overheated, higher rates could stifle mortgage refinancings, and subprime auto delinquencies are on the rise. Bankers could be fighting these fires and more in the new year.

December 29 -

Chemical CEO David Ramaker has a wide range of options diversify business lines, expand organically in several Midwestern states, pursue M&A or all of the above following his recent acquisition of Talmer. But new challenges accompany Chemical's higher profile, too.

December 28 -

Regulators have warned about the dangers of high commercial real estate concentrations despite bankers' assertions that they are managing risk better than they did before the financial crisis. Still, CRE concerns could influence M&A and loan diversification in 2017.

December 22 -

So now what? New York Community Bancorp and Astoria Financial have been mum about why they nixed their merger agreement, or where they go next, but the companies have a surprising number of options in the current climate.

December 20 -

Credit One Bank in Las Vegas, Nev., a credit card specialist, plans to almost double its workforce over several years to support business growth.

December 16 -

Pacific Metro Bank would cater to Chinese-Americans around Atlanta. The application process is worth watching since the group is seeking the first Georgia charter in seven years and would be based in a market where more than 90 banks have failed since 2007.

December 16 -

Kevin S. Kim thought he was joining a bank board to bring youth to an aging slate of directors. Eight years, four acquisitions and a banking crisis later, he is now the chief executive of the nation's largest Korean-American bank.

December 4 -

The Music City is booming because of entertainment and health care. Still, banks are monitoring growth in areas such as real estate development for signs of stress.

December 2 -

Anthony Labozzetta, CEO of Sussex Bancorp in New Jersey, isn't afraid of change. His unusual approach to banking helped Sussex emerge from the financial crisis with momentum. Now he's building a branch model that could serve as a blueprint for growth-minded banks.

November 30 -

The pending purchase of Carlile Bancshares will lower Independent's concentration in commercial real estate, while introducing the company to fast-growing markets in Texas and Colorado.

November 22 -

Commercial mortgage lenders, and investors in their bonds, have been more eager than the residential market to embrace Property Assessed Clean Energy loans even though those loans hold a superior-lien position. Here's why.

November 16 -

Franklin Financial Network in Franklin, Tenn., has filed plans to raise up to $62 million in a common stock offering.

November 16 -

Trends in commercial real estate lending, which has reached record levels at U.S. banks, are unsustainable, Fitch Ratings warned.

November 7 - New York

Regulators have pressed banks to watch out for rising concentrations of commercial real estate loans. Some banks have paid heed, but others are skyrocketing past recommended thresholds.

November 3